Bitcoin (BTC) has proven itself time and time again to be the world’s greatest rescuer of inefficient fiat structures and government agencies. In the last week Turkish Lira sunk 14 percent more against the US Dollar, leading Turks to look for Bitcoin (BTC) to secure their money.

Last weekend, Google Bitcoin (BTC) searches in Turkey nearly doubled the roof, as a sharp increase can be seen from the chart below.

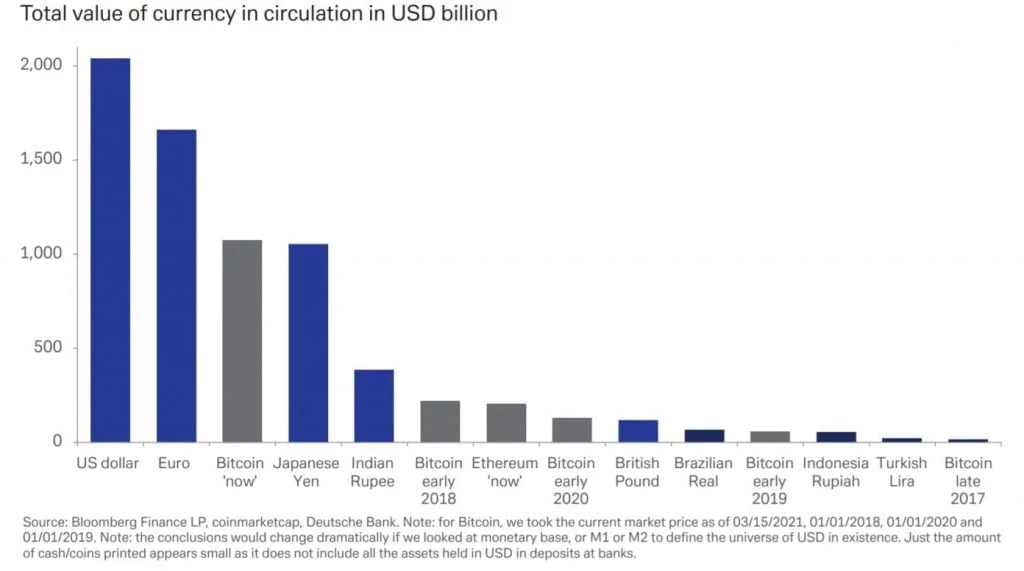

Bitcoin’s (BTC) success over the last couple of months has also helped strengthen the trust in the world’s largest cryptocurrency. At the time of the press, Bitcoin has a market value of $1,007 trillion at a price of $57,783. Bitcoin (BTC) thus strongly cemented its status as the third largest currency in the world in terms of its circulating total value, notes Deutsche Bank in a most recent survey.

Deutsche Bank has recognized the position of cryptocurrencies, recognizing that they are here to stay, even public institutions and central bank institutions have started to recognize it. Research analyst Marion Laboure, PhD at Deutsche Bank, writes in the study “Bitcoin’s $1 trillion market cap makes it all too important to overlook. As long as fund managers and businesses remain on the market, Bitcoin prices will continue to rise.”

However, the study recognizes that “Bitcoin transactions are still small and tradable.” The study notes that BTC holds the top ten place as a stock as well as a currency, while addressing Bitcoin’s status as asset, monetary or stock.

The big increase in BTC prices currently gives rise to Bitcoin’s spring as the world’s third larges currency in circulation. The study adds: ‘Bitcoin represented ‘only’ 3% in circulation of US dollars at the beginning of 2019, but increased above 40% in circulation in February 2021.’