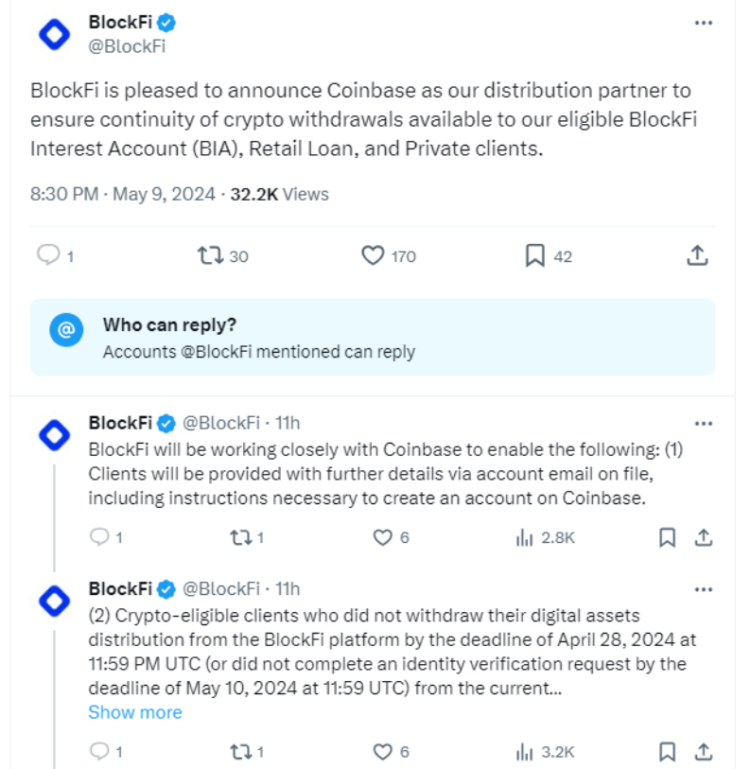

Bankrupt cryptocurrency lender BlockFi announced its intention to shut down its web platform in May and partner with Coinbase to enable customers to access and withdraw funds.

The company announced in a blog post that “eligible BlockFi Interest Accounts (BIA), Retail Loans, and Private Clients” can withdraw funds through its partnership with Coinbase.

BlockFi initiated bankruptcy proceedings in November 2022 after the collapse of FTX. Subsequently, in 2023, BlockFi proclaimed its insolvency and delineated strategies to restitute customers’ cryptocurrency assets by April 28, 2024, as per the withdrawal request deadline.

Customers who opted to use an existing or new Coinbase account to facilitate withdrawals from the current estate distribution will receive instructions on creating a Coinbase account, the lender informed them on Thursday, May 9. The deadline to withdraw digital assets from the estate distribution has passed.

For those who failed to meet the withdrawal and May 10 deadlines, the organization offers an extra opportunity for verification through the BlockFi platform. Without an approved Coinbase account, the assets of non-compliant clients may be liquidated into currency and subsequently distributed.

In future distribution cycles, which may involve funds recovered from FTX, the plan administrator will continue to utilize Coinbase.

BlockFi has declared that it has no plans to establish partnerships with other platforms to distribute cryptocurrencies. As a result, investors are urged to exercise caution to evade possible frauds perpetrated by third parties.

In the past, BlockFi has encountered instances of fraudulent activity wherein users were duped into receiving emails that imitated official correspondences and made false claims regarding the immediate withdrawal of their remaining balances.

March saw the execution of an in-principle settlement worth $875 million between BlockFi and the estates of FTX and Alameda Research. In addition to resolving BlockFi’s approximately $1 billion claims against FTX, the settlement involved FTX waiving “millions of dollars worth of avoidance claims and other counterclaims” brought against BlockFi.

As a government witness in Sam Bankman-Fried’s criminal prosecution, BlockFi CEO Zac Prince stated that the FTX founder’s actions were a direct cause of BlockFi’s bankruptcy.

The bankruptcy court authorized BlockFi’s Chapter 11 repayment plan to 10,000 creditors in September 2023. BlockFi owes over one hundred thousand creditors an estimated $10 billion, including $220 million to insolvent crypto hedge fund Three Arrows Capital and $1 billion to its three largest creditors.