Bittensor was compelled to halt its network activity on July 3 due to a wallet exploit that resulted in the theft of at least $8 million in digital assets.

Ala Shaabana, the co-founder of Bittensor, declared the network outage in a post on July 3 to contain the exploit.

“By way of an update, we have contained the attack and put the chain into safe mode (blocks producing but no transactions are permitted). We’re still mid-investigation and are considering all possibilities.”

The crypto space continues to experience significant delays in mass adoption due to the prevalence of hacks and exploits. The crypto industry has experienced 785 reported crypto breaches, resulting in nearly $19 billion in thefts over the past 13 years.

Potential private key breach led to $8M TAO Theft

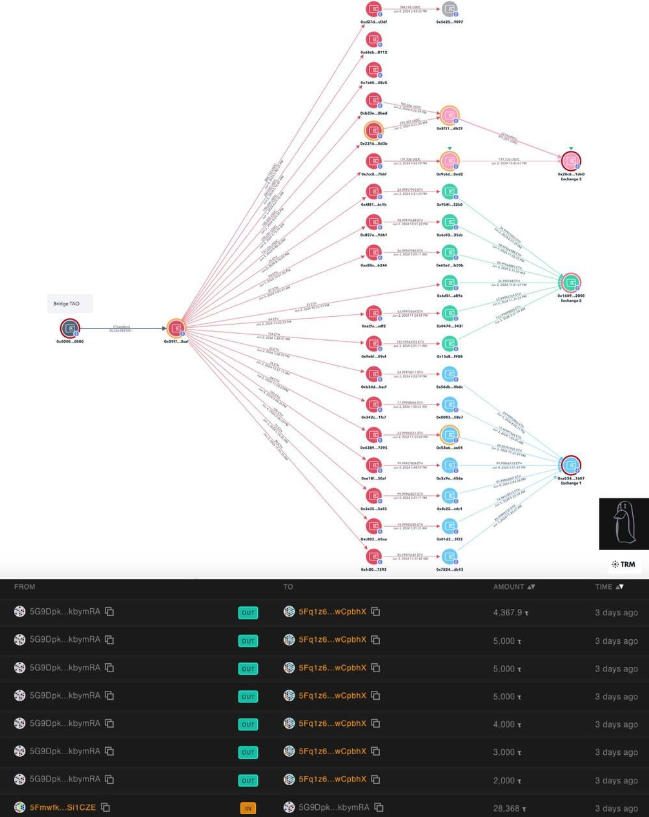

ZachXBT, a pseudonymous onchain investigator, initially identified the theft in a Telegram message on July 3. He composed the following:

“Bittensor was halted due to additional thefts earlier today potentially as a result of private key leakage.”

Acquiring 32,000 Bittensor (TAO) tokens worth approximately $8 million was possible by exploiting the unknown address “5FbW.”

ZachXBT reports that this most recent assault coincides with a month following the theft of $11.2 million in TAO tokens from a distinct wallet on June 1.

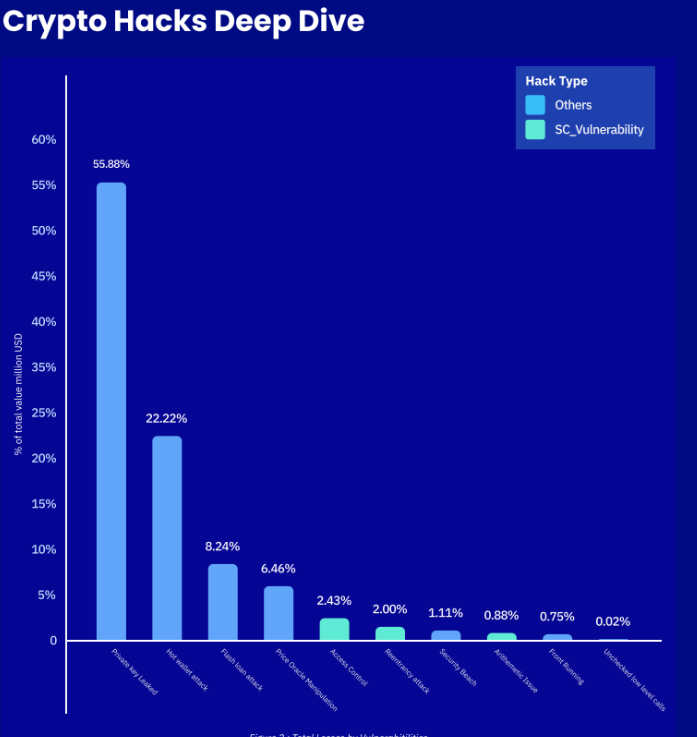

Although smart contract vulnerabilities were previously responsible for most hacked funds, private key leaks have surpassed smart contract-related assaults.

Merkle Science’s “2024 Crypto HackHub Report” report indicates that private key breaches resulted in the loss of over 55% of the hacked digital assets in 2023.

According to Mriganka Pattnaik, co-founder and CEO of Merkle Science, a crypto risk and intelligence platform, this is partially because hackers compete for more straightforward targets.

Pattnaik disclosed to Cointelegraph:

“While smart contract vulnerabilities remain a concern, hackers increasingly target areas outside smart contracts, like private key leaks. These leaks, often due to phishing attacks or insecure storage practices, have led to significant losses.”

In 2023, the amount of funds compromised due to smart contract vulnerabilities decreased by 92% to $179 million, a significant decrease from the $2.6 billion lost in 2022.