For Bitcoin miners, production costs have now overtaken profits, making it difficult for them to continue their business model.

Bitcoin (BTC) mining profitability has suffered from the crypto market crash that caused miners to liquidate their BTC holdings. In the first week of June, the cryptocurrency market entered a sell-off period, with the majority of cryptocurrencies plunging to a four-year low.

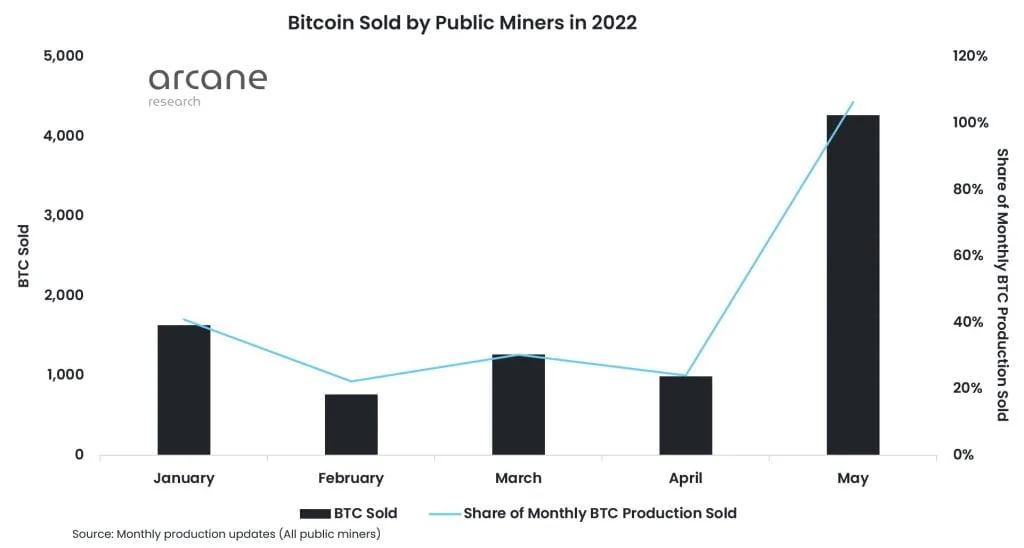

According to new data from Arcane research, public Bitcoin mining firms sold 100 percent of their BTC production in May, compared to the customary 20-40 percent previously.

In the first four months of 2022, public BTC mining enterprises sold 30% of their mined output, which jumped thrice in May and is anticipated to surge even more in June.

While public BTC miners account for only about 20% of the total network hash rate, their behavior frequently mirrors that of private miners.

Miners collectively control 800,000 BTC, making them one of the market’s largest whales. Public miners possess 46,000 BTC, and their selling frenzy could drive the price much down.

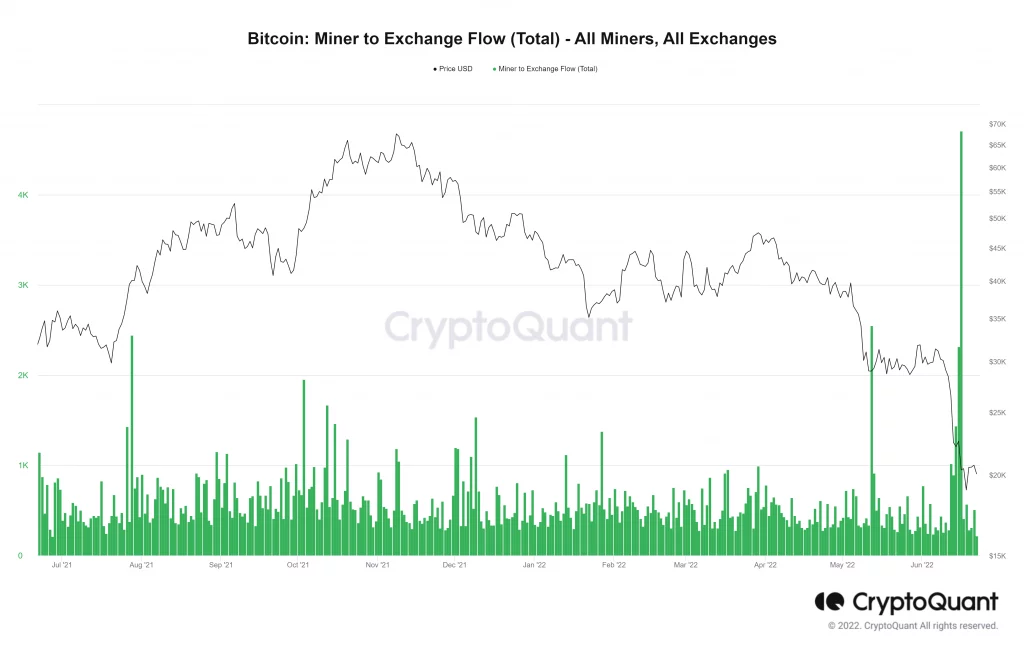

The situation has only gotten worse in June, with the Bitcoin price plummeting below the 2017 high of $20,000 and setting a new four-year low of $17,783. Miner-to-exchange flow, a data indicator that displays the volume of BTC delivered by miners onto exchanges, hit a new high in June, surpassing levels not seen since January 2021.

As previously reported by Coinscreed, the BTC miner to exchange flow ratio reached a fresh 7-month high when the BTC price fell below $21,000. The drop in BTC price has also rendered many mining computers unprofitable, prompting miners to exit the crypto market.

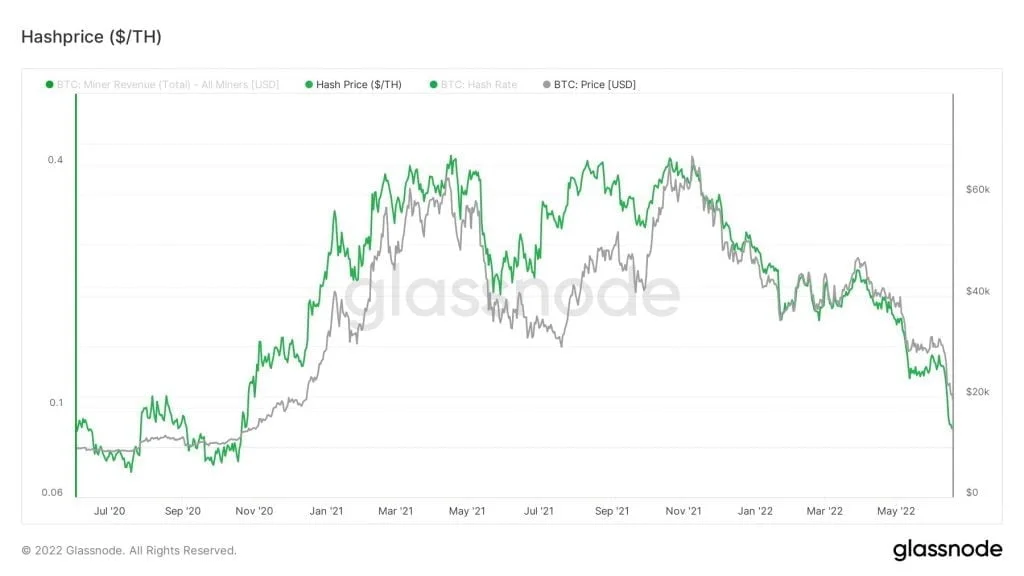

The hash price of bitcoin is a mining measure that indicates miner revenue per terahash. It is the average monetary value a miner receives every terahash calculation (USD/TH/s per day), which has dropped to a fresh 1.5-year low.

The Bitcoin Hash Ribbon has crossed, signaling that many miners are unplugging their devices owing to a lack of profitability.

Many believe it is a powerful price bottom indicator at a time of BTC price collapse and miner crisis, especially when miners start giving up.

BTC fell below $21,000 once more and was trading just above $20,000 at press time, a 6% drop in the previous 24 hours.