The news came three days after Mt. Gox Trustee completed the first test transactions on the Bitstamp exchange.

Bitstamp started the repayment of Mt. Gox creditors, after receiving all of the funds owed to them from the trustee.

On July 25, the cryptocurrency exchange received all Bitcoin, Bitcoin Cash, and Ethereum and began repaying creditors.

According to an announcement shared with Cointelegraph, the recipients can expect being able to fully control their assets within a week, after the completion of the necessary security controls.

While the Mt. Gox tragedy should not have happened, Bitcoin’s price increase since the occurrence demonstrates the asset’s value, according to Jean-Baptiste Graftieaux, Bitstamp’s global CEO, who wrote:

“We’re proud to play our part in making the Mt Gox investors whole. It’s a testament to Bitcoin’s value as an asset that, although the Mt Gox investors should never have been unable to access their tokens, many will make a serious profit.”

Approximately 127,000 creditors of Mt. Gox are owed over $9.4 billion in Bitcoin, and they have been waiting for more than a decade to receive their funds. This poses a significant threat to the Bitcoin market, as creditors are pushing for a sell-off.

The announcement was made just days after Mt. Gox conducted the initial test transactions on the Bitstamp exchange.

Mt. Gox’s UK creditors will have to wait a few more months: Bitstamp

The announcement is beneficial for creditors of Mt. Gox; however, Bitstamp users in the United Kingdom may need to wait a few more months to receive their assets.

Bitstamp’s announcement also stated that UK customers will be informed in “due course.”

“While UK customers will not be included in the first tranche of distributions, UK customers can expect to receive their restored within the next few months and will receive more information in due course.”

Other exchanges are also participating in the repayment of creditors.

Kraken’s CEO, Dave Ripey, stated that the company completed the repayment of Mt. Gox creditors on July 24.

Bitcoin Price Stagnant as Mt. Gox Creditors Hold Off Selling

In the 24 hours leading to 12:31 pm in UTC, Bitcoin’s price dipped over 3.2%, trading just above the $63,300 point.

Bitstamp data indicates that the world’s first cryptocurrency has experienced a 4.3% dip in the past five days.

However, Bitcoin’s price doesn’t seem to be affected by Mt. Gox creditors, as onchain data suggests they aren’t selling.

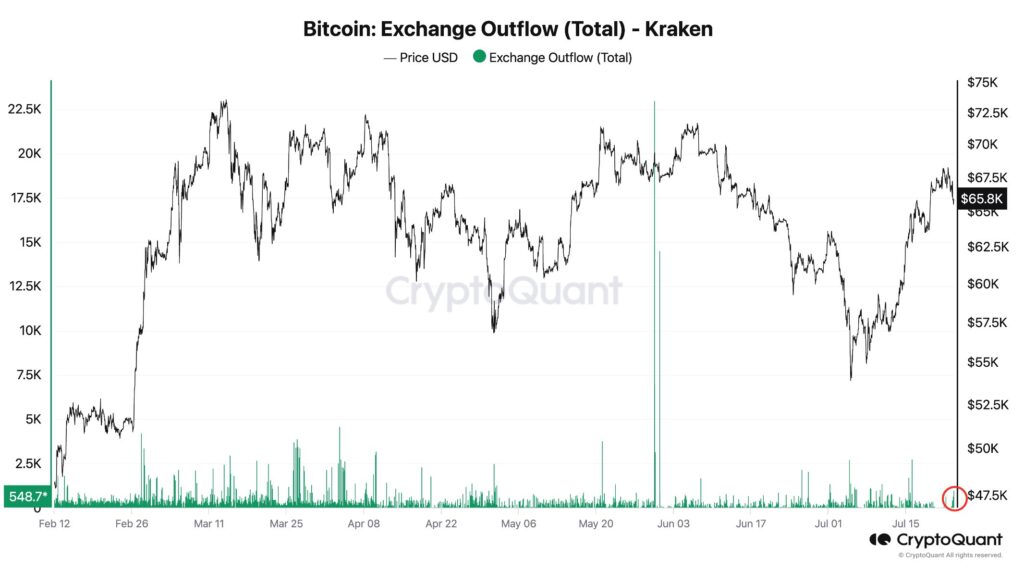

Ki Young Ju, the founder and CEO of CryptoQuant, stated in a July 24 X post that the trading volume on the exchange remained essentially unchanged following Kraken’s distribution to creditors.

“Mt. Gox creditors received Bitcoin 4 hours ago. There has been no significant spike in hourly spot trading volume dominance or BTC outflows on Kraken since then.”

According to other analysts, the Mt. Gox payments are expected to result in selling pressure among “paper hands,” which is a term used in the crypto industry to describe the crypto holders with the least conviction.