Bitcoin price corrections have resulted in huge outflows from spot Bitcoin ETFs in the last week. On Monday, the total outflows from ETFs exceeded $200 million.

Bitcoin (BTC), the world’s largest cryptocurrency, has experienced further selling pressure, resulting in a 1% decline and a move closer to $65,000.

The BTC price is currently trading at $65,685, which is a 5% decrease on the weekly chart.

Additionally, its market cap has just dipped below $1.3 trillion as of press time.

Interestingly, daily trading volume soared by 125%, exceeding $35.7 billion.

Bitcoin Price Drops Under 50-DMA

The Bitcoin price has plummeted to its one-month low and has breached the 50-day moving average, a critical support level that represents the short-term downtrend in the crypto.

Meanwhile, the Federal Reserve has indicated that it intends to maintain interest rates at a higher level than anticipated, which has resulted in continued selling pressure on Bitcoin.

The Bitcoin ETFs experienced a significant decline, resulting in $620 million in outflows from the Bitcoin investment products last week.

The Bitcoin ETF outflows appear to persist this week as well.

On Monday, June 17, all nine of the spot Bitcoin ETFs in the US had outflows totaling $208 million.

Grayscale’s GBTC has recorded outflows of over $60 million, while Fidelity’s FBTC has recorded outflows of over $80 million, according to the data provided by LookonChain.

More BTC Downside Left?

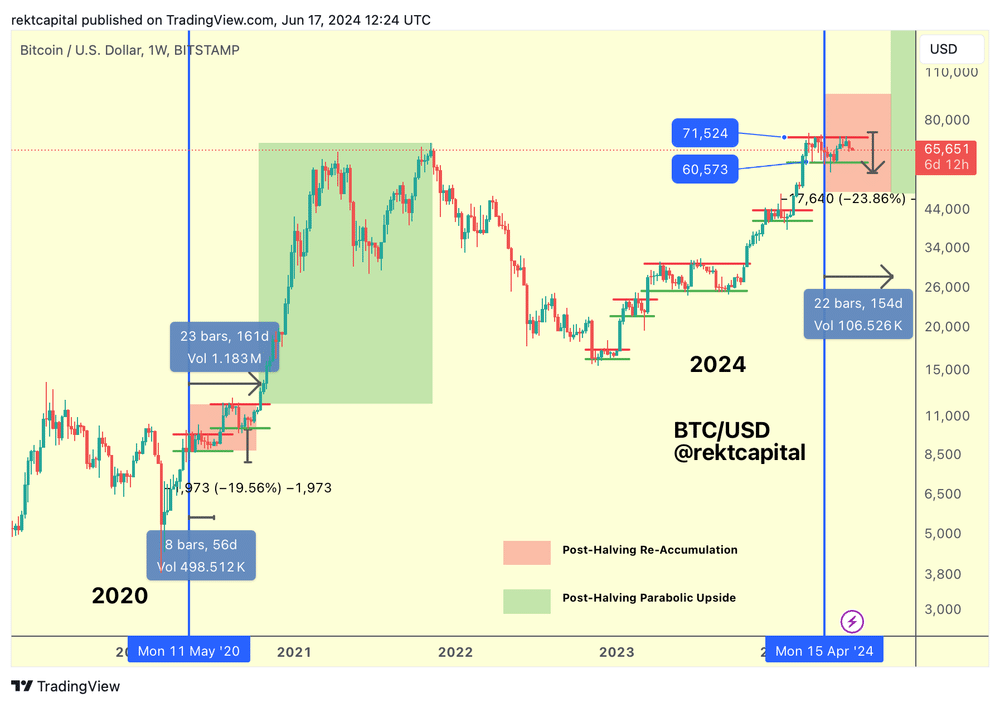

Popular crypto analyst Rekt Capital has offered an interesting perspective, claiming that the Bitcoin price is unlikely to surpass the recent high of $60,573-$71,524.

Each time, the BTC price has encountered rejection from the high of this re-accumulation range while descending further into the range itself.

Bitcoin must surpass the $71,350 range high to enter the parabolic phase.

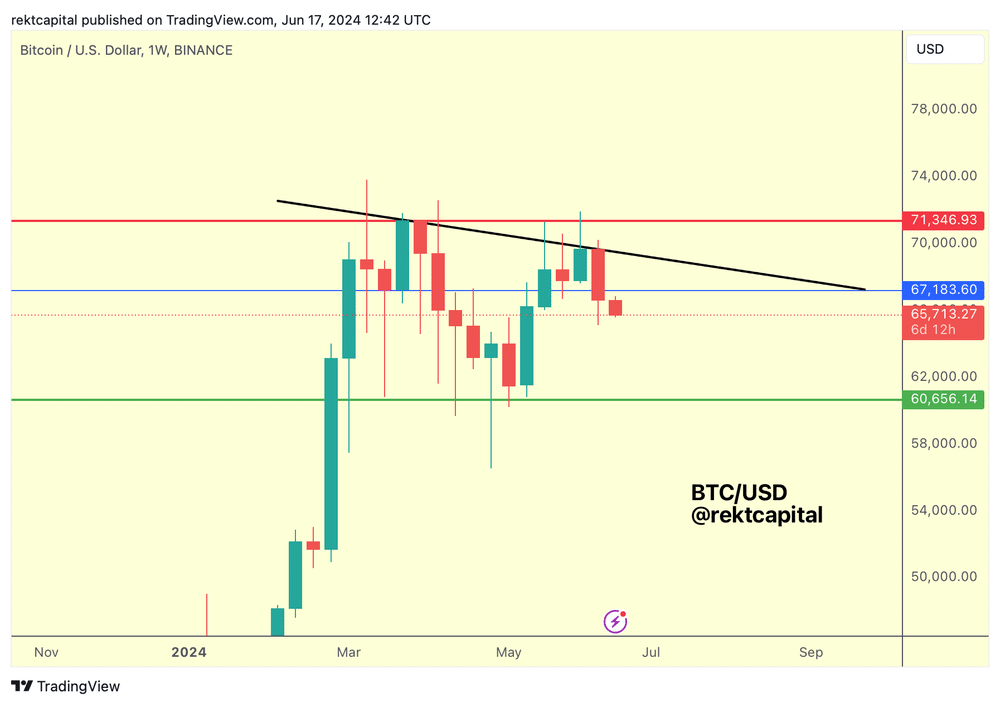

However, the BTC price is unable to surpass the lower high of $67,183 (depicted in the image below), indicating that the resistance is progressively falling.

Consequently, sellers are reducing their prices and are therefore prepared to sell at lower levels whenever the opportunity arises during rallies.

It is evident from the image above that even $67,200 is insufficient to provide essential assistance.

In March, the BTC price experienced a robust rebound from this level; however, the rebound quality from $67,200 was significantly lower.

The Bitcoin price’s weekly close below the blue level has demonstrated that $67,200 is a weaker support.

Analysts anticipate that the Bitcoin price may decline to $63,800.