BNB and the broader crypto market have declined from recent highs amid falling market sentiment.

Binance Coin (BNB) has experienced a decline in value since it reached an all-time high earlier this month, as crypto assets experienced a surge in value amid increased market activity.

In the same window, the broader market has also experienced a decline as sentiments plummet to levels that have not been observed in months. To provide context, the crypto market value has experienced a 2% increase in the past 24 hours, rising from $2.6 trillion to $2.38 trillion.

This has resulted in substantial inflows for BNB, which has been trading in accordance with market trends. Price increases have been observed in the asset during the midweek rebound, as inflows gradually increased.

This prompted a debate among community members regarding the asset’s market trajectory. Although some anticipate a brief rebound, others anticipate a more prolonged bull market to achieve those levels.

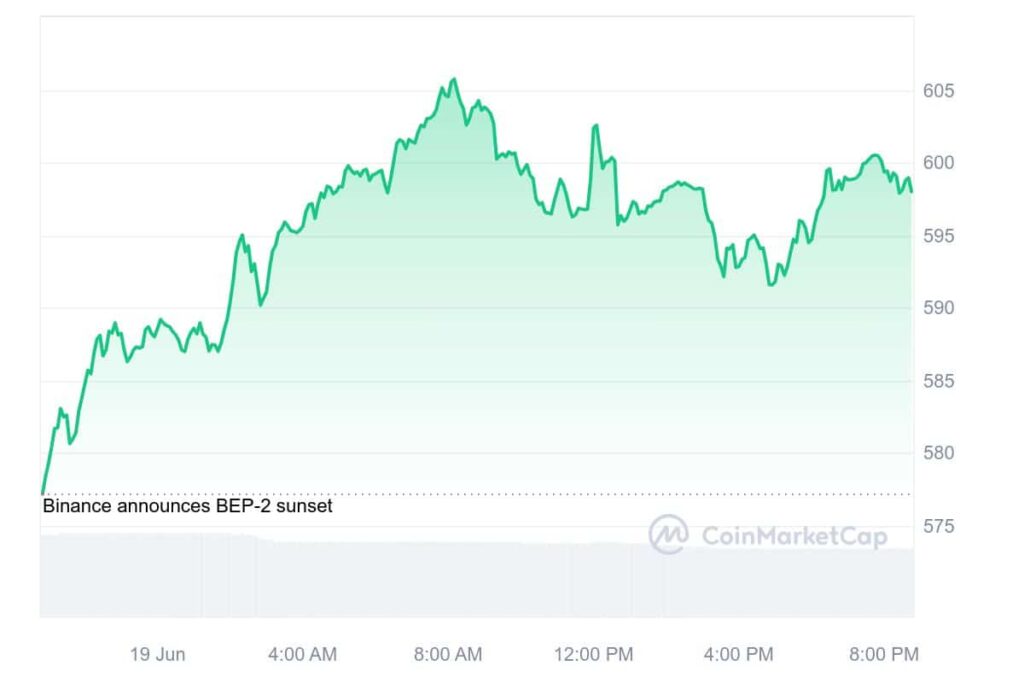

On June 6, BNB reached an all-time peak of $720; however, profits have been substantially diminished since that date. The asset was traded at $594, which was below numerous resistance levels, as sentiments plummeted. Day trading has sparked favorable action toward an upward movement, despite the fact that the stock is trading 17% below its all-time high.

The weekly position has plummeted by 5.76%, while the asset has increased by 2.74% in the past 24 hours. Additionally, there has been a 17% decrease in trading volumes, which has sparked speculation regarding low market volumes.

The asset reached a new all-time peak on June 3, as evidenced by a 56% increase in BNB token transfers from May 29 to June 3, according to data from BscScan. BNB became one of the crypto assets to achieve new highs this year as a result of substantial inflows from institutional investors.

A shift in macroeconomic factors, industry, and coin volumes are among the factors that could propel the assets to a new all-time high. Altcoins experienced inflows this year as a result of the price increase in Bitcoin.

According to market analysts, a surge in altcoins and meme currencies is anticipated as a result of a climb above $70,000. A regulatory shift and the forthcoming U.S. elections are also potential contributors to expanded gains.