BlackRock’s iShares Bitcoin ETF (IBIT) has surpassed $23 billion in inflows, with $329 million on October 21 and $1.5 billion over six days.

On the spot The amount of money flowing into Bitcoin exchange-traded funds (ETFs) has been steadily increasing over the past week and shows no signs of slowing down any time soon.

BlackRock Bitcoin ETF Hits Fresh Milestone

BlackRock’s iShares Bitcoin Exchange-Traded Fund (IBIT) reached a significant milestone on Monday, bringing the fund’s total inflows since its inception to more than $23 billion. Launched in 2024, IBIT now ranks among the top three exchange-traded funds (ETFs) in terms of inflows.

There is a significant amount of institutional demand for the asset class, as evidenced by the fact that the US Bitcoin exchange-traded fund (ETF) received more than $2 billion in inflows in the previous week.

On Monday, October 21, the total inflows reached $294 million, with BlackRock’s IBIT emerging as the standout performer. While the remaining exchange-traded funds (ETFs) reported either no net withdrawals or zero net inflows, IBIT generated $329 million in inflows yesterday.

Over the course of the most recent six trading sessions, IBIT has recorded inflows that amount to a total of $1.5 billion. The BlackRock Bitcoin ETF has now surpassed VIT to take a place among the top three exchange-traded funds (ETFs) in terms of inflows in 2024, according to Eric Balchunas, a strategist for Bloomberg ETFs.

This has been the best week for the BlackRock Bitcoin ETF. To exacerbate the situation, IBIT’s assets under management have now exceeded $26 billion, positioning it in the top 2% of all exchange-traded funds. On the other hand, these robust ETF inflows have not had much of an effect on the price of bitcoin because they have not been able to break through the important barrier level of $69,000.

At the time of this publication, the price of Bitcoin was trading at $67,528.79, a decrease of 2.29% from its previous level due to selling pressure. On the other hand, the daily trade volume has increased by sixty percent, reaching thirty-seven billion dollars.

The market experts at Bitfinex think that the impact of ETF inflows on Bitcoin may take longer than expected. They stated that:

ETF inflows can have a muted impact for a few days, and then the market reverses lower once the aggression from spot market buyers fades”.

There has been a significant increase in the amount of money flowing into Bitcoin exchange-traded funds (ETFs), according to market analysts, which indicates that the Trump trade is currently active.

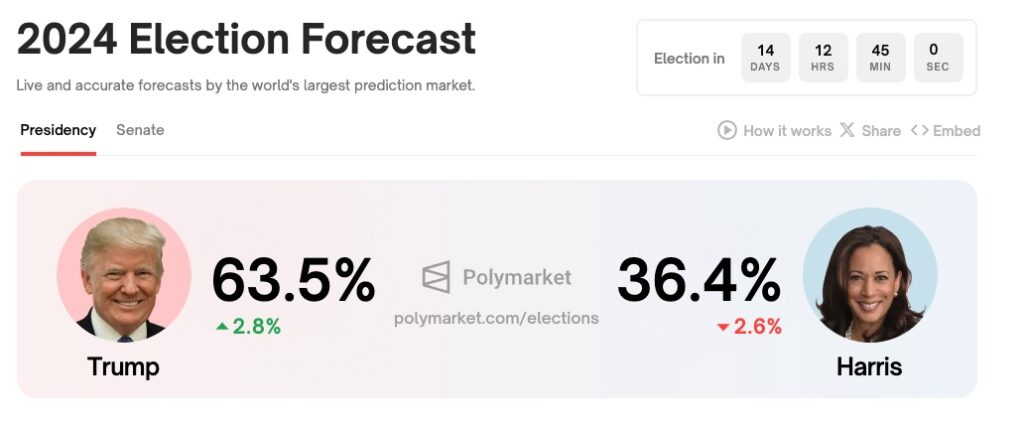

Trump’s chances of winning the election versus Kamala Harris have significantly increased to 63.5%, according to data provided by Polymarket. Ryan Lee, Chief Analyst at Bitget Research, asserts that institutional interest is evident in the six consecutive days of inflows, indicating a strong momentum.

“The main drivers are Trump’s rising odds of winning the election and a technical rebound in Bitcoin’s price. Trump is a known supporter of Bitcoin, and his increasing odds of winning are seen as a positive signal for the market”.

In addition, Lee mentioned that the recent approval of Bitcoin exchange-traded fund (ETF) options by the United States Securities and Exchange Commission’s (SEC) might further stimulate increased liquidity in ETFs.

The Securities and Exchange Commission (SEC) has given its clearance to exchange-traded fund (ETF) options, and QCP Capital believes that this will provide the ETF with the liquidity it needs to attract sustained inflows.