Following a Bloomberg report that the DOJ demanded $4B from Binance to conclude its investigation, BNB reached its highest price since June.

Following Bloomberg’s report that the United States Department of Justice is considering a $4 billion settlement with Binance to conclude its investigation into the company, BNB increased by more than 7% the previous day.

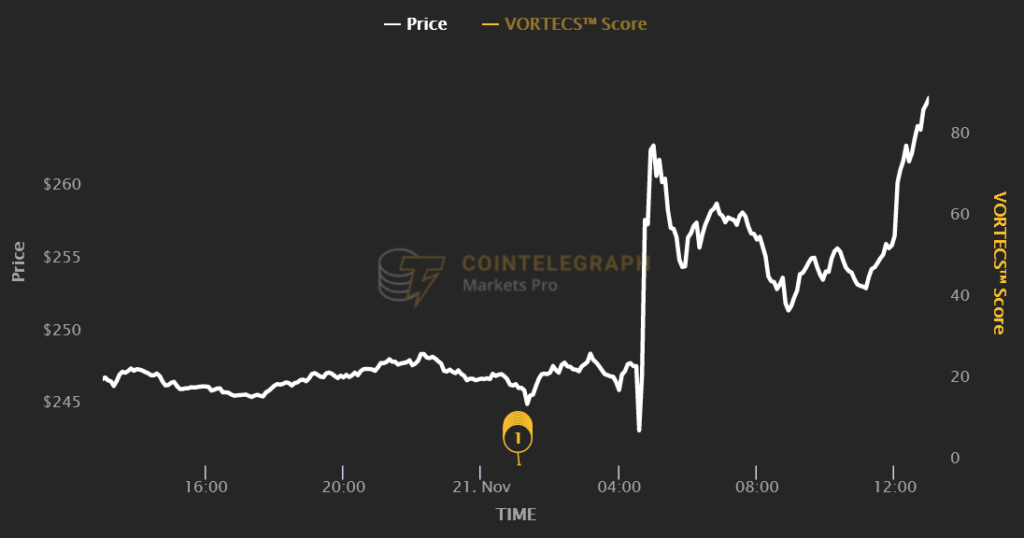

In approximately thirty minutes following a November 20 Bloomberg report that Binance was negotiating a settlement to a Department of Justice investigation into alleged sanctions violations, money laundering, and fraud, BNB surged 6% to $262, according to Cointelegraph Markets Pro.

Four hours later, the price of BNB declined to $252. However, two days later, on June 7, the Securities and Exchange Commission filed a lawsuit against Binance and CEO Changpeng “CZ” Zhao, alleging they violated various securities laws. BNB then spiked to $266, its highest level since that date.

The 24-hour price increase for the Binance-issued token is the greatest among the 75 largest cryptocurrencies by market capitalization. BNB is the fourth largest token by market capitalization at over $40 billion.

BNB market cap +$4b from the post headline low pic.twitter.com/6T6y3EveLF

— Hsaka (@HsakaTrades) November 20, 2023Despite the recent surge in price, BNB has gained 6.5% year-to-date but is down 61.4% from its all-time high of $686 on May 10, 2021.

In one possible settlement, Binance must pay a ten-figure sanction and remain operational in the United States under specific conditions.

Bloomberg reported that, at the latest, a prospective agreement announcement could be made by the end of the month. It will be one of the most substantial fines ever levied in a criminal cryptocurrency case if Binance complies.