Hedge fund manager and lekker Capital chief investment officer Quinn Thompson says buying this week’s Bitcoin dip is not advisable compared to the previous price dip.

Quinn Thompson, the chief investment officer at Lekker Capital, believes that the 6% decline in Bitcoin since September 30 presents an opportunity for investors to accumulate additional BTC.

Thompson stated in a post on X on October 3 that purchasing Bitcoin at its current price of $61,000 is a “no-brainer.” He also noted that the “macro backdrop” of the crypto asset’s price action has considerably changed compared to previous price drops.

He included a chart of Bitcoin’s price action from March 5, 2018—when BTC achieved a new all-time high of $73,700.

The price of Bitcoin collapsed and subsequently fell significantly below its 200-day moving average, a critical technical indicator that traders employ to assess the mid-term strength of specific assets, as Thompson emphasized three previous “similar setups.”

However, this time, BTC rebounded abruptly from the technical level, which Thompson interpreted as a “clear invalidation” due to a “180-degree shift in the macro backdrop.” This suggests that prices begin to rise.

“I don’t usually give very short-term views, but seems like a no-brainer to be bidding this area.”

Earlier this week, markets were jittery due to the escalating geopolitical tensions in the Middle East. Risk assets, such as Bitcoin, experienced a significant decline in value as Iran initiated military action against Israel.

The fragility of the US economy and the uncertainty surrounding the November election have also had an impact on risk assets.

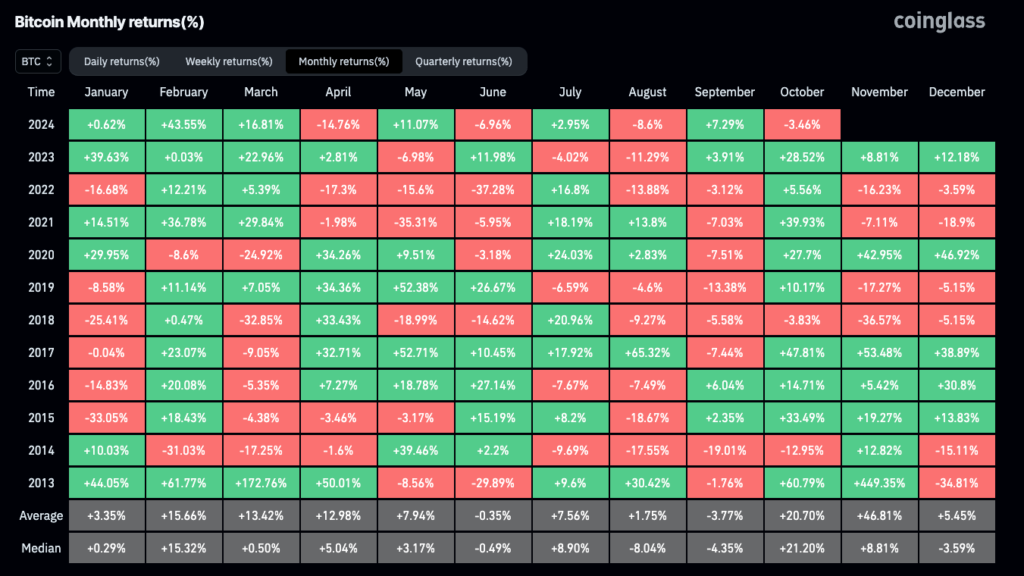

In the interim, the number of references to “Uptober” — a moniker coined to describe October for its historically favorable crypto price action — has decreased on social media as markets continue to retreat.

Thompson and other analysts concur that the absence of recent optimism presents an opportunity for a temporary rebound.

“The market’s dip has resulted in a decrease in excitement for October, which does provide an opportunity for a rebound.” Maksim Balashevich, the founder of Santiment, stated, “The extent of the significant downtrend is uncertain.”

Most gains occur later, although October has historically been a robust return month, with an average increase of over 20% in the last 11 years.

In the initial half of October 2023, Bitcoin experienced a 7% decline to $26,650. However, it experienced a nearly 30% increase in the subsequent two weeks, culminating in a month-end price of $34,500. This prompted some traders to consider the possibility of a significant upward movement later in the month.