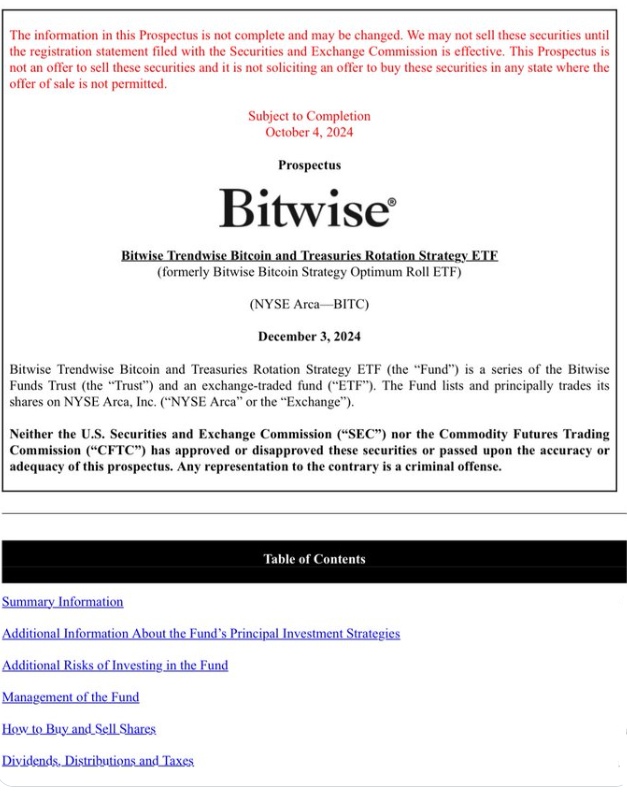

Bitwise Asset Management had a new ETF filing to convert three crypto futures ETFs from long-only strategies to strategies that rotate between crypto futures and US Treasuries.

The company is refining the investment strategy of its three crypto futures ETFs to alternate between cryptocurrency and US Treasuries using its proprietary strategy, “Trendwise.”

The above strategy, to be undertaken in aid of helping to reduce downside risk and foster long-term growth, shall be effective on or about December 3, 2024.

The Bitcoin Strategy Optimum Roll ETF will commence operations under the Trendwise Bitcoin and Treasuries Rotation Strategy ETF (BITC) on the specified date.

The Trendwise Ethereum and Treasuries Rotation Strategy ETF will replace the Ethereum Strategy ETF, while the Trendwise BTC/ETH and Treasuries Rotation Strategy ETF will operate under the new name.

With minimal disruption, the new strategy dynamically adapts to market trends and volatility. Additionally, it prioritizes long-term price appreciation in its investments.

According to Bitwise CIO Matt Hougan:

“Momentum is a well-established factor in virtually every asset class, and it is powerful in crypto as well. The new Trendwise strategies capitalize on that momentum through a trend-following strategy that rotates between crypto and Treasuries exposure based on market direction. The goal is to help minimize downside volatility and potentially improve risk-adjusted returns.”

Bitwise’s strategy depends on a proprietary signal of market momentum for crypto assets. This is contingent upon the 10- and 20-day exponential moving averages and encompasses Bitcoin and Ethereum.

The funds would typically invest in cryptocurrencies if the 10-day EMA were more significant than the 20-day EMA-a condition.

This suggests an upward trend and may result in a transition to US Treasuries if the reverse occurs. The funds will preserve the current expense ratios and tax treatments. Additionally, there would be no action item that existing investors would be required to perform.

Bitwise to broaden its crypto offerings with XRP ETF

This action contributes to Bitwise’s event-packed 2024. The company introduced its inaugural spot, Bitcoin ETP, in January and its inaugural Ethereum ETP in July of this year. This world’s largest crypto index fund manager expanded its European presence in August by acquiring crypto fund provider ETC Group.

Bitwise, a crypto index fund manager, recently submitted an S-1 registration to the SEC to provide a spot XRP ETF. Investors would have direct access to the Ripple Labs crypto token if authorized.

This would entail additional advancements in the mainstream opportunities for cryptocurrency investment. Regulated financial instruments in the United States would facilitate the investments.

The advancement represents an additional stride in the diversification of cryptocurrency investment opportunities. It also fosters optimism regarding the potential for a regulated financial product to provide broader access to XRP.