BTC.com, a cryptocurrency mining pool, was the victim of a recent $3 million hack that caused a considerable loss of corporate and client assets.

Attackers stole over $2.3 million in corporate assets in addition to about $700,000 in client assets on December 3. The formal statement was issued on December 26 by BIT Mining Limited, the parent company of the mining pool.

The hack was reported by BIT Mining and BTC.com to Chinese law enforcement officials in Shenzhen. The local authorities then started an inquiry into the occurrence, gathering information and enlisting the aid of relevant Chinese agencies. According to the release, the initiatives have already assisted BTC.com in recovering part of the assets.

“The Company will devote considerable efforts to recover the stolen digital assets,” BIT Mining said, adding that it has also deployed technology to “better block and intercept hackers.”

Despite the event, BTC.com is still providing its clients with mining pool services, according to the company:

“BTC.com is currently operating its business as usual, and apart from its digital asset services, its client fund services are unaffected.”

One of the biggest cryptocurrency mining pools in the world, BTC.com, offers multicurrency mining services for a number of different digital assets, including Bitcoin and Litecoin.

In addition to offering mining services, BTC.com runs a blockchain browser. A publicly traded corporation with an NYSE listing, whose parent entity is BIT Mining.

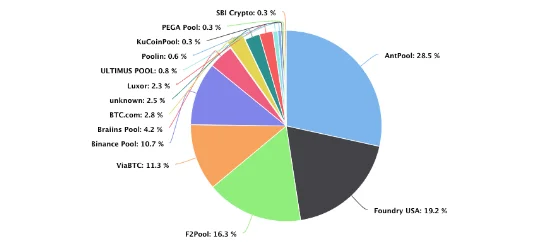

According to statistics from BTC.com, the seventh-largest mining pool globally has a hash rate of 5.80 exahashes per second (EH/s), 2.5% of the overall mining pool distribution for the last seven days. More than 5% of the overall hash rate is made up of its whole contribution.

China, which last year decided to impose a complete ban on all cryptocurrency activities, is now facing yet another case involving cryptocurrencies as a result of the investigation into the hack on BTC.com. Despite the prohibition, China lost its position as the leading source of Bitcoin hash rates in 2021 and fell to second place, before rising again in January 2022.