BlackRock’s Bitcoin holdings surpassed $6 billion on February 15, while spot Bitcoin ETFs saw a net inflow of $477 million.

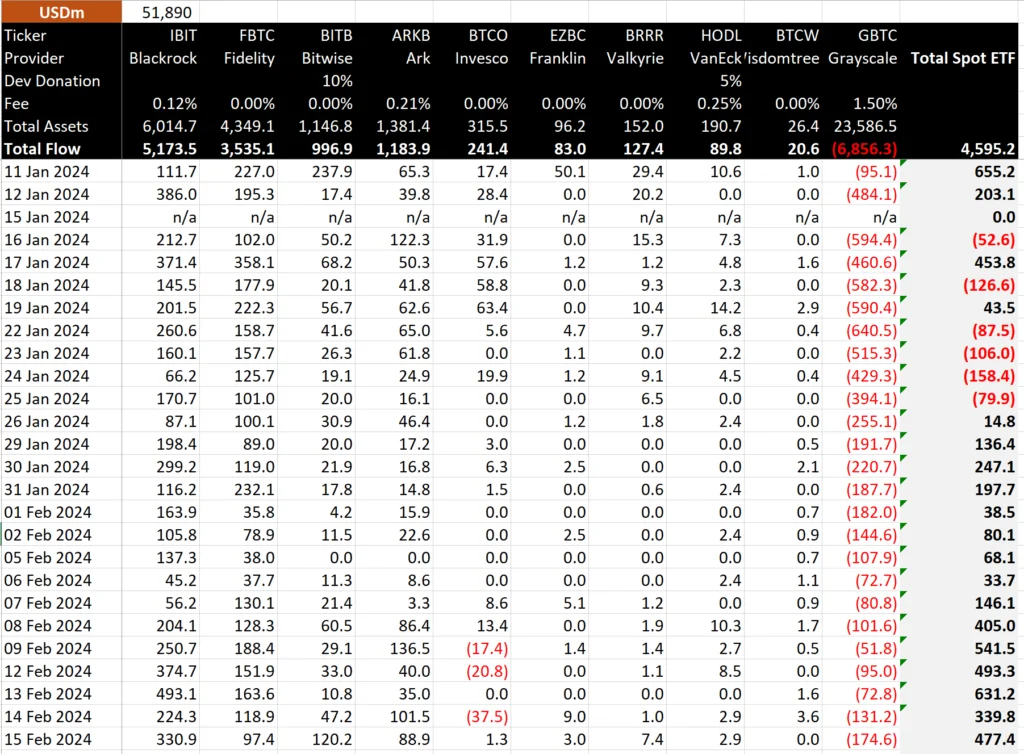

Spot Bitcoin ETFs received an additional substantial inflow of over $477 million, marking the fifteenth consecutive inflow as supply continues to fall short of demand. The holdings of BlackRock’s iShares Bitcoin ETF surpassed $6 billion, and the second-largest day for Bitwise Bitcoin ETF since the spot Bitcoin ETF debut.

BlackRock Leads Spot Bitcoin ETF Records Net Inflow

The most recent data from BitMEX Research indicates that spot Bitcoin ETFs experienced a net inflow of $477.4 million on Thursday. Since the most recent inflow, Bitcoin ETFs have amassed a seven-day net inflow of more than 61,800 BTC.

Thursday, the iShares Bitcoin ETF (IBIT), which BlackRock manages, witnessed an extraordinary inflow of $339.9 million. Bitwise Bitcoin ETF (BITB) follows with an inflow of $120.2 million. Nonetheless, inflows into the Fidelity Bitcoin ETF (FBTC) slowed to $97.4 million on Thursday.

BlackRock has been significantly outperforming its rivals, with total inflows exceeding $5.17 billion and BTC holdings exceeding $6 billion, totaling 115,991.3.

An increase from Wednesday’s $131.2 million outflow, GBTC experienced a $174.6 million outflow. Consequently, the net inflow for spot Bitcoin ETFs was $652 million, excluding GBTC.

Origins of BlackRock and Fidelity Wise Presently, Bitcoin ETFs possess BTCs worth more than $10.3 billion. As a result of the ETFs purchasing 10,000 Bitcoin per day over the standard equilibrium, the price increases. However, supply continues to be significantly less than demand.

Increased Bitcoin Demand Concerns

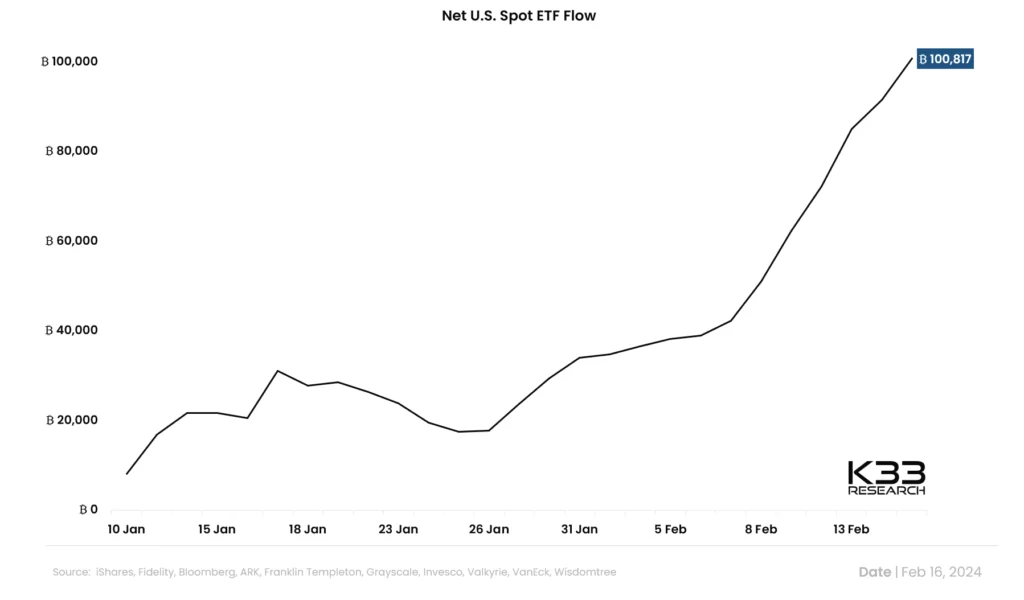

A K33 Research Vetle Lunde senior analyst reported that the net U.S. spot ETF flow surpassed 100,000 BTC on Friday. This corresponds to two-thirds of the yearly decline in Bitcoin issuance after the forthcoming halving.

A Bitcoin maximalist, Samson Mow, expressed concern regarding the excessive demand for spot Bitcoin ETFs. “At the current price of Bitcoin, this level of demand is not sustainable,” he stated.

The demand exceeds the supply by a factor of ten, with additional supply coming from other sources. In a recent interview, MicroStrategy’s Michael Saylor highlighted the tenfold disparity between supply and demand.

The price of Bitcoin has decreased by 1% over the last twenty-four hours and is currently $51,787. The respective 24-hour minimum and high prices are $51,371 and $52,820, respectively. Moreover, trading volume has declined by thirteen percent over the past twenty-four hours, suggesting a decline in investor interest.