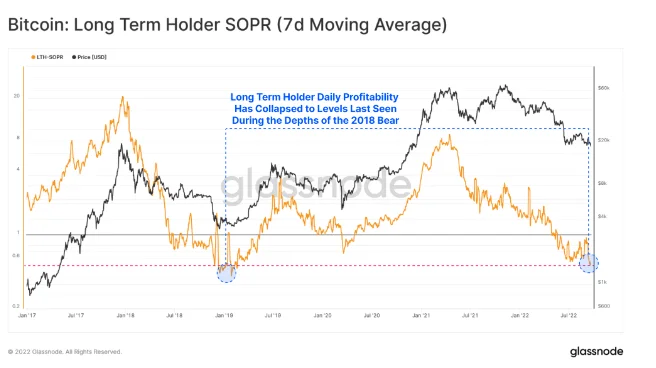

Since the 2018 crypto bear market, the decline in Bitcoin profitability for long-term holders has reached its lowest point.

The long-term profitability of Bitcoin (BTC) has dropped to levels last seen in December 2018’s previous bear market. BTC owners are selling their tokens at an average loss of 42%, according to statistics provided by the cryptocurrency analytics company Glassnode.

According to Glassnode data, long-term holders of the most popular cryptocurrency are selling their tokens at a cost basis of $32,000, which means that the average purchase price for these holders is above $30,000.

Several macroeconomic reasons might be blamed for the current market downturn and diminishing profitability. The stock market, particularly tech equities, which are currently experiencing an even more severe decline than crypto, continues to have a strong association with the BTC market.

The suffering of BTC investors has increased as a result of rising inflation and the central bank’s failure to control it. Traders and long-term investors are turning to short-term profitable and less hazardous products as they have considerably less money to invest.

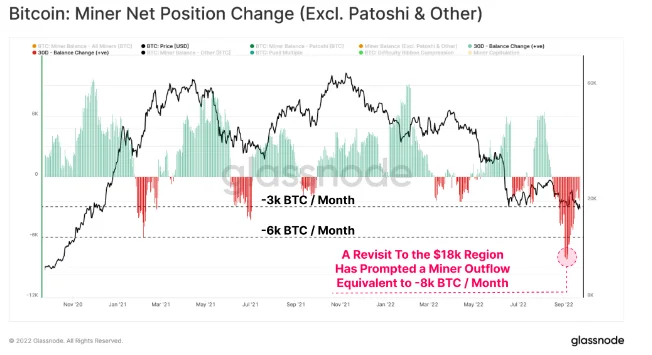

This was also demonstrated by the sell-offs of BTC miners; historically, BTC miners have been long-term investors hoping to make a larger profit. But as mining becomes more complex and energy costs rise, these miners’ profit margins have shrunk, compelling them to accept short-term gains.

Since prices were rejected from the local high of $24.5 thousand, there have been significant outflows from bitcoin miner balances, indicating that overall miner profitability is still somewhat stressed. The miner outflow has fluctuated between 3,000 and 8,000 BTC, but according to market statistics, a price drop to $18,000 may result in a monthly outflow of 8,000 BTC.

The most popular cryptocurrency, Bitcoin, is now trying to break through the $20,000 resistance despite repeated breaks above it in September. It is trading in the $19,000–$20,000 region.

A multi-year low has been attained in the long-term holder profitability when combined with miner profitability. The levels, however, are very comparable to when the crypto market bottomed out in earlier cycles.

Although it repeatedly broke through the $20,000 resistance in the month of September, Bitcoin is currently trading around the $19,000–$20,000 zone and is fighting to overcome it. Compared to its market high of $68,789 set in November of last year, the leading cryptocurrency is currently trading at a 70% discount.