The California Commission for Fair Political Practices has revised its campaign disclosure manuals to include specific guidelines for cryptocurrency contribution declarations to political candidates and committees.

The agenda for an impending commission meeting includes a discussion of updated campaign disclosure manuals, which have been rewritten to reflect recent legislative and regulatory changes.

These updates include campaign contribution limits, limited liability companies (LLC) disclosure requirements, reporting of behested payments, cryptocurrency contributions, excessive contributions, advertising disclosure requirements, and other non-substantive changes.

The sections of the manuals that now include reporting guidelines for cryptocurrency contributions are of particular interest.

Following the guidelines, a political committee may solicit cryptocurrency contributions as non-monetary contributions, subject to specific requirements. Cryptocurrency contributions will be subject to applicable limits and will not be accepted by foreign entities, lobbyists, or anonymous donors.

It is also prohibited for committees to receive cryptocurrency contributions directly through peer-to-peer transactions. Donations in cryptocurrencies can be accepted through payment processors chosen to function as vendors on behalf of the committee.

The commission also requires cryptocurrency donations to be made and received through U.S.-based payment processors registered with the U.S. Department of the Treasury and the Financial Crimes Enforcement Network, which use KYC protocols to verify the contributors’ identities.

If a committee chooses to accept cryptocurrency contributions, it must validate that the respective cryptocurrency payment processors use KYC procedures to verify contributor identities.

The payment facilitators must also collect each contributor’s name, address, occupation, and employer and share this information with committees within twenty-four hours of receiving a cryptocurrency donation.

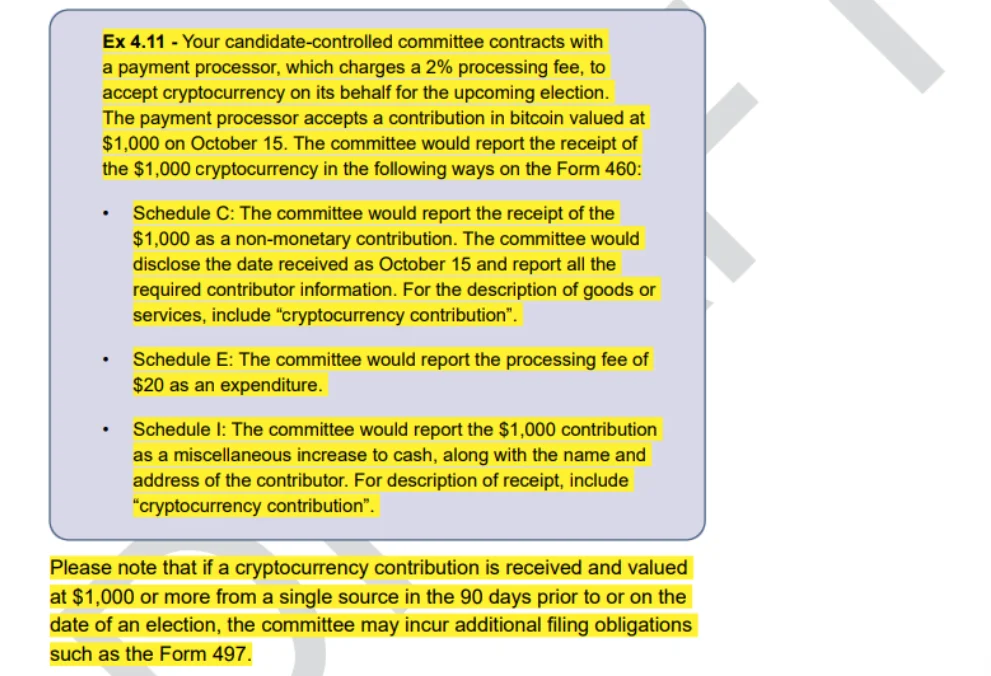

Payment processors are also anticipated to convert cryptocurrency contributions to U.S. dollars immediately upon receipt at the current exchange rate and deposit funds into the committee’s campaign bank account within two business days.

According to Commission guidelines, cryptocurrency donations are classified as non-monetary donations. Any processing fees paid to the processor are not deducted from the reported amount, and committees are instructed to document the entire contribution as a “miscellaneous increase to cash.”