Bloomberg’s Jamie Coutts Anticipates Doubling of Tech Sector, Envisioning 20% Crypto Dominance in Global Markets by 2025.

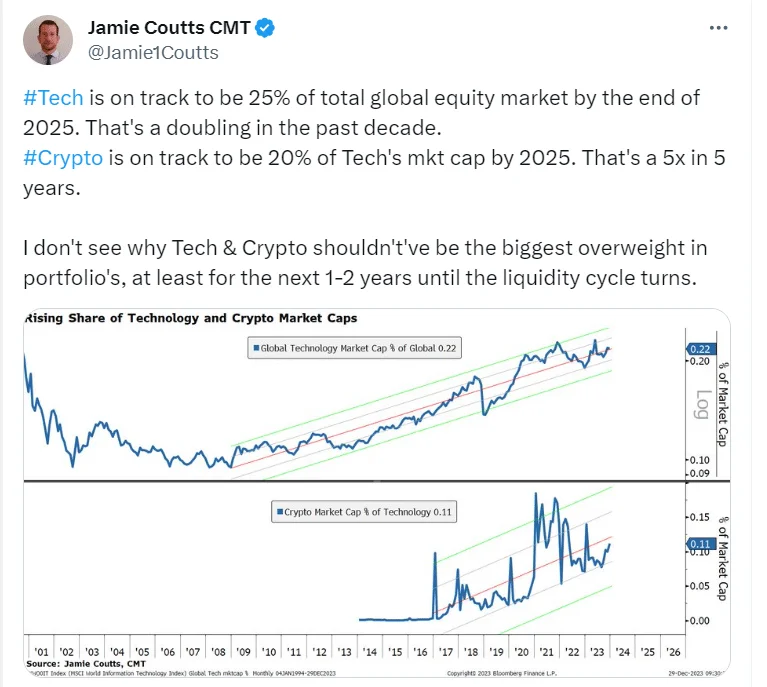

Jamie Coutts, an analyst at Bloomberg Intelligence, extols the cryptocurrency and technology sectors in anticipation of a profound transformation in the worldwide equity domain. Coutts, a renowned analyst in his field, emphasizes that by the end of 2025, technology will account for an astounding 25% of the worldwide equity market.

Moreover, he predicts that by the same year, the cryptocurrency market, which is an essential component of the technology industry, will hold a significant 20% share of the market capitalization of the tech sector. This forecast indicates an extraordinary fivefold growth in merely five years.

The technology Industry Doubles in a Decade

Coutts ‘ analysis emphasizes the remarkable expansion of the technology industry, which projects that its market share will more than double in the coming decade. The tech industry’s robust position in the broader equity market is notably attributed to its dynamic nature, propelled by advancements and digital transformations.

In the interim, investors enthusiastic about leveraging this upswing may discover that technology equities offer a compelling prospect for significant profits. Although recognizing the remarkable expansion of technology, Coutts goes one step further by urging investment portfolios to prioritize technology and cryptocurrencies.

Based on his recent X platform post, he posits that the current focus on the technology and cryptocurrency industries will likely endure for the next one to two years or until a substantial shift occurs in the liquidity cycle.

The Ascent Of Cryptocurrency To Rule Global Markets

Coutts’ prognosis for the cryptocurrency market, positioned within the vast technology sector, delineates an extraordinary ascension. The estimation that digital assets will comprise one-fifth of the market capitalization of the technology sector by 2025 demonstrates their growing acceptability and influence.

In the interim, the leading analyst at Bloomberg Intelligence has recently made a forecast that aligns with the increasing worldwide attention towards virtual assets.

Furthermore, an array of elements, including the forthcoming halving of Bitcoin and the approval of Bitcoin Spot ETFs, could contribute to the sector’s popularity.

Notably, with the convergence of traditional and digital finance, investors may discover that strategically allocating a substantial portion of their portfolios to technology and cryptocurrencies can be advantageous in navigating the ever-changing investment environment.

Coutts’s insights, meanwhile, provide a persuasive manual for individuals aiming to capitalize on the opportunities presented by these ever-evolving markets in the years to come.