The trading volume on Cardano NFT exchange increased by 40% this quarter, placing it third behind Solana and Ethereum.

Cardano’s non-fungible token (NFT) market is growing swiftly despite the general non-fungible token (NFT) collapse in 2021 and even 2022. In fact, as a result of a rise in NFT trading volume, Cardano rose to become the third-largest NFT protocol.

They are directly behind the two titans, Solana and Ethereum. Cardano is rumored to have one of the most sophisticated ecosystems on the crypto market. Cardano continues to make news in the midst of the crypto bear run, despite the FUD that has been generated about it.

Cardano is the third-largest NFT protocol by trading volume as of this quarter, according to a poll by blockchain and decentralized apps (dApps) analytics company DappRadar. The report added,

“Cardano is currently one of the top three blockchains by NFT trading volume”

Poor Performance of NFTs

In GeneralTrading volumes for NFTs, or “digital art and collectibles recorded on blockchain,” sharply decreased. From a record high in January of this year to just $466 million in September, it dropped by 97%. OpenSea, the most popular NFT trading platform in terms of volume, saw a 75% decrease in sales from just two months prior.

Bloomberg claims that the rapidly tightening monetary policy is cutting off investment flows to speculative assets, causing a greater $2 trillion wipeout in the cryptocurrency sector, including the waning NFT mania.

Cardano’s Rise in the NFT Market

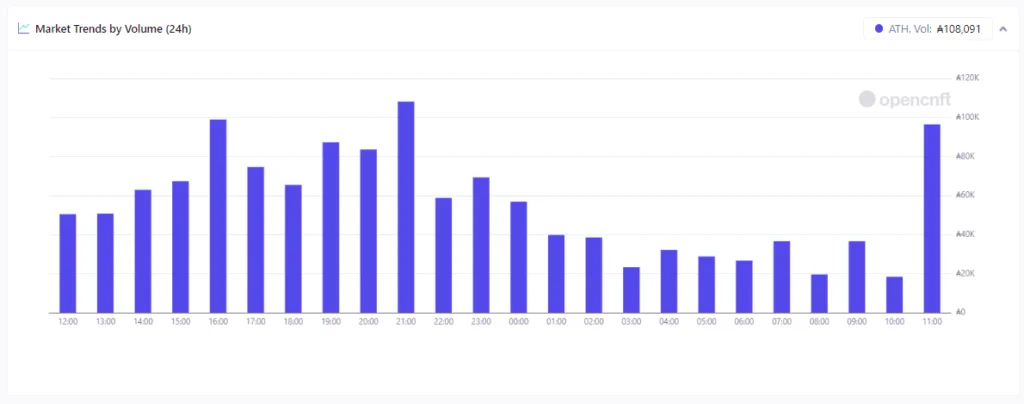

With $191 million in NFT volume over the preceding 30 days, Cardano has surpassed Solana and Ethereum to become the third-largest NFT protocol. The increase over the previous 24 hours is plainly seen in the NFT market tracker OpenCNFT.

The floor price of 10,000 ADA was attained by The Ape Society, Cardano’s largest NFT project in terms of collection share by 24-hour volume. The most transactions on the Cardano network have occurred since May, totaling 82,880. With these figures, the blockchain network saw a 75% increase from month to month.

The network’s Vasil update, which went online on Sept. 22 after a series of delays but doubled the network’s operating capacity, is mostly responsible for the spike in trading volume. The update sparked the release of Plutus v2, the network’s smart contract language, which facilitated chain development for developers.