In response to the increasing demand for institutional cryptocurrency services in Europe, Austrian fintech unicorn Bitpanda is introducing an institutional-grade cryptocurrency trading platform called Bitpanda Wealth.

A significant cryptocurrency broker established in 2014, Bitpanda has introduced Bitpanda Wealth, a new service designed for corporate treasuries, family offices, external asset managers, and high-net-worth individuals.

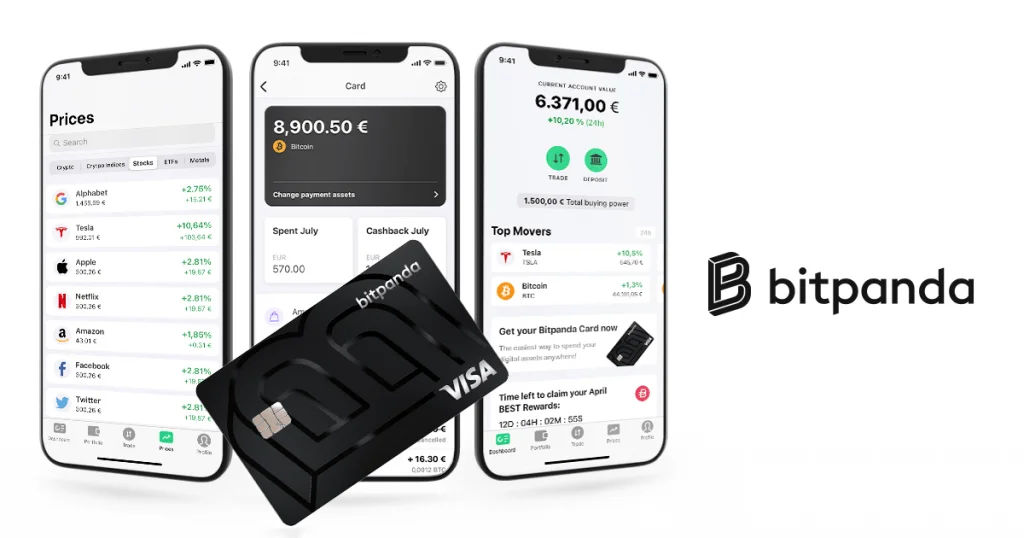

Bitpanda stated in a January 30 announcement that the new institutional platform utilized the same infrastructure where several significant European banks had placed their trust. In addition to a suite of services designed to facilitate cryptocurrency investment, administration, and reporting, Bitpanda Wealth also provides exchange-traded funds, commodities, leverage products, and other assets.

Bitpanda is focusing on a European sector that “appears to be underserved,” according to CEO and co-founder Eric Demuth.

Demuth stated, “This area is of considerable interest but lacks sufficient solutions.” Bitpanda has consulted with “several private banks and affluent clients who have articulated a desire for a unique service.”

The CEO noted that the new institutional platform utilizes Bitpanda Custody, a proprietary custody solution that employs cold storage to safeguard its clients’ assets. Bitpanda Custody, which is registered with the Financial Conduct Authority of the United Kingdom, provides segregated purses to corporate treasuries, service providers, institutional investors, and token issuers.

“Demuth declared:

“When it comes to asset security, we are monitored by multiple financial market authorities, and have our funds and business practices regularly validated by external parties. We are trustees on behalf of our users, and all of their funds are held in cold storage — that’s a major difference between Bitpanda and an exchange.”

Cold storage, also known as a cold wallet, is among the most secure methods for storing the private keys that grant access to cryptocurrency holdings.

In contrast to online hot wallets frequently employed by cryptocurrency trading platforms, cold wallets operate without an internet connection, thereby substantially diminishing the likelihood of security breaches and attacks.

Bitpanda has introduced several platforms with a focus on institutions before Bitpanda Wealth. In 2019, the company also introduced Bitpanda Pro, which offered brokerage services and an over-the-counter trading desk. After raising 30 million euros in Series A funding in 2021, Bitpanda Pro changed its name to One Trading.

“One Trading was completely disconnected from Bitpanda following a successful Series A last year,” the CEO of Bitpanda told Cointelegraph.

Bitpanda, a significant European cryptocurrency company, has been diligently collaborating with local regulators to obtain the licenses required to offer its services.

Norway issued Bitpanda a virtual assert service provider certificate in October 2023. Additionally, the firm possesses permits in the Czech Republic, Austria, Germany, France, and Sweden, among others.

In 2023, Bitpanda also supported the introduction of cryptocurrency trading services by Raiffeisenlandesbank Niederosterreich-Wien, a subsidiary of Raiffeisen Bank.