On September 27, the crypto exchange Bitfinex made a significant transaction by sending $100,000 worth of the stablecoin Tether (USDT) to the layer-2 subsidiary platform DeversiFi and was charged $23M in gas fee.

The exchange paid 7,676 ETH, or $23.7 million, for unknown reasons, making it the biggest gas fee ever recorded on the Ethereum network.

The deposit transaction was launched at 11:10 UTC this morning from Bitfinex’s second-largest wallet, via a second address, to the wallet of DeversiFi, according to blockchain data from EtherScan.

Even while DeversiFi advertises a service that “avoids gas costs and annoyance, saving you time and money with every trade or swap,” the transaction had an “erroneously high gas fee.”

To put the magnitude of this cost into perspective, consider that the average transaction fee on the Ethereum blockchain is currently 0.013 ETH ($39.96). Furthermore, two weeks ago, $2 billion in Bitcoin was transferred for an infinitesimal cost of $0.78 between unknown wallets.

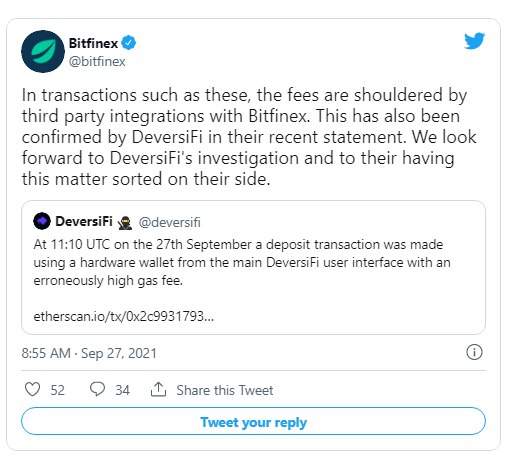

DeversiFi stated that they have begun investigative procedures to determine the most likely cause of the problem, while also stating that “no customer funds on DeversiFi are at risk, and this is an internal issue for DeversiFi to resolve,” as well as that “no customer funds on DeversiFi are at risk, and this is an internal issue for DeversiFi to resolve.” ““Operations will not be harmed.”

“In transactions such as these, the costs are shouldered through third-party integrations with Bitfinex,” Bitfinex responded on Twitter “implying that the fee will not be borne directly by the exchange.

In June 2020, three small to medium transactions registered seismic charges, with one 0.55 ETH transfer costing $2.6 million in fees, comparable to the Bitfinex instance.

“I’m anticipating EIP-1559 to dramatically minimize the rate of things like this happening by decreasing the need for users to try to set fees manually,” Ethereum co-founder Vitalik Buterin said at the time, agreeing with the human-error story.

However, once the last of the three transactions was confirmed as a “malicious attack” when the wallet owner contacted the mining pool that facilitated the transaction, experts in the area spread speculations of extortion, fraudulent activities, and even money laundering. In this example, the owner received 90% of the funds that were lost.