Over the course of the recent weekend two of the world’s largest cryptocurrencies – BTC and ETH – have made significant gains, breaking through key resistance levels.

In the last 24 hours, Bitcoin has risen to about $48,000, while Ethereum has risen above $3,300.

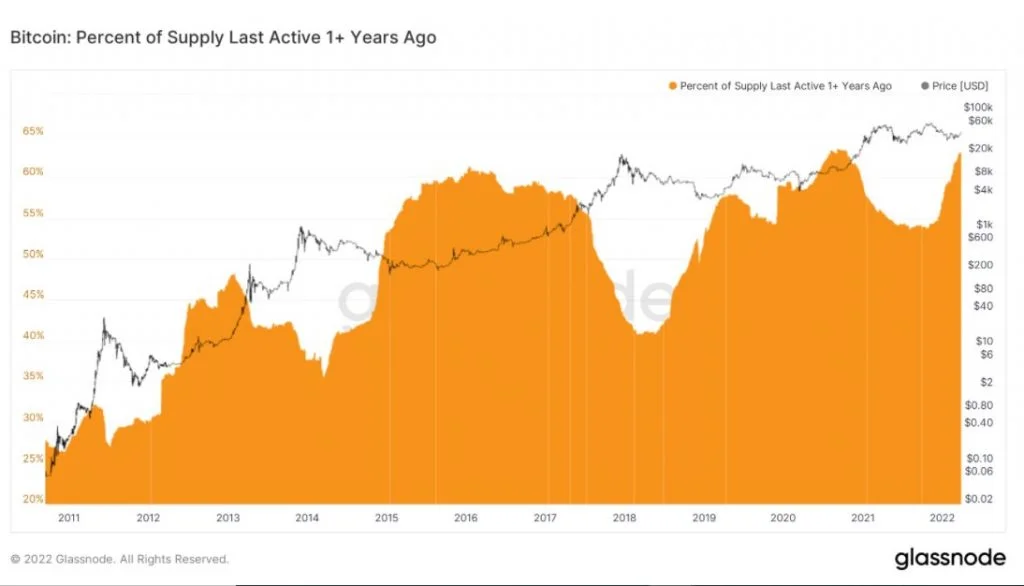

Bitcoin’s long-term holder accumulation has hit its greatest level ever as the bitcoin continues to make strong gains according to Glassnode. Furthermore, as Bitcoin maintains a weekly close above $46,000, it appears that its short-term capitulation has come to an end.

Bitcoin is 45% off the lows and Long-term holder accumulation is still at the highest level ever. pic.twitter.com/JyRZLi3KUH

— Will Clemente (@WClementeIII) March 28, 2022

Additional on-chain data indicates that the Bitcoin accumulation is still rather strong at this point in time. Dylan LeClair, a crypto market analyst, provides the following explanation using data from Glassnode:

Bitcoin is trading at $48,000 and throughout its entire history, there has only been one other time that the percentage of supply that hadn’t moved in over a year was at this level; September 2020.

However, as the Bitcoin (BTC) price hits $48,000, it is possible that some short-term profit booking will occur at this point. Take, for example, the Bitcoin MVRV ratio. It displays the average Profit/Loss of Bitcoin holders who purchased the coin within the previous calendar year.

As we know the Bitcoin price has risen beyond $47,000 for the first time in three months, since January 4, 2022. Lesia Chenko, a cryptocurrency market analyst, writes:

Short-term MVRV (30d) is breaking above 10%, meaning recent Bitcoin buyers are on average up 10% on their investment. Previous two times when avg P/L of short-term traders reached 10% we faced strong selling pressure (sending BTC down over 15%).

Ethereum (ETH) whale addresses are increasing

This year, the world’s second-largest cryptocurrency has displayed similar volatility to Bitcoin. However, the accumulation of Ethereum (ETH) by whales, continues to take place on the sidelines. According to Santiment, a provider of on-chain data:

The number of #Ethereum addresses with 10k+ $ETH has grown to the largest amount (1,329) since December, 2021. This includes 40 more in just 5 weeks. There has been an evident correlation between the number of whale addresses & future price movement.