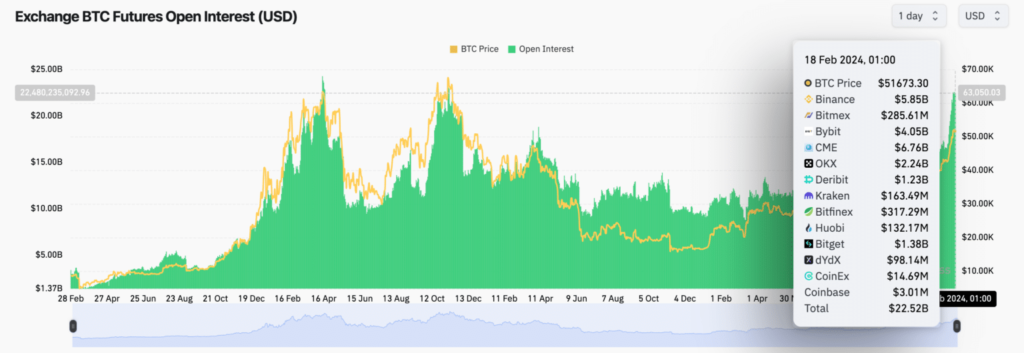

Bitcoin open interest reached a three-year high of $22.5 billion, signaling bullish momentum for the leading cryptocurrency. Meanwhile, the S&P 500 index also hit a new record high of 5,000, boosted by Goldman Sachs’ revised forecast.

Bitcoin Open Interest Surges to $22.5 Billion

Bitcoin open interest, the total value of outstanding futures contracts, shot up to $22.5 billion during the last weekend, the highest level since January 2021. This indicates a strong interest and activity in the Bitcoin derivatives market, which could lead to further price action ahead.

Open interest is a measure of market liquidity and sentiment, reflecting the amount of money traders have locked in their positions. A high open interest usually means that traders are confident and expect more volatility in the market.

Conversely, a low open interest means that traders are cautious and expect less movement in the market.

The surge in Bitcoin open interest coincides with the Bitcoin price flirting around $52,000, a key support level that has been tested several times in the past few days. As the BTC price holds above this level, it could signal a bullish continuation for the leading cryptocurrency, which has gained over 15% since the start of the year.

S&P 500 Index Reaches 5,000, Goldman Sachs Raises Forecast

On the other hand, the U.S. equity markets have been roaring with the S&P 500 index trading at its all-time high levels of 5,000. The index, which tracks the performance of 500 large-cap U.S. companies, is already up by 5.54% so far in 2024.

The S&P 500 index was boosted by the revised forecast from Goldman Sachs Group Inc. strategists, who increased their 2024 target for the index after it surged past the significant 5,000 milestone this month. In a recent note to clients, the team, led by David Kostin, highlighted increased profit estimates as the primary driver behind the adjustment.

Kostin now predicts the S&P 500 index will climb to 5,200 by the year’s end, reflecting a 2% uptick from the mid-December forecast of 5,100. This new target implies a 3.9% gain from Friday’s closing price.

It’s worth noting that Kostin’s initial projection in November 2023 had the S&P 500 index reaching 4,700 by the end of this year, 2024. Goldman Sachs’ bullish stance, with a 5,200 price target for the S&P 500 index in 2024, positions it among the most optimistic on Wall Street.

Other market analysts, like Tom Lee of Fundstrat Global Advisors and John Stoltzfus of Oppenheimer Asset Management, have shared a similar year-end outlook.

The S&P 500 index and Bitcoin have maintained a close and symbiotic relationship in the past. After Bitcoin’s strong rally last year in Q4 2023, the Bitcoin price has been largely catching up to it.

The correlation between Bitcoin and the S&P 500 index measures the degree to which the two assets move in the same direction. A positive correlation means that they tend to move together, while a negative correlation means that they tend to move in opposite.