Continued ETF inflows might help Bitcoin hit an all-time high, which the asset came within $200 of on Oct. 29.

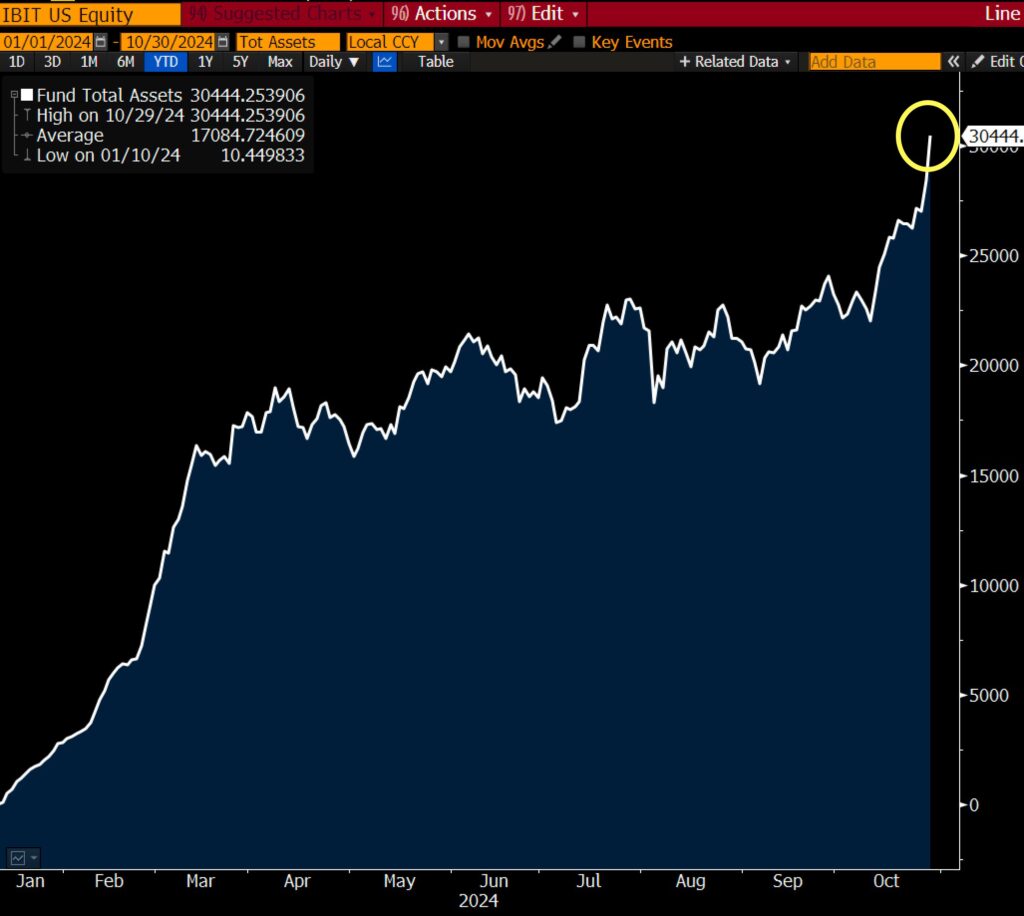

BlackRock’s spot Bitcoin exchange-traded fund (ETF) has exceeded $30 billion in holdings, indicating a growing interest in the leading cryptocurrency.

The largest asset manager achieved this $30 billion milestone less than 10 months after launching its Bitcoin ETF, which started trading on January 10.

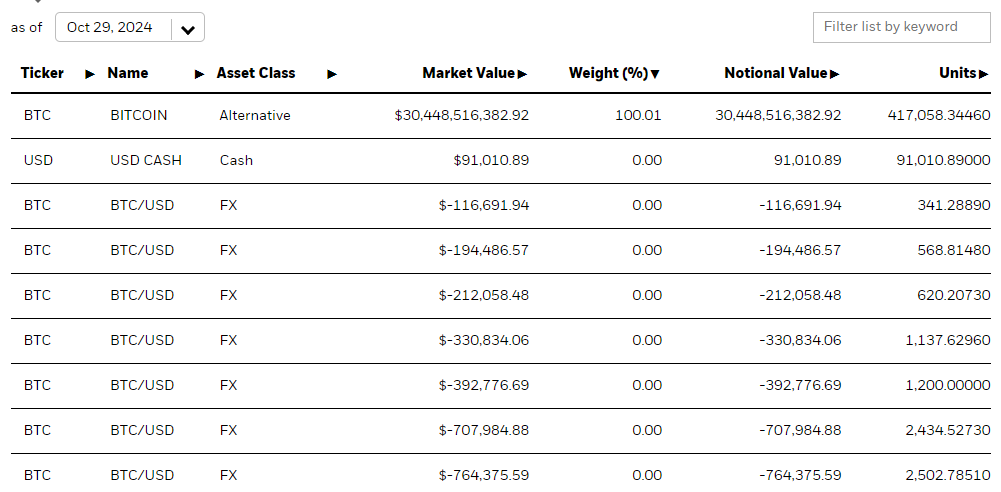

According to data, BlackRock currently holds over 417,000 Bitcoins, valued at more than $30.4 billion based on today’s prices.

Inflows into Bitcoin ETFs have been rising in anticipation of the upcoming United States presidential election on November 5.

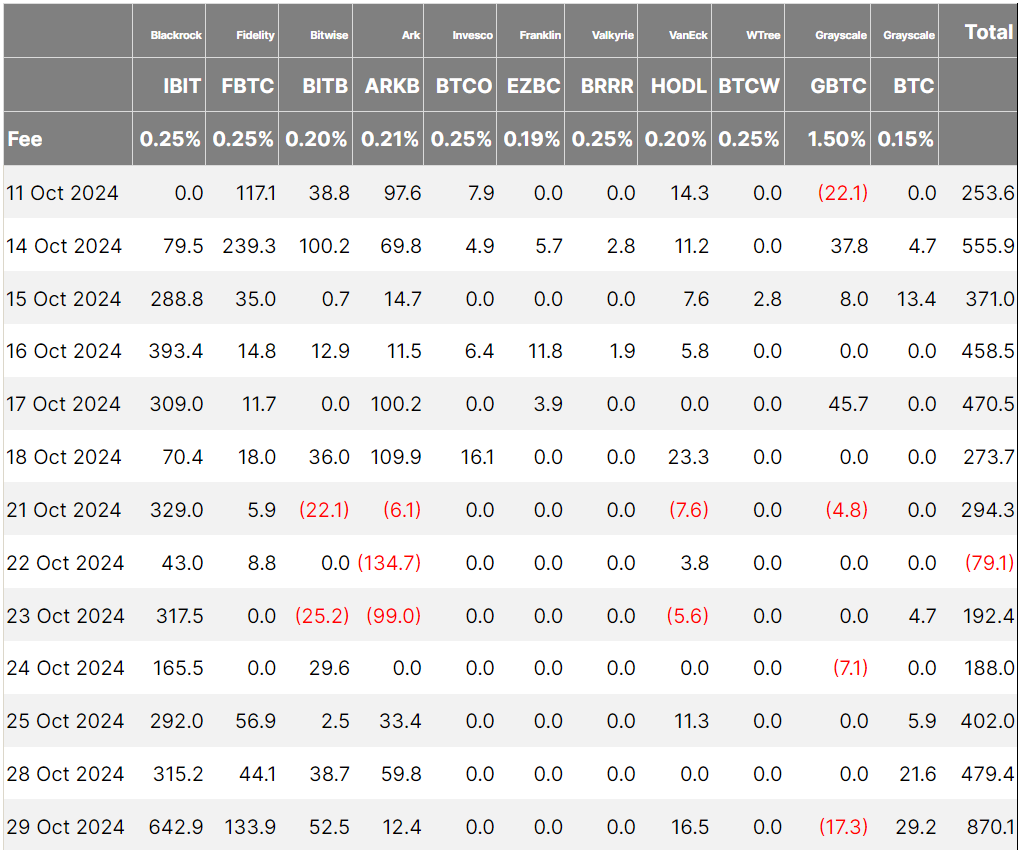

On October 29, Bitcoin ETFs recorded $870 million in cumulative net inflows, making it the second-highest day for inflows since March 12, when the ETFs accumulated over $1 billion worth of BTC, according to Farside Investors data.

Eric Balchunas, a senior ETF analyst at Bloomberg, stated that reaching the $30 billion milestone is an “all-time record” for ETFs.

In an October 30 X post, Balchunas noted:

“It hit this milestone in just 293 days, an all-time record. The old record was $JEPI which did it in 1,272 days. $GLD took 1,790 days. Unreal.”

Growing ETF inflows may contribute to Bitcoin’s price climbing to an all-time high. By February 15, just one month after their launch, US-based spot Bitcoin ETFs accounted for approximately 75% of new Bitcoin investments, driving its price above the $50,000 mark.

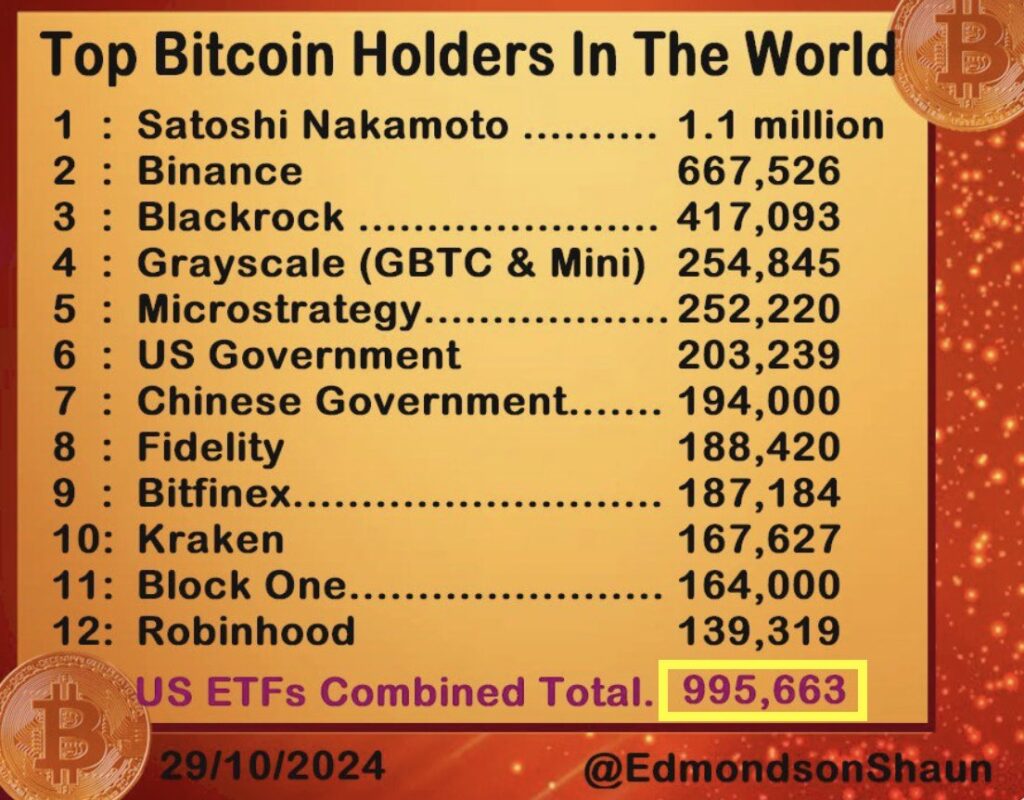

Bitcoin ETFs Set to Cross 1 Million in BTC Holdings — ETF Analyst

Bitcoin ETFs are poised to reach a significant milestone within the next 24 hours, potentially exceeding a cumulative 1 million BTC — worth over $71.7 billion. Balchunas pointed out that the ETFs currently hold about 996,000 BTC, suggesting there’s “a good chance to pass 1 million today.”

If this occurs, the Bitcoin ETFs could become the largest Bitcoin holders globally by this November, surpassing Satoshi Nakamoto’s wallet, which contains over 1.1 million BTC, according to Balchunas.

An increasing number of analysts predict a new all-time high for Bitcoin. Bitfinex analysts anticipate a rally to $80,000 before the end of 2024, driven by the options market structure and the possibility of a Republican presidential victory.

However, some analysts caution that the current Bitcoin rally may be a “Trump hedge,” lacking the fundamental macroeconomic conditions needed to propel BTC to an all-time high.