British Columbia Securities Commission (BCSC) panel reports that LiquiTrade is guilty of operating an illegal exchange in Canada, which could result in sanctions ranging from fines to a ban

In November 2022, LiquiTrade’s Latoken crypto exchange was initially accused of violating Canada’s Securities Act for processing $300 million in daily transactions for its 1.5 million user base.

Latoken cryptocurrency exchange

According to a BCSC commission, LiquiTrade violated the Canadian securities legislation nearly two years into the investigation:

“LiquiTrade has never been registered in any capacity under the Act, and there is no recognized exchange or clearing agency in British Columbia operated by LiquiTrade or using the name LATOKEN.”

Numerous violations for LiquiTrade

By allowing users to trade contractual rights of underlying crypto assets, the BCSC panel determined that LiquiTrade was deemed a derivative investment.

Consequently, LiquiTrade was compelled to register under the Securities Act to facilitate contract trading in Canada, specifically British Columbia lawfully. The statement included the following:

“The panel also found that LiquiTrade was operating as an exchange. But it was not authorized to do so by the BCSC, as required by the Act.”

As of March 2024, Canada has prohibited the operation of four cryptocurrency exchanges: Catalyx, KuCoin, Poloniex, and xt.com. Conversely, the region permits the operation of 15 crypto trading platforms, including Fidelity, Coinbase, and Bitbuy.

The potential sanctions against LiquiTrade include a prohibition of services and monetary penalties.

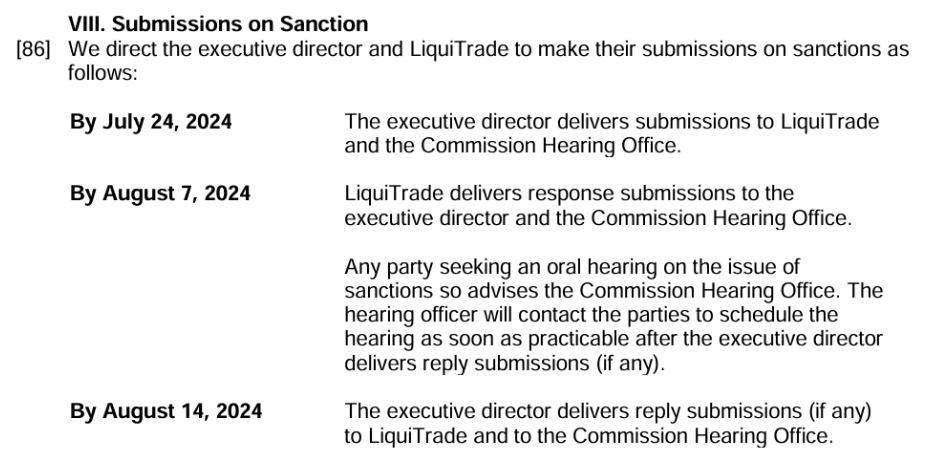

The sanctions against LiquiTrade will be formalized by August 14, as indicated in the court filing.

Licensed trading platforms continue to prosper as Canada implements regulations against unregistered crypto exchanges.

Dean Skurka, CEO of Canadian crypto asset platform WonderFi, stated in an interview with Cointelegraph, “We have certainly observed a resurgence in retail.”

“It is not going to occur overnight,” Skurka stated; however, there are indications of public interest in cryptocurrency. He observed that WonderFi experienced a surge in new signups concurrently with Bitcoin’s new all-time high price.