The BMEX tokens, according to BitMEX‘s token whitepaper, will allow the exchange to enhance its services and attract new consumers.

BitMEX, a cryptocurrency exchange, has given out 1.5 million BMEX, its first native token, to consumers in an effort to rekindle retail interest. The tokens were given out as a result of a user’s earlier trading activity.

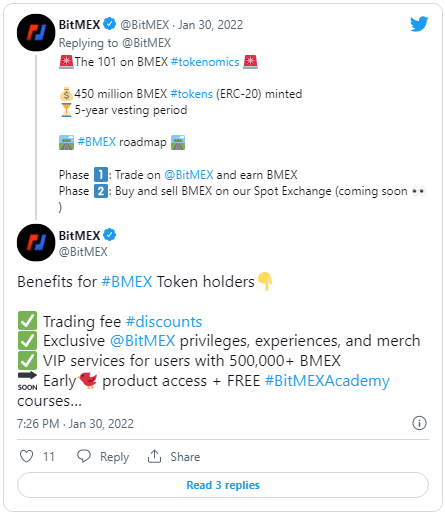

About the BMEX tokens

The Ethereum-based tokens have a maximum quantity of 450 million and are locked in a 5-year vesting contract. These will be used to reward new and existing BitMEX customers, as well as provide them with trading fee discounts.

The tokens are distributed as follows: 5% is set aside for future airdrops, 20% is set aside for liquidity when BMEX spot trading launches, 20% is set aside for BitMEX employee incentives, 30% is set aside for marketing and affiliate benefits, and 25% is set aside as a long-term reserve.

BMEX tokens, according to BitMEX’s token whitepaper, allow the exchange to enhance services and attract new consumers. This is a step forward from its early days as a strictly futures-based cryptocurrency exchange. Futures are a type of financial instrument that tracks the price of an asset.

The exchange stated in the litepaper that it plans to burn BMEX every quarter to boost usefulness for holders.

Benefits of the BMEX tokens

Holders of BitMEX Tokens enjoy free access to BitMEX Academy classes and private community channels, as well as a higher rate of return on BitMEX EARN deposits, the exchange’s passive earning product.

For holders of 500,000 BMEX or more, savvier privileges include invitations to special events, BitMEX apparel, and VIP seats to sporting activities.

BMEX holders can start staking on the 1st of February. With the introduction of the BitMEX spot market in early Q2, spot trading of BMEX tokens will begin. At the time of writing, the tokens could not be withdrawn.