LUNA, Terra’s native cryptocurrency, has seen a robust increase despite recent market turmoil. The LUNA cryptocurrency is aiming for a new all-time high and is now trading 7.5 percent higher at $95.36 with a market capitalization of $35.7 billion.

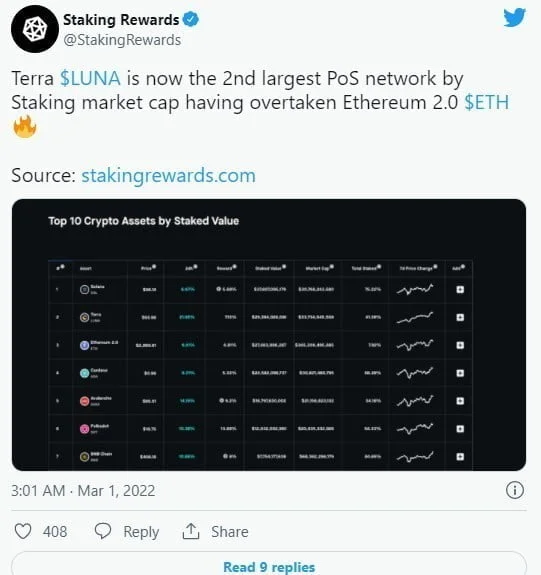

According to the most recent data from staking incentives, Terra’s LUNA has surpassed Ethereum 2.0 as the second-largest Proof-of-Stake (PoS) network.

With increasing demand among DeFi protocols, Terra’s LUNA has emerged as a significant challenger to Ethereum. Terra LUNA, on the other hand, trails Ethereum in terms of total value locked (TVL), which presently stands at $23.7 billion.

Among the top ten cryptocurrencies, LUNA has seen the most growth in the last week, with a gain of 77%. It has surpassed giants such as Solana (SOL), Cardano (ADA), and Avalanche to become the seventh-largest cryptocurrency by market cap (AVAX).

So, why is the cost of LUNA so high?

The Luna Foundation Guard (LFG) announced last week that the LUNA cryptocurrency would be sold over-the-counter. This money will be used to “establish a Bitcoin-denominated Forex Reserve for UST,” according to the Luna Foundation. LFG explained why this was done:

Although the widespread adoption of UST as a consistently stable asset through market volatility should already refute this, a decentralized Reserve can provide an additional avenue to maintain the peg in contractionary cycles that reduces the reflexivity of the system.

In terms of user acceptance, Terra has been one of the fastest-growing Layer-1 protocols. The price of its own cryptocurrency, LUNA, has mirrored this.

Terra is also on track to cut into Ethereum’s DeFi market cap. In such a short amount of time, the Terra ecosystem now hosts 13 DeFi protocols. This year, a huge number of DeFi protocols are expected to enter the Terra ecosystem. LUNA’s price has also risen due to the burning mechanism of Terra’s native stablecoin, UST.