Bithumb will soon totally bar its employees from accessing its platform to trade crypto, following the introduction of staff-related trading limitations a few months ago.

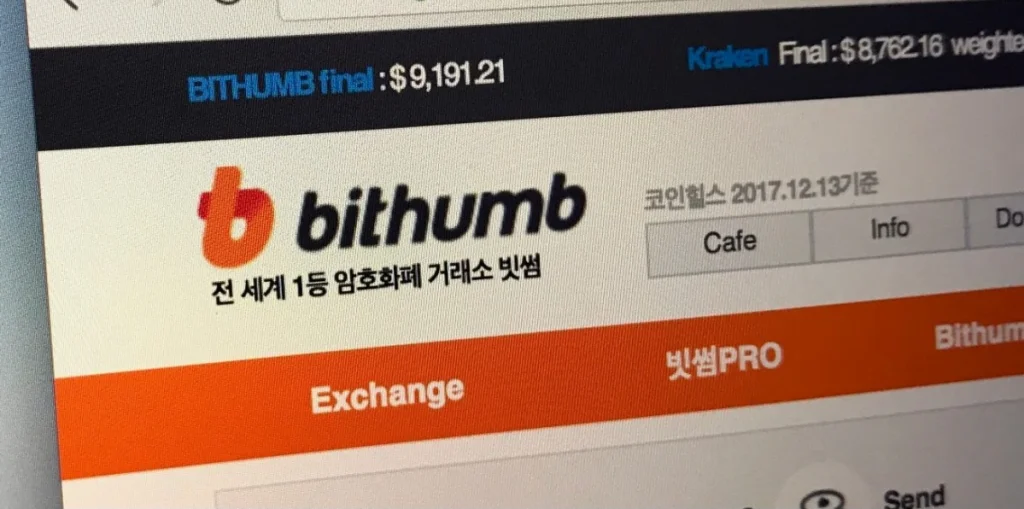

A major South Korean cryptocurrency exchange, Bithumb, has imposed trading restrictions on its workers, prohibiting them from trading on the platform.

Starting this month, Bithumb employees will be prohibited from purchasing or selling bitcoin using their Bithumb accounts, according to an official Friday release.

According to the firm, the restriction is intended to reinforce internal regulations and enhance transaction transparency on the Bithumb exchange. Staff workers were previously required to send written declarations detailing account withdrawals as part of the action last month.

The exchange will also develop a permanent monitoring system, which will include self-audits and an internal reporting system, according to the release.

The recent development comes after Bithumb imposed a number of additional limitations on its employees, including a ban on trading during business hours and others. Years ago, Bithumb said, the company put in place a number of employee-related procedures to avoid data leaks, unfair trading practices, and market manipulation.

Bithumb’s spokesman refused to provide Cointelegraph with any additional information about the subject.

The announcement comes as South Korea continues to stiffen its stance on regulating domestic crypto firms, broadening the purview of government monitoring of the country’s crypto exchange market.

The South Korean government has given cryptocurrency exchanges until September 2021 to register with local financial regulators.

The Financial Services Commission (FSC) changed its financial reporting requirements in March, requiring cryptocurrency exchanges to submit regular transaction reports to the Financial Intelligence Unit and to open real-name accounts with Korean banks.

Smaller South Korean exchanges have been considering suing the government for allegedly failing to accept responsibility for heavy regulatory demands, according to local publications.