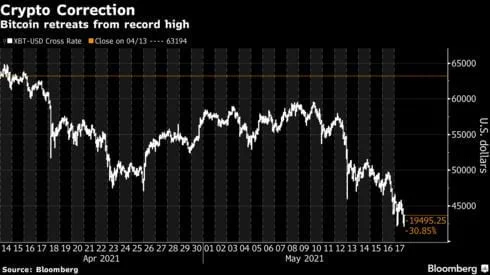

Bitcoin is probably going to lose its value for quite a long time after tumbling about 35% since hitting a record high a month ago, as per perhaps the greatest financial backer in the biggest digital money.

“I think we are going to consolidate for a while, four to six weeks,” Michael Novogratz, CEO of Galaxy Digital LP, said in a meeting, calling a $40,000-to-$50,000 value range reasonable.

Bitcoin fell as low as $42,133 on Monday following an unpredictable end of the week that saw Tesla CEO Elon Musk whipsaw financial backers with a progression of tweets in the wake of his choice to quit tolerating the coin for vehicle acquisitions in view of its ecological effect. Bitcoin’s computerized record utilizes an overall organization of PCs to work, a cycle that is gotten known as mining.

I took his mining comments at face value,” Novogratz said. “I don’t think that’s Bitcoin-specific, that’s everything specific: The gold market, YouTube — all uses a lot of electricity. And Elon has businesses in clean energy.”

The cryptocurrency industry is looking at its Environmental, Social, and Corporate Governance (ESG), and how to mitigate Bitcoin’s impact through things like carbon offset credits, he said.

“Like all industries, ESG is important, and the crypto industry including Galaxy is going to address it,” Novogratz said.

The explosion in interest for joke coins like Doge — which Musk has been tauting on Twitter — makes it harder for people to take the broader cryptocurrency market seriously, Novogratz said in a Bloomberg Television interview. Yet he said there was real angst behind some of the support for Doge.

“What you’re seeing is a response against the monetary policies of the U.S. and the world,” he said. Crypto has become too tribal, so much so that a friend of his who criticized Doge on Twitter received six death threats, Novogratz said.

Bitcoin should still finish the year higher even after the recent slide, Novogratz said. The U.S. Securities and Exchange Commission could approval of a Bitcoin exchange-traded fund at the end of this year or early next year, he said.

“My guess is the next catalyst is the ETF,” Novogratz said.

While Bitcoin continues its gyrations, New York-based Galaxy — which hopes to list on a U.S. exchange in the second half of the year — reported strong first-quarter results Monday. Even after the recent volatility, Bitcoin is up around 45% for the year.

Net comprehensive income, excluding non-controlling interests, increased to $860.2 million, from a net comprehensive loss of $26.9 million in the prior-year period. Counterparty trading volumes grew more than 290% year over year. Its preliminary assets under management rose to $1.27 billion as of March 31, a 58% jump from the prior quarter.

Galaxy is involved in a slew of businesses, ranging from mining to helping companies with acquisitions to investing in startups. In May, Galaxy acquired crypto custodian BitGo for $1.2 billion. Erin Brown, who was previously chief risk officer at Jump Trading, was named chief operating officer Monday.

Galaxy is as of now exchanging more than 90 coins. The majority of the portfolio is in 15 coins, however, including Bitcoin, Ethereum and some DeFi coins, utilized in decentralized-finance applications like distributed loaning and installments.

“Ethereum certainly has a moment,” Novogratz said in the Bloomberg Television meet. He said it’s the most decentralized blockchain network and has the most engineers and the most applications “by a long shot.” He said he figured Ethereum would exchange somewhere in the range of $2,800 and $4,000 in a comparable “combination” period he referenced for Bitcoin.

“Let’s not miss the big picture for the small picture,” Novogratz said. “We are going through a once-in-a-generational change in this crypto blockchain advancement, where the monetary foundation is beginning to be modified. That cycle is picking energy.”