Bitfinex exchange has launched new Bitcoin and Ether volatility futures for investors in response to a recent spike in crypto market volatility.

Two new perpetual futures contracts are now being traded on Bitfinex’s derivatives platform Bitfinex Derivatives, powered by iFinex Financial. The company made this announcement to Cointelegraph on April 3.

The Ethereum Implied Volatility Index (EVIV), the Bitcoin Implied Volatility Index (BVIV), and the Volmex Implied Volatility indices serve as the foundation for the new contracts. The indexes monitor the implied volatility of BTC and ETH options contracts or the 30-day projected volatility.

Bitfinex’s head of derivatives, Jag Kooner, told Cointelegraph, “the creation of these indices allows our customers to not only monitor but trade the implied volatility of Bitcoin and Ether in a simple perpetual format.”

Perpetual futures, sometimes called perpetual swaps or just perpetuals, are derivative contracts that let traders make long-term predictions about an asset’s value without worrying about it expiring.

Since other contracts rely on a dated structure, Kooner claims that perpetual futures make the “most tradable format in the crypto space.” He mentioned:

“Tracking the 30-day implied volatility in Bitcoin and Ether options contracts without the need to roll — i.e. dated futures — opens up the product to both retail and institutional investors alike.”

Along with cryptocurrencies, Bitfinex offers over 60 perpetual futures contracts covering commodities like precious metals and oil, foreign exchange, and stocks. The new contracts join these offerings. Kooner said, “We will be able to add implied volatility as another asset class with these new contracts.”

In the context of options trading, implied volatility measures how much the market anticipates an asset’s value fluctuating over a given time frame.

Volatility increases when investors anticipate significant movement but decreases when they anticipate minimal movement in an asset’s price.

According to Kooner, introducing the new trading tools was a reaction to the values of cryptocurrencies reaching all-time highs. He mentioned:

“With many crypto prices reaching new ATHs, the likelihood of increased volatility and significant drawdowns means there is more utility for these indexes than ever.”

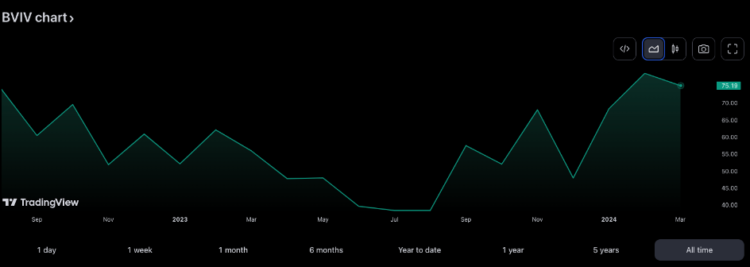

The announcement follows the unprecedented peak in bitcoin volatility in March 2024. March 11 saw a peak of 85 points for the Crypto Volatility indicator (CVI), which measures 30-day future volatility and acts as a “market fear index” for the cryptocurrency market.

Two days before Bitcoin’s historic highs above $73,000 on March 13, the CVI touched its all-time high. As of this writing, the CVI indicated that the cryptocurrency volatility index is approximately 76.