Despite the recent sell-off, Bitcoin miners are hesitant to sell their BTC as hashrate rises.

According to on-chain analytics service Glassnode, Bitcoin miners are accumulating as the network hash rate continues to recover.

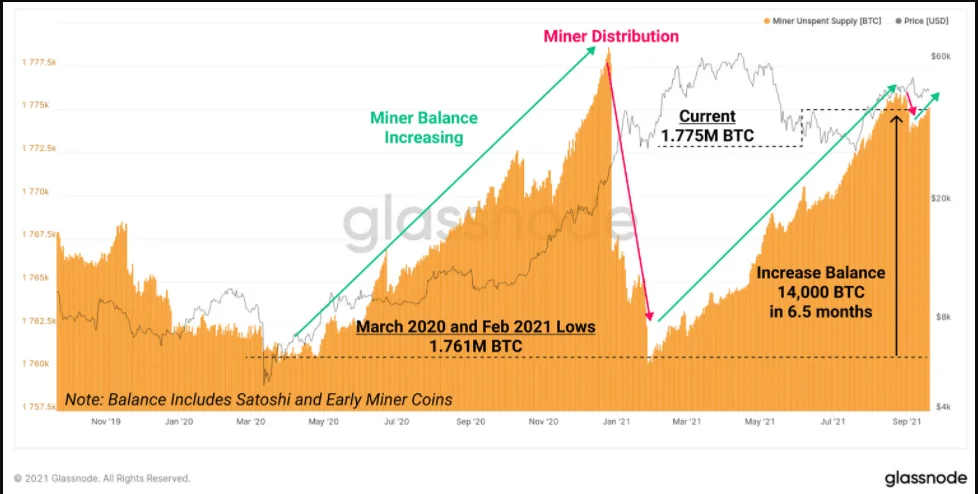

According to glassnode’s Sept. 20 Week on Chain report, miner BTC balances are increasing, with wallets affiliated with miners stockpiling 14,000 BTC worth nearly $600 million over the last six and a half months.

Miners have kept a higher share of their gains in the bull markets of 2020 and 2021, according to the report, than in past market cycles. Miners typically sell BTC to finance their operating costs, like as electricity and gear.

As the Bitcoin network’s hash rate rebounded this quarter, the pattern of miner accumulation persisted.

Glassnode claimed that Bitcoin’s hashing power has dropped 51 percent to a local low of 90 Exahashes in late June, amid fears about a mass Chinese miner migration.

According to a seven-day moving average, network hashing power has regained 52 percent to tag 137 Exahashes. Most mining operations have now relocated and are up and running again, according to hash rate recovery.

The Bitcoin hash rate, on the other hand, is currently 34% lower than its all-time high of 184 Exahashes set in May.

Despite growing mining reserves and a recovery in hash rates, shares in publicly traded mining companies have fallen as the broader financial markets retrace amid fears that Chinese property giant Evergrande may default on its loans soon.

Riot Blockchain’s stock has dropped 2.4 percent since the start of trading on Sept. 20, despite the company investing heavily in a new data center in Texas and doubling its hashing capacity this year.

Marathon and Hive Blockchain are both down 1.5 percent since Monday morning, while Hut 8 equities are down 5.4 percent – rounding out the performance of each of the “Big Four” North American mining companies.

Mining stocks, on the other hand, have outperformed Bitcoin this week, with BTC down more than 10% to $42,730 at the time of writing, according to CoinGecko.