Bankrupt and now defunct BlockFi has entered into a settlement in which it has consented to the revocation of its license and to cease unsafe practices.

The California Department of Financial Protection and Innovation (DFPI) has permanently revoked the license of BlockFi, a bankrupt cryptocurrency lender, two years after the company declared bankruptcy.

On November 7, DFPI announced that the license revocation followed an investigation by the agency, which initially suspended BlockFi’s license in November 2022.

BlockFi agreed to the revocation as part of a settlement that also required the company to stop any violations and to cease unsafe practices, according to DFPI.

BlockFi’s License Violations

After suspending BlockFi’s license two years ago, the DFPI fully revoked it upon discovering that the company had violated the California Financing Law (CFL).

DFPI found that BlockFi failed to assess borrowers’ ability to repay, charged interest before loan proceeds were issued, did not offer credit counseling, and did not report payment history to credit bureaus.

Additionally, the company inaccurately disclosed annual percentage rates in loan documentation.

DFPI Commissioner Clothilde Hewlett stated:

“While we encourage innovation in our financial marketplace, companies must comply with laws and protect consumers to continue operating in California.”

As part of the settlement, DFPI imposed a $175,000 fine on BlockFi for CFL violations. However, the fine was waived to focus on consumer repayments due to BlockFi’s bankruptcy status and lack of operations.

BlockFi’s Web Platform Closure and Bankruptcy Developments

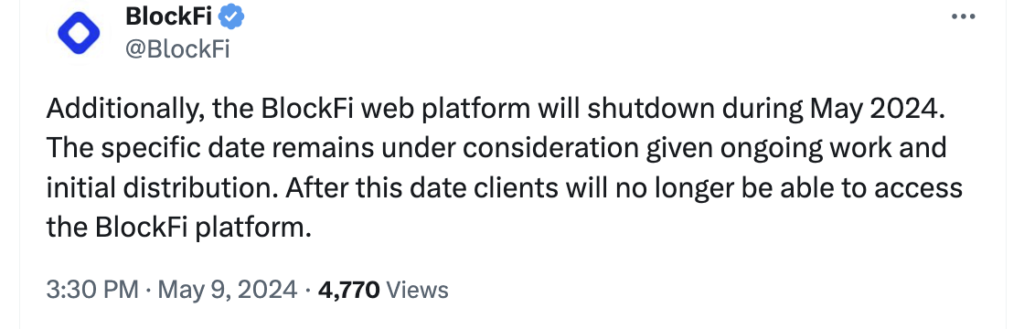

The license revocation in California follows BlockFi’s termination of its web platform in May 2024, which left customers unable to access the platform.

Due to their significant financial ties, BlockFi’s bankruptcy troubles began after FTX’s collapse in November 2022.

In its Chapter 11 bankruptcy filing in November 2022, BlockFi disclosed it had substantial exposure to FTX, including a $400 million credit line extended to FTX US in July 2022.

As reported by Bloomberg, FTX US owed BlockFi $275 million, making it one of BlockFi’s largest unsecured creditors.

In March 2024, BlockFi reached an $875 million settlement agreement with the estates of FTX and Alameda Research. The company began its first interim cryptocurrency distributions through Coinbase in July 2024.

As of April 2023, BlockFi’s liabilities were estimated to be between $10 billion and over 100,000 creditors.