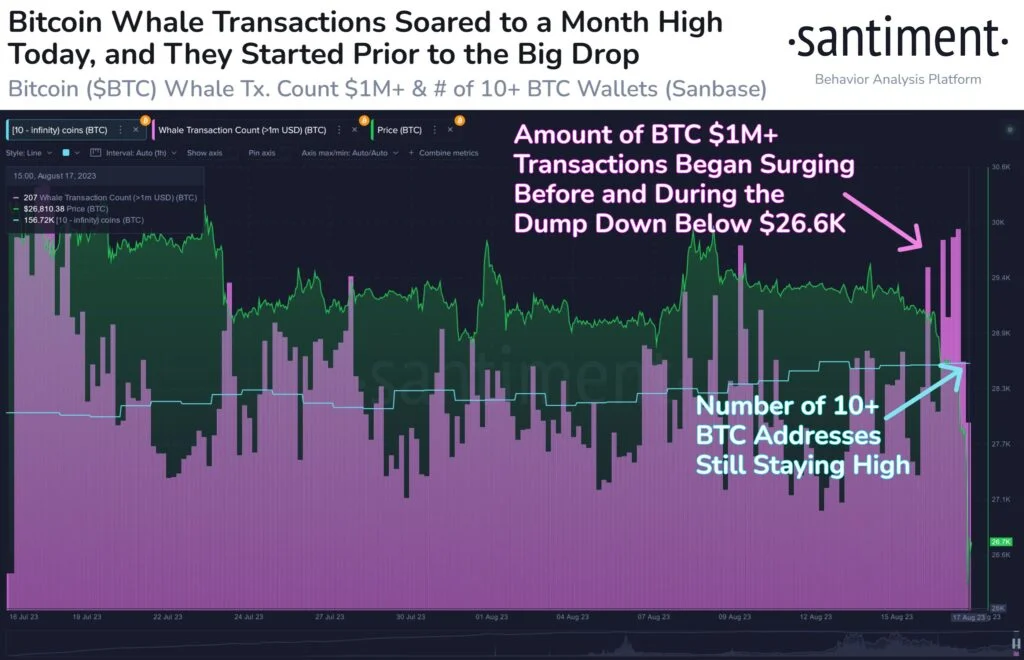

On-chain data reveals a notable increase in transactions worth $1 million, indicating that Bitcoin whales are responsible for the collapse.

As a result of SpaceX’s sale of $373 million worth of Bitcoin, the price of the world’s largest cryptocurrency, Bitcoin (BTC) fell below $26,000, a 9% drop. Bitcoin’s decline has also dragged the broader crypto market down by 7% over the past 24 hours, eroding $70 billion in investor wealth.

The Bitcoin (BTC) price is 7.83% lower at $26,394, with a market cap of $513 billion at press time. This could be an opportunity for long-term investors to load their bags.

A prominent cryptocurrency investor Ali Martinez explained that the Bitcoin RSI had reached 9.43 on the 4-hour chart. The previous time the BTC price reached these RSI levels, it rebounded strongly.

#Bitcoin | I just bought the $BTC dip! The last two times the RSI hit 9.73 on the 4-hour chart, it presented the perfect entry. I believe it could be the same now! pic.twitter.com/UauQMYRhkU

— Ali (@ali_charts) August 17, 2023The Bitcoin outlook is unquestionably adverse, and a further price correction is possible. However, a staggered purchasing strategy at each dip could be an excellent way to capitalize on the correction.

However, many investors are curious about what comes next. As the Bitcoin price escapes the volatility pressure, we can anticipate more.

I won't make any decision on #Bitcoin until Monday. What happens 90% of the time is a relief rally that causes FOMO and longs pile up. People get excited thinking it's coming back then we nuke once more. Then the pain and shorts come, people actually bearish. Then the hated rally pic.twitter.com/TPiu0M0SFt

— IncomeSharks (@IncomeSharks) August 17, 2023Calls to Buy The Dips in Bitcoin on The Rise

The recent Bitcoin price correction has increased the number of calls to purchase the dips, according to data on the blockchain. Thursday, August 17, Bitcoin ‘Buy the dip’ calls reached a four-month peak, according to on-chain data provider, Santiment.

After a week of declines in altcoins, Bitcoin experienced a significant decrease, resulting in a widespread decline across the entire cryptocurrency market. Santiment reports that #buythedip calls have reached their most incredible level since April, despite prices exhibiting a moderate recovery.

In addition, the Santiment data indicates that whales have been quite active during the recent spill. Uncertainty persists after the recent price decrease in crypto markets, representing one of the most significant declines in 2023.

A notable increase in $BTC transactions exceeding $1 million suggests that billionaires actively participate in this decline. Santiment notes that the quantity of large wallets stays the same.