Bitcoin whales withdrew 1,110 BTC ($107.7 million) from Binance, signaling potential upward pressure toward $100,000.

In the past twenty-four hours, there has been an increase in the amount of activity among Bitcoin whales, which indicates that there may be upward pressure for the price of Bitcoin to rally to $100,000 today itself.

Bitcoin Whales Accumulate the Dips

There have been six new whale wallets that have withdrawn more than 1,110 Bitcoins from the cryptocurrency exchange Binance in the past several hours. According to the blockchain analytics platform Lookonchain, wealthy investors and Bitcoin whales have begun to accumulate Bitcoin during the past few years, during which time the price of Bitcoin has dropped below $97,000.

Over the course of the last eight hours, six newly established wallets are responsible for the withdrawal of 1,110 Bitcoins from the Binance exchange. This amount is equivalent to approximately $107.7 million.

This action indicates that major holders are becoming more confident in Bitcoin’s long-term prospects, despite the fact that market volatility continues to exist. Furthermore, IntoTheBlock’s information shows that 60,000 addresses have bought 22,740 BTC at a price higher than the current one.

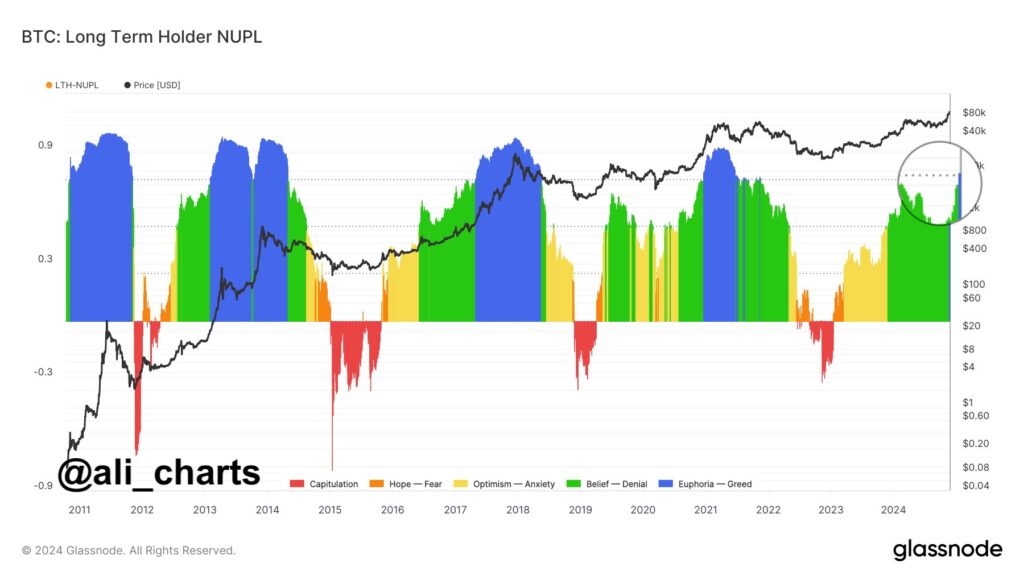

An impressive 458,000 addresses have accumulated a colossal 344,000 BTC, establishing a solid foundation for the possibility of an upward movement. There is a possibility that this robust support will act as a catalyst for the next major price spike in Bitcoin. The cryptocurrency researcher Ali Martinez, on the other hand, observed that long-term holders are exhibiting signs of “greed.”

Similar trends suggest that it will take between eight and eleven months for Bitcoin to reach its peak. Martinez pointed out that if the pattern continues, there is a possibility that the market level for Bitcoin could reach its highest point between June and September of 2025.

Based on the technical chart, the price of Bitcoin continues to demonstrate strength. Bitcoin has recently recovered from its intraday low of $95,788 and is currently trading at $95,788. At the time of this publication, the price of Bitcoin is now trading at $98,650, down 0.60 percent, and it has a market size of $1.95 trillion.

Cryptocurrency analyst Ali Martinez has highlighted a bullish signal for Bitcoin (BTC). This signal comes as the SuperTrend indicator on the hourly chart begins to turn positive in the midst of the continued activity of Bitcoin whales. A strengthening Relative Strength Index (RSI) accompanies this change, coinciding with Bitcoin breaking through a crucial resistance trendline.

Martinez argues that these events could pave the way for a significant increase in price, which could potentially herald the long-awaited rise toward $100,000. The analyst made the observation, “Today could be the day!”. Additionally, there has been a considerable increase in the amount of cryptocurrency trading activity on centralized exchanges, which indicates a highly bullish feeling.

According to 10x Research, in contrast to the speculative frenzy that occurred in March, which resulted in a single-day retail trading peak of $16.2 billion in Korea, the present market is experiencing sustained high volumes over a number of consecutive days.

This indicates that there is a more widespread and sustained interest in trading. As an additional point of interest, MicroStrategy is the primary force behind large trading in the Bitcoin industrial complex, with trade volumes exceeding 130 billion dollars in the previous week.

After raising this amount of money through convertible notes the previous week, market watchers anticipate that the company will make a new acquisition of $3 billion worth of Bitcoin on Monday.

During the time that Bitcoin and the rest of the cryptocurrency market are entering a phase of consolidation, GameFi and Metaverse tokens have effectively assumed the lead in the surge.