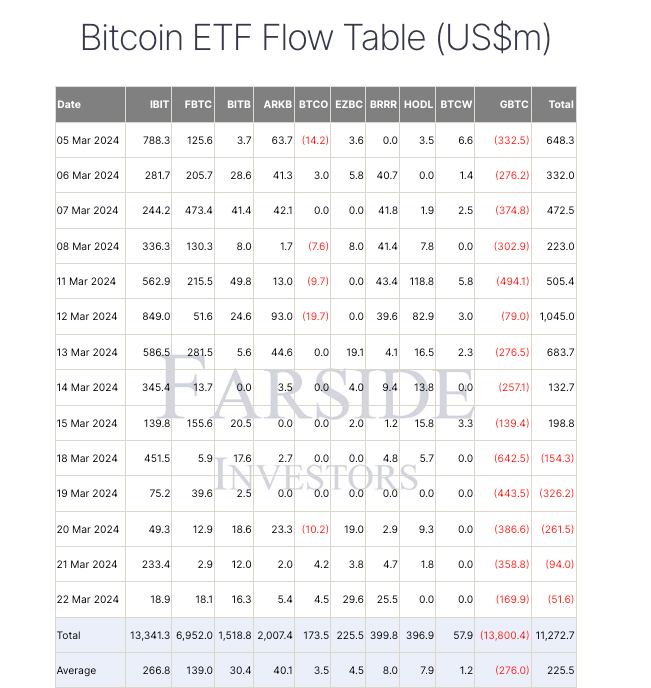

The amount of Bitcoin in BlackRock’s spot Bitcoin ETF could overtake crypto asset manager Grayscale’s GBTC within the next three weeks.

As of March 22, the Bitcoin ETF managed by BlackRock had 238,500 Bitcoin (BTC) in its balance sheet, valued at current prices at $15.5 billion. However, the fund has reported an average daily inflow of $274 million, or approximately 4,120 new Bitcoins entering the fund each day.

Grayscale’s Bitcoin Trust (GBTC) has maintained an approximate inventory of 350,252 BTC, currently valued at $23 billion. During the past two weeks, it has encountered an average daily discharge of approximately $277 million, equivalent to 4,140 BTC.

In the absence of significant fluctuations in the inflow and egress rates, BlackRock has the potential to surpass Grayscale by April 11 in terms of aggregate Bitcoin holdings.

If BlackRock’s daily average inflow of 7,200 Bitcoin were to return to the previous week, this timetable could be even closer to realization; in other words, the switch could take place within ten days.

“I say within the next two weeks — it’s going to happen

BlackRock will formally ascend to the status of the global preeminent institutional holder of Bitcoin should it surpass Grayscale The largest day of net outflows in GBTC’s history occurred on March 18, when the company recorded a staggering $643 million.

Although there was a slight decrease in outflows in the days that followed, the increased magnitude of withdrawals prompted multiple analysts to caution about the possibility of a decline in the value of Bitcoin.

Eric Balchunas, a senior Bloomberg ETF analyst, was unconcerned by the outflows led by GBTC and predicted that the exodus could be nearly completed within the coming weeks.

Furthermore, Blachunas postulated that the predominant cause of the outflows observed last week was the insolvencies of cryptocurrency companies, including Genesis and Digital Currency Group, on account of their “scale and regularity.”

Officially, BlackRock’s spot Bitcoin ETF surpassed MicroStrategy’s cryptocurrency holdings on March 10. MicroStrategy has recorded 214,246 BTC as of the publication date, following the acquisition of an additional 9,000 BTC on March 19.