Bitcoin the first and father of all decentralized digital currency is one whose price is determined by a number of factors. Bitcoin price determinants may range from supply, demand, mining cost and sometimes surprisingly predictions.

About bitcoin?

Bitcoin is decentralized digital money that was first introduced in January of 2009. It is based on ideas presented in a white paper by Satoshi Nakamoto, a mysterious and pseudonymous figure.

The identity of the individual or people behind the technology is still unknown. Bitcoin promises reduced transaction fees than existing online payment methods, and it is run by a decentralized authority, unlike government-issued currencies.

Bitcoin is classified as a cryptocurrency since it is protected by cryptography. There are no physical bitcoins; instead, balances are recorded on a public ledger that anyone can see (although each record is encrypted).

A large amount of computational power is used to verify all Bitcoin transactions, a process known as “mining.” Bitcoin is not issued or backed by any banks or governments, and a single bitcoin has no monetary value.

Despite the fact that Bitcoin is not legal cash in most parts of the world, it is extremely popular and has sparked the creation of hundreds of rival cryptocurrencies known as altcoins. When Bitcoin is traded, it is typically abbreviated as BTC.

Investing in Bitcoin comes with risks

After Bitcoin’s meteoric price rise in recent years, it has attracted speculative investors. Bitcoin was worth $7,167.52 on December 31, 2019, and had increased by more than 300 percent to $28,984.98 a year later. In the first part of 2021, it continued to rise, reaching a new high of over $68,000 in November.

As a result, many people buy Bitcoin for its financial potential rather than its utility as a medium of commerce. However, because of the lack of a fixed value and the fact that it is digital, its purchase and uses come with a number of hazards.

The Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), the Consumer Financial Protection Bureau (CFPB), and other agencies have issued several investor alerts.

The concept of a virtual currency is still unique, and Bitcoin, in comparison to traditional assets, lacks a long-term track record or history of trustworthiness to back it up. Bitcoin is getting less experimental every day as its popularity grows; but, after only a decade, all digital currencies are still in development.

“It’s about the highest-risk, highest-return investment you can make,” says Barry Silbert, CEO of Digital Currency Group, which develops and invests in Bitcoin and blockchain businesses.

Some of the various risks associated with investing in Bitcoin includes:

Regulatory danger

Investing in any of Bitcoin’s numerous forms is not for the faint of heart. Bitcoin is a cryptocurrency that competes with government-issued money and can be used for black market transactions, money laundering, illicit activities, and tax evasion.

As a result, governments may seek to regulate, restrict, or prohibit Bitcoin use and sale (and some already have). Others have devised a variety of regulations.

The New York State Department of Financial Services, for example, adopted laws in 2015 that required enterprises dealing with the buy, sell, transfer, or storage of Bitcoin to keep track of customers’ identities, hire a compliance officer, and keep capital reserves. Any transaction with a value of $10,000 or more must be recorded and disclosed.

The lack of standardized laws surrounding Bitcoin (and other virtual currencies) raises concerns about its long-term viability, liquidity, and universality.

Threat to security

The majority of people who own and use Bitcoin did not get their coins from mining operations. Instead, people purchase and trade Bitcoin and other digital currencies on one of the many popular online markets known as Bitcoin or cryptocurrency exchanges.

Bitcoin exchanges are fully digital and, like any other virtual system, are vulnerable to hackers, viruses, and system failures. A thief could transfer stolen Bitcoin to another account if they obtain access to a Bitcoin owner’s computer hard disk and steal their private encryption key.

(Users can avoid this by storing their Bitcoin on a computer that is not connected to the internet, or by using a paper wallet, which involves printing out the Bitcoin private keys and addresses and not storing them on a computer at all.)

Hackers can also attack Bitcoin exchanges, obtaining access to tens of thousands of accounts and digital wallets containing Bitcoin. Mt. Gox, a Bitcoin exchange in Japan, was forced to close operations after millions of dollars worth of Bitcoin were stolen in a hacking event in 2014.

Given that all Bitcoin transactions are permanent and irreversible, this is extremely troublesome. It’s the same as dealing with cash: any Bitcoin transaction can only be reversed if the person who received the funds refunds them.

There is no third party or payment processor, as there is with a debit or credit card, therefore there is no way to get help or appeal if something goes wrong.

Insurance hazard

The Securities Investor Protection Corporation insures some investments (SIPC). Normal bank accounts are insured up to a set amount by the Federal Deposit Insurance Corporation (FDIC), which varies by jurisdiction.

Bitcoin exchanges and Bitcoin accounts, in general, are not covered by any federal or government program. SFOX, a primary dealer and trading platform said in 2019 that it would be able to offer FDIC insurance to Bitcoin investors, but only for the portion of transactions involving cash.

Fraud

Despite the fact that Bitcoin uses private key cryptography to authenticate owners and record transactions, scammers and fraudsters may try to sell fake Bitcoin.

In July 2013, for example, the SEC filed a lawsuit against the operator of a Bitcoin-related Ponzi scam. Another typical form of fraud is Bitcoin price manipulation, which has been documented.

Market danger

Bitcoin valuations, like any other investment, can go up and down. Indeed, the currency’s value has fluctuated dramatically during its brief life.

It is highly sensitive to any newsworthy developments because it is subject to high volume buying and selling on exchanges. According to the Consumer Financial Protection Bureau, the price of Bitcoin dropped by 61 percent in a single day in 2013, and the one-day price decline record in 2014 was 80 percent.

If fewer individuals accept Bitcoin as a form of payment, the value of these digital units may plummet, and they may become worthless.

When the price of Bitcoin fell from its all-time high during the cryptocurrency rush in late 2017 and early 2018, there was conjecture that the “Bitcoin bubble” had burst.

Although Bitcoin has a significant advantage over the hundreds of other digital currencies that have sprung up as a result of its brand recognition and venture capital funding, a technological breakthrough in the shape of a superior virtual coin is always a threat.

History of Bitcoin Price

Bitcoin’s price fluctuates between investor enthusiasm and frustration with its promise. After the 2008 financial meltdown, Satoshi Nakamoto, the secretive Bitcoin creator(s), conceived it as a daily transaction medium and a mechanism to sidestep established banking infrastructure.

Since then, cryptocurrency has grown in popularity as a means of exchange, attracting traders who wager on price fluctuations. It has also evolved into a new sort of investment a mechanism to hold value and protect against inflation; Bitcoin also has investments tied to its price.

Though this new story may hold more weight, previous price variations were mostly caused by regular investors and traders wagering on an ever-increasing price with little regard for rationale or facts.

However, Bitcoin’s price has recently shifted. As the cryptocurrency markets mature, institutional investors are beginning to enter, and regulatory authorities are developing rules expressly for them. Despite the fact that Bitcoin’s price fluctuates, it is now considered a component of the mainstream economy rather than a tool for speculators looking for quick profits.

Understanding the Factors that influence Bitcoin’s price

Bitcoin, unlike traditional currencies, is neither issued by a central bank nor backed by a government; as a result, monetary policy, inflation rates, and economic growth statistics that traditionally influence currency value do not apply to Bitcoin. The following factors, on the other hand, have an impact on Bitcoin prices:

• The supply of Bitcoin and the demand for it in the market

• The price of manufacturing a bitcoin via the mining process.

• Bitcoin miners receive rewards for validating transactions on the network.

• The number of cryptocurrencies in competition

• Laws that govern its sale and use

• Its internal governance situation

• Up to date information

Supply

The supply of a particular asset has a significant impact on its price. A rare asset is more likely to command high prices, whereas a plentiful asset will command low prices. Since its beginning, Bitcoin’s supply has been falling.

The protocol of the cryptocurrency only allows for the creation of new bitcoins at a set rate, which is supposed to slow down over time. As a result, the supply of Bitcoin has decreased from 6.9% in 2016 to 4.4 percent in 2017 and 4% in 2018.

Bitcoin halving events, which happen every four years, usually result in a big price increase because the cryptocurrency’s supply has been cut.

Demand

Bitcoin has drawn the attention of retail investors, despite the fact that it has yet to find popularity as a medium of trade.

The demand for Bitcoin changes depending on economic and geopolitical factors. China’s residents, for example, may have utilized bitcoin to avoid capital regulations in 2020, according to reports. Bitcoin has also grown in popularity in nations like Venezuela that have significant inflation and devalued currencies.

It’s also popular among criminals, who use it to move big sums of money for illegal purposes. Finally, more media coverage has raised investor interest in cryptocurrencies.

All of this means that a decrease in supply has coincided with an increase in demand, fueling bitcoin prices. The bitcoin ecosystem has become characterized by alternating periods of booms and crashes. In 2017, for example, a surge in bitcoin prices was followed by a protracted winter.

Production/Mining Costs

The cost of production, like that of other commodities, has a significant impact on setting the price of bitcoin. Bitcoin’s price in crypto marketplaces is strongly connected to its marginal cost of manufacturing, according to studies.

The cost of production for bitcoin is generally equal to the total of direct fixed expenses for infrastructure and electricity required to mine the cryptocurrency, as well as an indirect cost due to the algorithm’s difficulty level.

Miners compete to solve a difficult math problem, with the first miner receiving a reward of newly minted bitcoins as well as any transaction fees that have accumulated since the last block was found.

To solve the problem, you’ll need to use brute force, which means a lot of computing power. In terms of money, this implies the miner will have to invest in racking mining rigs with high-end CPUs. Bitcoin mining also costs a lot of money in terms of electricity.

According to some estimates, the amount of electricity consumed by bitcoin mining is equivalent to or greater than that consumed by whole countries.

The difficulty level of bitcoin mining’s algorithm is an indirect cost. The difficulty levels of bitcoin’s algorithms can speed up or slow down bitcoin production, altering its overall supply and, as a result, its price.

Competition

Hundreds of different tokens compete for crypto investment funds, despite the fact that Bitcoin is the most well-known cryptocurrency. Bitcoin is expected to dominate cryptocurrency markets by 2021. However, its power has dwindled with time.

Bitcoin accounted for more than 80% of the total market capitalisation of cryptocurrency markets in 2017. By 2021, that percentage has dropped to under 50%.

The main cause for this was a rise in the knowledge of alternative currency and their possibilities. Because of a surge in decentralized finance (DeFi) tokens, Ethereum’s Ether (ETHUSD) has emerged as a formidable challenger to Bitcoin.

Ether, the cryptocurrency utilized as “gas” for transactions on its network, has attracted investors who see its promise in redesigning the rails of modern financial infrastructure. On October 13, 2021, Ethereum accounted for about 18% of the total market capitalization of cryptocurrency markets.

The popularity of Ripple’s XRP (XRPUSD) and Cardano’s ADA (ADAUSD) has also risen, while the rise of stablecoins has drawn attention to Binance’s BNB token (BNBUSD).

Competition has lured investors to the asset class, despite the fact that it has drained investment money away from the Bitcoin ecosystem. As a result, demand for cryptocurrencies has soared, as has public awareness of them.

Bitcoin has profited from the attention as a type of standard-bearer for the cryptocurrency ecosystem, and its prices have risen.

Recent Regulatory Changes

Bitcoin was created in the aftermath of a financial catastrophe brought on by the relaxing of derivatives laws. The cryptocurrency ecosystem is mostly uncontrolled, and it has earned a reputation for being devoid of borders and regulations.

The fact that Bitcoin is unregulated has both advantages and disadvantages. On the one hand, its lack of regulation allows it to be freely used across borders and is not subject to the same government-imposed limitations as other currencies.

On the other side, it means that using and trading Bitcoin can result in criminal charges in most financial jurisdictions. The great majority of institutional investors are still hesitant to invest in the asset class, resulting in decreased liquidity and increased volatility in the ecosystem.

On June 9, 2021, El Salvador made Bitcoin legal tender. This is the first time a country has done so. Any firm that accepts cryptocurrency can use it for any transaction. El Salvador’s major currency is still the US dollar.

The more governments adopt bitcoin into their economies and markets, the more likely it is to become a genuine investment asset class. Bitcoin regulatory changes are actively followed by cryptocurrency investors and traders since it is a leading indicator of liquidity in the crypto markets. These changes put downward pressure on its price by affecting supply and demand.

China’s measures to prohibit bitcoin trading and restrict the operation of bitcoin-mining infrastructure, for example, have an impact on the cryptocurrency’s supply and demand.

Cryptocurrency judgements issued by the Securities and Exchange Commission (SEC) in the United States frequently have a direct impact on the price of Bitcoin.

In October 2021, for example, the price of Bitcoin soared above $66,000 the day after the Securities and Exchange Commission (SEC) approved trading of the first bitcoin-related ETF in the United States: the ProShares Bitcoin Strategy ETF (BITO).

Recent Happenings

Because of Bitcoin’s fledgling ecosystem, news events have a direct impact on its price. These developments might take many forms.

As previously stated, regulatory news can have a significant impact on cryptocurrency values. Hard and soft forks, which modify the number of bitcoins in circulation, have the potential to affect investor perceptions of the cryptocurrency.

For example, in August 2017, the fork of Bitcoin’s blockchain into Bitcoin Cash caused price volatility and boosted the value of both coins.

Bitcoin’s price is influenced by its governance regulations, which are defined by a group of core developers. Investors pay close attention to protocol changes that affect the number of bitcoins in circulation, as well as philosophical arguments among developers over the cryptocurrency’s future path.

Let’s take a look at Bitcoin’s price since inception, how some of these factors have played a major role in determining it and see what the future hold for it.

Yesterday’s Bitcoin price

2009–2015

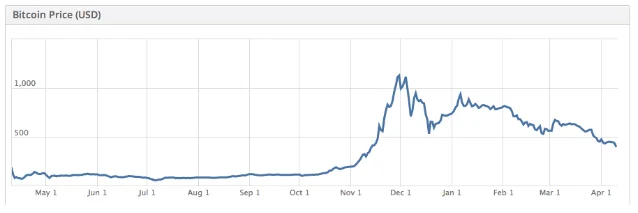

When Bitcoin was first introduced in 2009, it had no value. Its price soared to $.09.2 on July 17, 2010. On April 13, 2011, Bitcoin’s price surged again, from $1 to $29.60 by June 7, 2021, a gain of 2,960 percent in three months.

Following that, cryptocurrency markets had a dramatic downturn, with Bitcoin’s price bottoming out at $2.05 by mid-November. Its price grew from $4.85 on May 9 to $13.50 by August 15.5 the following year.

2012 was a rather uneventful year for Bitcoin, while 2013 saw significant price increases. It started the year at $13.28 and hit $230 on April 8; it then experienced an equally quick slowdown, dropping to $68.50 a few weeks later on July 4.

Bitcoin was selling at $123.00 in early October; by December, it had risen to $1,237.55 before plummeting to $687.02 three days later. Bitcoin’s value plummeted in 2014, reaching $315.21 at the start of 2015.

Today’s bitcoin price

2016–2020

Prices gradually increased throughout 2016, eventually reaching over $900 by the end of the year. Bitcoin’s price hovered around $1,000 throughout 2017 until mid-May, when it broke $2,000, and then soared to $19,345.49 on Dec. 15.

Other companies began inventing cryptocurrencies to compete with Bitcoin once mainstream investors, governments, economists, and scientists took notice.

The price of bitcoin remained flat for the following two years, with sporadic bursts of activity. In June 2019, for example, there was a revival in price and trade volume, with prices above $10,000. By mid-December, however, it had dropped to $6,635.84.

When the economy collapsed in 2020 owing to the COIVD-19 epidemic, Bitcoin’s price exploded once more. The price of bitcoin was $6,965.72 at the start of the year.

The pandemic closure, as well as following government policy, exacerbated investors’ concerns about the global economy, hastening Bitcoin’s growth. Bitcoin was trading for $19,157 at the close of business on November 23. In December 2020, the price of bitcoin was just under $29,000, up 416 percent from the start of the year.

2021–Present

Bitcoin broke its 2020 price record in less than a month in 2021, hitting $40,000 on January 7, 2021. As Coinbase, a cryptocurrency exchange went public in mid-April, Bitcoin prices hit fresh all-time highs of over $60,000.

As a result of institutional interest, Bitcoin’s price rose even higher, reaching a high of more than $63,000 on April 12, 2021.

Prices had dropped by half by the summer of 2021, with the lowest being $29,795.55 on July 19. In September, the market enjoyed another bull run, with prices reaching $52,693.32, before plummeting to $40,709.59 two weeks later.

Bitcoin hit an all-time high of $68,000 on November 10, 2021. Bitcoin plummeted to $49,243.39 in early December 2021 before fluctuating further as investors were concerned about inflation and the advent of a new variation of COVID-19, Omicron.

While forecasts are always a gamble, especially with something as volatile as Bitcoin, it hasn’t stopped experts from attempting them.

The future price of bitcoin

Bitcoin price to reach $500,000 by 2026

We’ll utilize data from prior bitcoin prices over a four-year period to make these predictions.

While many analysts estimate that the price of Bitcoin will reach $100,000 by 2021, we believe it might reach 5x that level by 2026.

In the year 2014,

Bitcoin’s average price is currently about $388, down from a 52-week high of around $1,132, according to Bitcoin Average.

In the year 2018

Bitcoin fell another 4.5 percent to $3,635, extending the big crypto meltdown of 2018. It’s down 33% in the last week and 75% so far this year. Bitcoin was down 82 percent from its all-time high of $19,666 a year ago.

In the year 2022

Bitcoin fell as much as 6% to touch a low of $39,771.91, according to Coin Metrics, reclaiming most of its losses. It traded about 1.3% lower at $41,904.87.

According to these past data, the price of Bitcoin increased by more than 100 percent every four years. In the next four years (2026), we can say that the price of Bitcoin will almost be between $500,000 and $800,000 Seeing the cryptocurrency is trading at $44,076 at the time of writing. (There is no actual fact or metric to back up this claim).

Note: This is not financial advice, the findings presented here are only the writer’s opinion. Before making any form of investment, make sure you do your own research (DYOR).