Even though Bitcoin has been in a correction phase for nearly two months, analysts and optimists have managed to maintain their bullish outlook.

This rejection of a bear phase, while not entirely unjustified, has been made on numerous occasions by several analysts and Bitcoin advocates, most likely to maintain a positive investor attitude.

According to the recently published “Bitcoin price prediction 2021” analysis, this is an important factor. According to the conclusions of the analysis, 62 percent of the panellists questioned felt that bitcoin is not now in a bear market.

Several variables, including prolonged buying interest, Bitcoin’s price history, and the continued relevance of fundamentals, were cited by these panellists as crucial markers in determining their view on the cryptocurrency.

According to the following figure, even though Bitcoin values have been drifting sideways, new entities have continued to join the network.

Every day, over 50,000 new entities were seen to be added to the Bitcoin blockchain, and the weekly net growth on the Bitcoin network was higher than that recorded at the beginning of the year, when the prices of bitcoin were beginning to reach new highs.

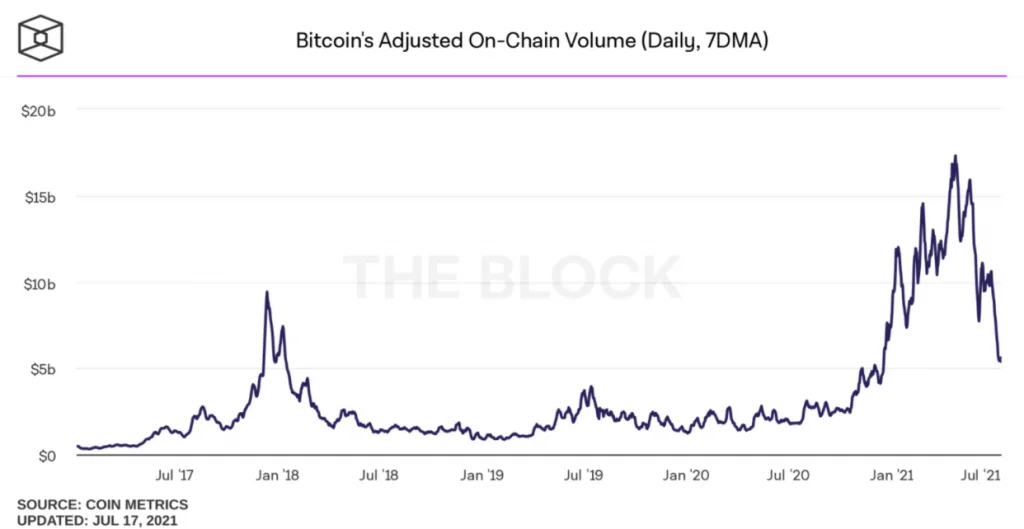

Other on-chain measurements, on the other hand, that contradict these assertions cannot be ignored. Using the data above, you can see how Bitcoin’s adjusted on-chain volume has been progressively declining over the last few months.

The daily transaction volume has plummeted to about $6 billion from a peak of over $16 billion in May, indicating that traders were withdrawing from the network.

When it comes to the aforementioned analysis, a panel of experts comprised of leaders from the cryptocurrency field throughout the world estimated that the price of bitcoin would reach $318,417 by December 2025. This has been ascribed to the occurrence of halving events as well as inflation.

According to some estimates, 30 percent of the dollars currently in circulation were produced in 2020, providing enough momentum for a looming inflation scare shortly to warrant concern. Another possible explanation for this expected spike is widespread bitcoin use.

Around 54% of the panellists predicted that “hyperbitcoinization,” which is the process by which bitcoin will completely take over global finance, will occur by 2050, according to the data. However, 25 percent of those who answered the survey anticipated it would happen much sooner, by 2035, and another 20 percent said it would happen by 2040, according to the survey.

DeFi offers lucrative and safer alternatives to virtually all traditional investment vehicles, and the fact that institutional investors are becoming interested in crypto funds and derivative markets has resulted in billions of dollars being locked into DeFi, with additional billions being managed by asset management firms.

All of these factors point to the inevitable “hyperbitcoinization” of global banking in the coming decades, albeit pinpointing a specific date shortly may be difficult.

Those who make significant investments will receive the rewards of their efforts, and this is true for everyone.

Another prediction made by the panellists was that bitcoin will overtake traditional currencies as the preferred money in poor countries within 10 years. Moreover, 21% of respondents believe that level of acceptance will not occur for more than ten years.

Even in the face of news such as El Salvador’s adoption of Bitcoin and Venezuelans adopting it as a means of combating hyperinflation, it is possible that such views are not totally accurate.

According to a recent assessment on crypto preparedness, developing countries were still a long way from reaching widespread crypto acceptance or being prepared for it.

There were a variety of reasons behind this, including a lack of regulatory attention, the absence of Bitcoin ATMs, a lack of citizen engagement, and so on.

Other factors that may contribute to this include illiteracy, a lack of internet access or electricity, insufficient infrastructure, and government reluctance, among other challenges that developing countries are commonly confronted with.