Following the steady trade of Bitcoin at a low price in recent times, Glassnode has predicted a further decline in the price for the next 3 to 6 months.

Bitcoin (BTC), the world’s largest cryptocurrency, is still under heavy selling pressure. On Monday, May 23, the Bitcoin price fell 3%, falling below $30,000 despite a rise in the US equity market.

Bitcoin has been trading in the $28,500-$31,500 range for some time now. According to Glassnode data, the Bitcoin market has been trading lower for eight weeks in a row, making it the longest “continuous string of red weekly candles in history.”

Furthermore, a look at the Bitcoin derivatives market indicates the possibility of further decline, at least in the next three to six months. Glassnode, and on-chain data provider, explains in its latest report that the Bitcoin options market continues to price in near-term uncertainty.

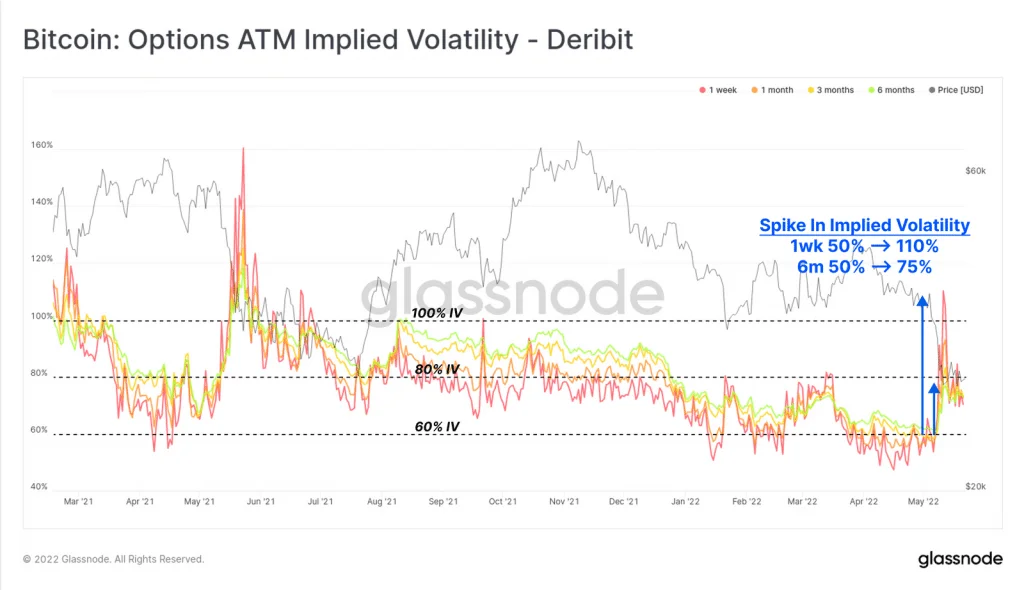

The implied volatility of Bitcoin option increased significantly during the market sell-off last week. Glassnode elaborates:

“Short-dated at-the-money options saw IV more than double, from 50% to 110%, whilst 6-month dated option IV jumped to 75%. This is a break higher from what has been a long period of very low implied IV levels.”

Bitcoin Options Have Higher Preference

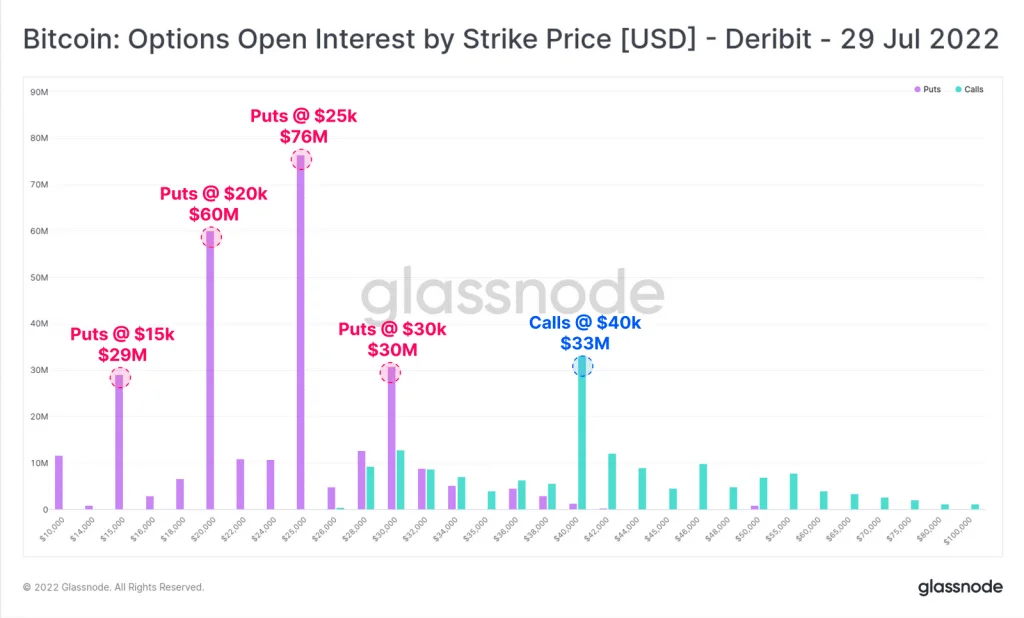

With a strong bearish sentiment, Bitcoin put option have a strong preference for the end of Q2 2022. Over the last two weeks, the Bitcoin put/call ratio for open interest has risen from 50% to 70%. It indicates that the market is preparing to hedge additional downside risks.

By the end of the second quarter, there will be strong put Bitcoin options with strike prices of $25k, $20k, and $15k. At the same time, the number of open call options is very low. As a result, by the middle of this year, investors have a strong preference for hedging risks and speculating on further price declines.

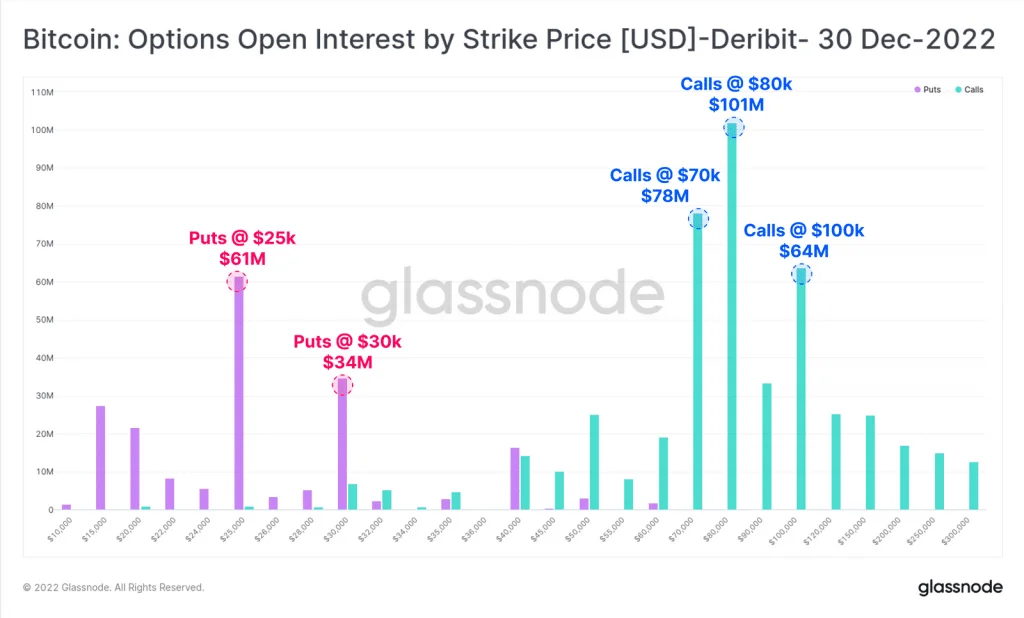

Long-term, or by the end of the year, the options interest setup for Bitcoin is noticeably positive. Glassnode explains:

“There is a clear preference for call options, with a concentration around strike prices of $70k to $100k. Furthermore, the dominant put option strike prices are at $25k and $30k, which are at higher price levels than the mid-year.”