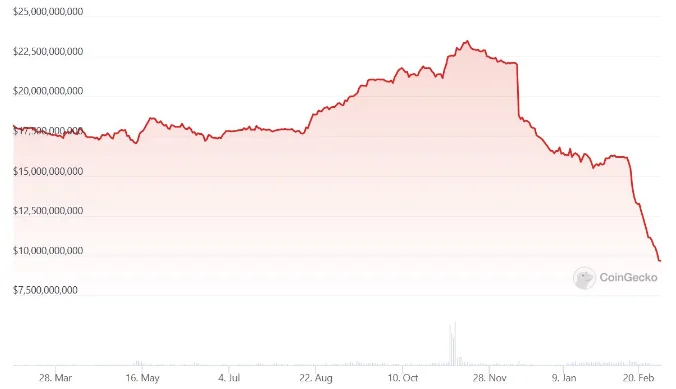

For the first time in almost two years, Binance’s USD (BUSD) market cap has dropped below $10 billion from its all-time high of $23.49 billion, set on Nov. 15, 2022.

Binance Due to a scheduled delisting from a major cryptocurrency exchange and a legal crackdown on its token issuer in the United States, USD’s market cap has dropped below $10 billion.

Since reaching an all-time high market valuation of $23.49 billion on Nov. 15, a few days after the shocking collapse of FTX, BUSD’s market cap has been on a sharp decline.

Since June 29, 2021, the stablecoin’s market cap has dropped to $9.66 billion as of March 3.

BUSD was most recently the focus of a prospective lawsuit against Paxos by the US Securities and Exchange Commission on February 12 due to a suspected breach of investor protection regulations. Since then, BUSD’s market capitalization has decreased by $6.65 billion.

The New York Department of Financial Services also issued a directive to Paxos on February 12 to halt minting and issuing BUSD, which is likely what caused the stablecoin’s market cap to decline.

BUSD will be removed from Coinbase’s exchange on March 13 due to the stablecoin “no longer meeting our listing requirements,” a Coinbase official said earlier this week.

With many citing the current issue surrounding Silvergate Bank and the delayed release of its annual 10-K financial report on March 1, the overall cryptocurrency market has also suffered a decline in market cap.

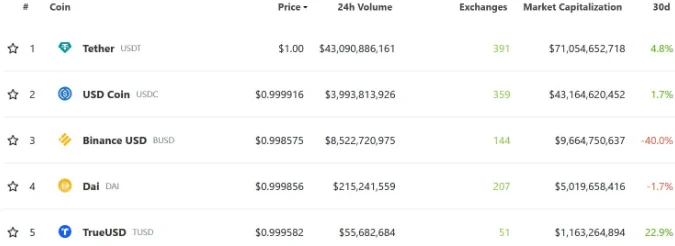

The Binance-branded stablecoin soon overtook Tether USDT and USD Coin to claim a third place among stablecoins after its September 2019 introduction.

According to the market cap, the stablecoin is presently ranked 10th among all cryptocurrencies. Solana, with a market capitalization of $7.98 billion, is the next cryptocurrency on the list.

Intriguingly, Binance CEO Changpeng “CZ” Zhao said during a Twitter Spaces event on February 14 that he never had high expectations for the Binance stablecoin project and had even predicted that it “may fail” when it initially launched.

While the cryptocurrency exchange seeks to diversify its stablecoin holdings, Binance recently issued approximately $50 million worth of TrueUSD (TUSD) to make up for the decline in demand for BUSD.