On April 5, global asset manager BlackRock added five major Wall Street firms to its Bitcoin exchange-traded fund (ETF) prospectus.

The document modifies BlackRock’s S-1 registration statement with the US Securities and Exchange Commission. Its new members include ABN AMRO Clearing, Citadel Securities, Citigroup Global Markets, Goldman Sachs, and UBS Securities.

Virtu Americas, Macquarie Capital, Jane Street Capital, and JPMorgan Securities are a few of the previously approved ETF participants.

Because they can issue and redeem ETF shares, which entails trading them for cash or a matching basket of securities reflecting the ETF’s holdings, authorized participants are essential to the functioning of the BTC ETF.

The latest additions suggest that “big-time firms now want a piece of the action and are now OK being publicly associated w[ith] this,” according to Eric Balchunas, an analyst for Bloomberg.

The main goal of the SEC’s stance on a cash generation and redemption mechanism for Bitcoin ETFs was to reduce the possibility of transactions involving market manipulation.

The cash mechanism means that, unlike the traditional in-kind model, where market participants handle the underlying assets directly, new shares of a Bitcoin ETF will only be produced or redeemed through cash transactions.

Asset managers like Hashdex initially proposed this strategy to stop intraday price manipulation. Due to the SEC’s guidance, other asset managers, including industry titans BlackRock, ARK Invest, and Grayscale, have included this method in their disclosures.

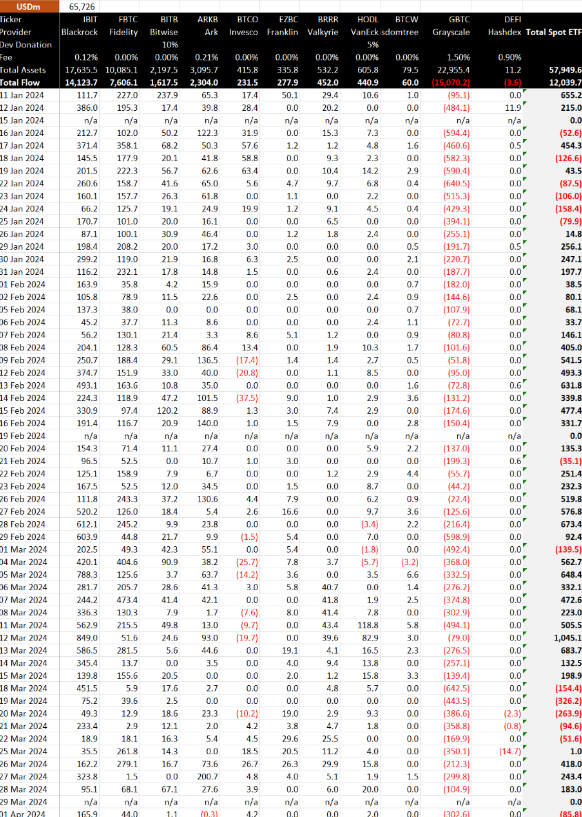

Although the trading volume of the Bitcoin ETFs increased to $111 billion in March, some studies indicate that the demand for the product is declining.

Grayscale and Fidelity funds are the next in line for assets under management and trading volume, with BlackRock’s iShares Bitcoin Trust (IBIT) leading the way. BitMEX Research data indicates that as of April 1, BlackRock’s IBIT holdings were $17.6 billion.