Du Jun’s claims are predicated on the notion that bitcoin bull markets are inextricably linked to a process known as halving, which occurs every few years.

Du Jun’s Assertions

In an interview with CNBC over the weekend, Du Jun stated that, based on previous market cycles, there may not be another one for around three more years. He stated that “we are currently in the early stages of a bear market,” before going on to say that;

“Following this cycle, it won’t be until end of 2024 to beginning of 2025 that we can welcome next bull market on bitcoin.”

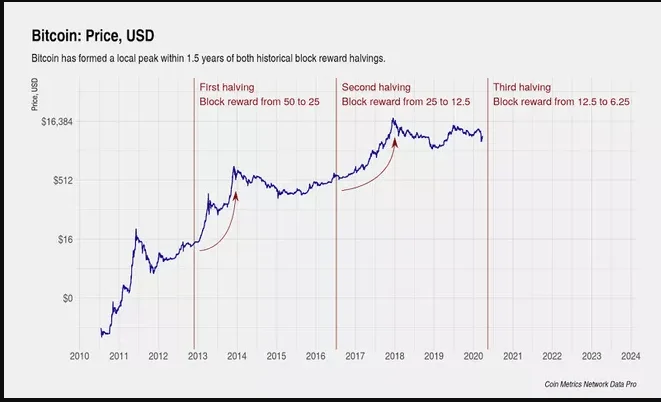

In Jun’s opinion, Bitcoin market cycles are all intimately linked to the halves of the currency. Prices have skyrocketed into a new bull run in the year that follows the halving of Bitcoin prices in prior cycles, according to CoinDesk. According to current plans, the next halving will take place on May 4, 2024, which will occur in 803 days. As a result, if history repeats itself, the crypto markets could see a resurgence in late 2024.

The halving of block incentives for miners will drop the current 6.25 BTC per block to 3.125 BTC per block as a result of the halving. Following the last halving, which took place in May 2020, there was little market action until the months of October and November of the same year, respectively. By the middle of December, the previous all-time high had been surpassed by a significant margin.

There are more relevant elements than in prior market cycles, and there are now institutional investors and exchange-traded products active in the present market cycle, which makes it distinct from previous market cycles. Jun confirmed that making forecasts was no longer as simple as it used to be:

“It is really hard to predict exactly because there are so many other factors which can affect the market as well — such as geopolitical issues including war, or recent Covid…”

Vitalik Buterin, the co-founder of Ethereum, has also spoken out against bear markets, claiming that many engineers would welcome another crypto winter. His remarks were made at the ETHDenver conference, which ended on February 20.

“The people who are deep into crypto, and especially building things, a lot of them welcome a bear market,” he stated.

What you should know about Bitcoin Halving

Bitcoin halving is one of the most significant events on the blockchain. Increased demand for Bitcoin, along with a reduction of bitcoins in circulation, results in an increase in the price of the cryptocurrency. The halving of Bitcoin has ramifications for all parties involved with the cryptocurrency’s ecosystem.

To fully comprehend what a Bitcoin halving is, it is necessary to first gain an understanding of how the Bitcoin network operates.

Bitcoin Network

Blockchain, the technology that underpins Bitcoin, is essentially a collection of computers (or nodes) that run Bitcoin’s software and store a partial or complete history of transactions that have occurred on its network. Whether a transaction is approved or rejected on the Bitcoin network is up to the discretion of each full node, or a node that has a complete history of all transactions on the Bitcoin network.

In order to accomplish this, the node performs a number of tests to confirm that the transaction is legitimate. These include ensuring that the transaction contains the right validation parameters, such as nonces, and that it does not exceed the maximum length allowed by the transaction’s specifications.

Each transaction is reviewed and approved on an individual basis. It is stated to take place only when all of the transactions contained within a block have been approved by the system. Following approval, the transaction is appended to the current blockchain and disseminated to all other nodes in the network.

The blockchain becomes more stable and secure as more computers (or nodes) are added to it. It is believed that 14,616 nodes are currently running Bitcoin’s code. 1 Although anyone can join the Bitcoin network as a node if they have enough storage to download the whole blockchain and transaction history, not all nodes are miners.

Bitcoin Halving Explained

The block reward provided to Bitcoin miners for processing transactions is cut in half every 210,000 blocks mined, or roughly every four years. The rate at which new bitcoins are released into circulation is halved in this event, which is referred to as halving. Until all bitcoins are distributed, this is Bitcoin’s approach of enforcing synthetic price inflation.

This system of incentives will last until roughly the year 2140, when the intended limit of 21 million people is reached. Miners will be rewarded with fees for processing transactions, which will be paid by network users. These fees ensure that miners continue to be motivated to mine and maintain the network.

The halving event is significant because it signifies yet another decrease in the rate at which new Bitcoins are created when the overall supply of bitcoins approaches 21 million. There are around 18.85 million bitcoins in circulation as of October 2021, with just roughly 2.15 million left to be released via mining awards. 3

The reward for each block produced in the chain was 50 bitcoins in 2009. It was 25 bitcoins per block after the first halving, then 12.5, and finally 6.25 bitcoins per block as of May 11, 2020. Consider what would happen if the amount of gold taken from the Earth was cut in half every four years. If gold’s worth is determined by its scarcity, reducing its production every four years would theoretically raise its price.

Are Cryptocurrency markets Retreating?

Crypto markets are already down roughly 38% from their peak in mid-November, and if prior bear markets are any indication, they could go far further. With a value of 25, the Bitcoin ‘fear and greed’ Index was still reading ‘severe dread.’

According to CoinGecko, most major crypto tokens were trading flat on the day at the time of writing, with a total capitalization of roughly $1.87 trillion.

At $39,363, Bitcoin remained below $40,000, but Ethereum had clawed its way back to $2,750. On the day, Solana (SOL), Terra (LUNA), and Shiba Inu (SHIB) all gained 6-8 percent.