Spot Ethereum ETFs made an impressive launch on Tuesday, attracting $107 million, so Bitwise CIO Matt Hougan is bullish for other crypto ETFs, including Solana funds.

Bitwise Asset Management’s Chief Investment Officer, Matt Hougan, expressed optimism regarding the future of crypto exchange-traded funds (ETFs) upon the introduction of Spot Ethereum ETFs on July 23.

Hougan underscored the exceptional reception of the recently introduced Ether ETFs.

Furthermore, he believes that this has opened the door for other crypto ETF developments, such as the Solana (SOL) ETF.

Bitwise CIO On Ethereum ETF Performance

Hougan observed that the Ether ETFs, which included Bitwise’s own ETH ETF (ETHW), exceeded expectations.

Moreover, ETHW alone seeing over $200 million in inflows on the first day. “To be honest, it’s exceeded my expectations through lunchtime,” Hougan remarked in a Bloomberg interview.

He added, “We had about half a billion dollars traded in these new ETFs. By comparison, the average ETF trades about a million dollars on its launch day.”

The Ethereum ETFs are among the most successful ETF launches in history, with a substantial trading volume that is second only to Bitcoin ETFs.

Moreover, the performance of Ether ETFs has substantial implications for the broader crypto market.

Hougan proposed that the approval of these ETFs represents a new era in crypto investment.

“Long term, as we look into 2025, we’ve entered the ETF era of crypto,” he said. “We’re going to see ETFs on multiple crypto assets; we’re going to see index-based ETFs.”

Additionally, he emphasized that the Solana ETF filings by VanEck and 21Shares were already in.

This enhances the likelihood that other altcoins will also establish a presence in the ETF market.

In addition to the bullish narratives of other experts, Spot Ethereum ETFs experienced substantial inflows on the first day.

ETH ETF Day 1 Inflows

BlackRock ETH ETF (ETHA) became the market leader among its peers on the first day of launch, with a total inflow of $265 million.

Concurrently, Fidelity’s Ether ETF (FETH) experienced inflows of over $70 million, while other participants, including Franklin, VanEck, Invesco, and 21Shares, experienced inflows of $5 to $15 million.

However, Grayscale’s ETHE fund experienced sizable outflows, which amounted to $484 million.

These negative flows constituted an astonishing 5% of the $10 billion in assets under management.

Grayscale transferred $1 billion to its Ethereum Mini-Trust to provide initial capital for the launch event, and this outflow occurred just one day later.

Other Experts’ Comments

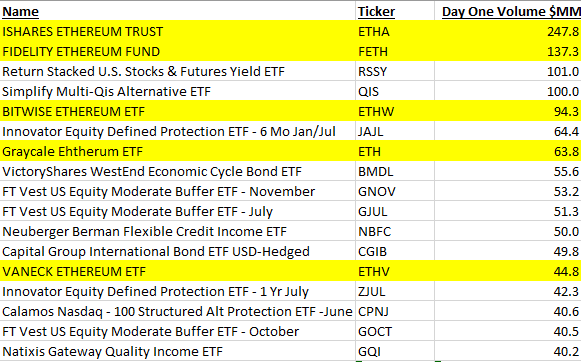

Eric Balchunas, a Bloomberg analyst, emphasized the extraordinary nature of these initiatives.

He noted on the social media platform X that ETHA had the highest day-one volume of all new launches in the previous year, excluding Bitcoin ETFs.

He further stated that ETHW was rated fifth, FETH was ranked second, and other Ether ETFs also performed well.

Similarly, Matthew Sigel, VanEck’s Head of Digital Assets Research, underscored the favorable outcome for Ethereum ETFs, stating, “23% of Day 1 Spot Bitcoin ETF Volumes is a Great Result for #ETH ETFs, which collectively traded $1.1 billion.”

Outlook For ETF Market

Hougan predicted that institutional investors would have a more substantial influence on the inflows of BTC and ETH ETFs in the future.

According to the most recent 13F filings, institutional investors currently account for 5-6% of Bitcoin ETF inflows.

He anticipates that the institutional migration will increase to 50%.

Additionally, Spencer Bogart, the General Partner at Blockchain Capital, predicted that Ether ETFs could experience inflows over $10 billion within the initial year.

In the same vein, Ryan Rasmussen, the Head of Research at Bitwise, predicted that the price of ETH could reach a new all-time high between $6,500 and $7,500.

The U.S. Securities and Exchange Commission (SEC)’s approval of Ethereum ETFs has spurred discussions regarding the potential introduction of ETFs for other altcoins.

Geoffrey Kendrick, an analyst at Standard Chartered Bank, previously predicted that the SEC may approve ETFs for Solana (SOL) and Ripple-backed XRP by 2025.

Kendrick observed that the market anticipates these developments; however, they are unlikely to transpire in 2024 as a result of the intricate approval procedure.

He also indicated that the SEC’s decision not to classify ETH as a security could have broader implications.

He suggested that other cryptocurrencies with similar technology to Ether could also evade being classified as securities, which could potentially facilitate the launch of their own ETFs.