Traders forecast a weekend oversold bounce after Bitcoin price hit an intraday low of $38,750.

Bitcoin price and the wider cryptocurrency market suffered another decline on March 4, which comes on the heels of the global economic consequences from the ongoing conflict in Ukraine. The Russia-Ukraine war continues to weigh heavily on a majority of the world’s financial markets.

According to data from Cointelegraph Markets Pro and TradingView, after peaking above $41,000 in the early hours of March 4, a wave of selling in the afternoon pushed the price of bitcoin below $39,100.

Here’s what a few analysts have to say about BTure prospects as the world enters a period of increasing economic turmoil.

Potential Retest Of $38,000

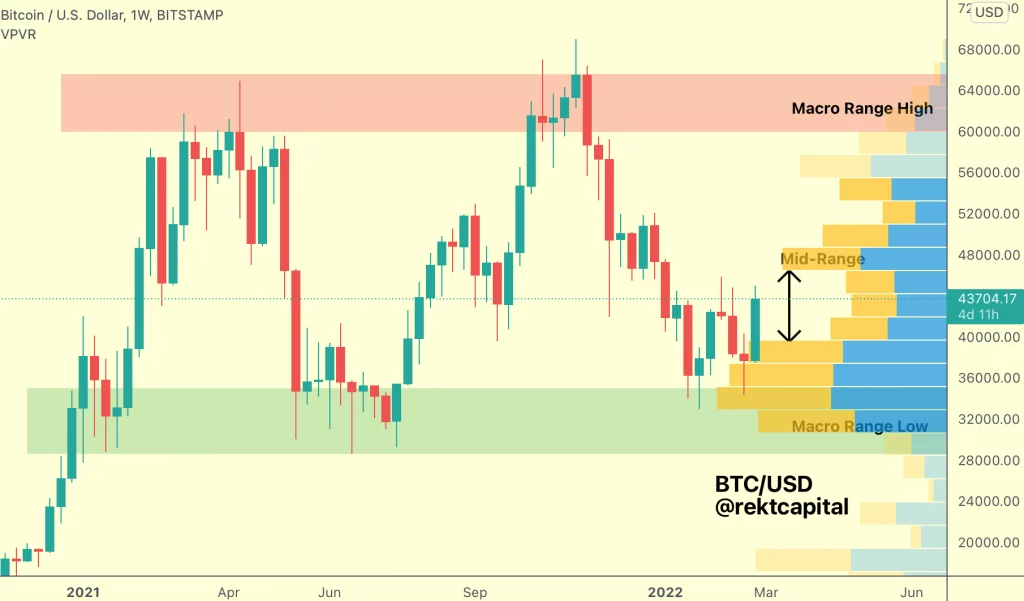

According to Rekt Capital, $43,100 is a key level for Bitcoin because the last time it closed below this level on the weekly conversation, it was “price rejected to the red $38,000 area for a retest.”

According to Rekt Capital,

“Upon a weekly close below the black at $43,100, BTC may possibly be positioning itself for a similar price trajectory.”

Traders Suggest A Close Watch On 50-MA

Independent market expert Scott Melker provided additional insight into which technical signs traders are watching. Melker posted the graph below, emphasizing the significance of the 50-day moving average (50 MA).

Melker stated:

“Humans and bots alike are watching the 50 MA on the daily to see if it will hold. Got some bids there. That’s the blue line below price, for those who don’t know.”

Overhead Resistance At $43,100

Another independent market, Michaelhaal van de Poppe gave a series of key resistance zones to watch if the price of Bitcoin recovers over the weekend. “Bitcoin is correcting as tensions around Ukraine increase, and anxiety is mounting as gold is flying upwards,” Van de Poppe wrote with the graphic.

van dePoppe stated:

“Might be seeing a bounce, if we do, I’m looking at $43,100-$43,500 as a potential resistance point. Overall shaky markets, altcoins dropping too.”

The total cryptocurrency market capitalization is currently $1.76 trillion, with Bitcoin commanding 42.7 percent of the market.