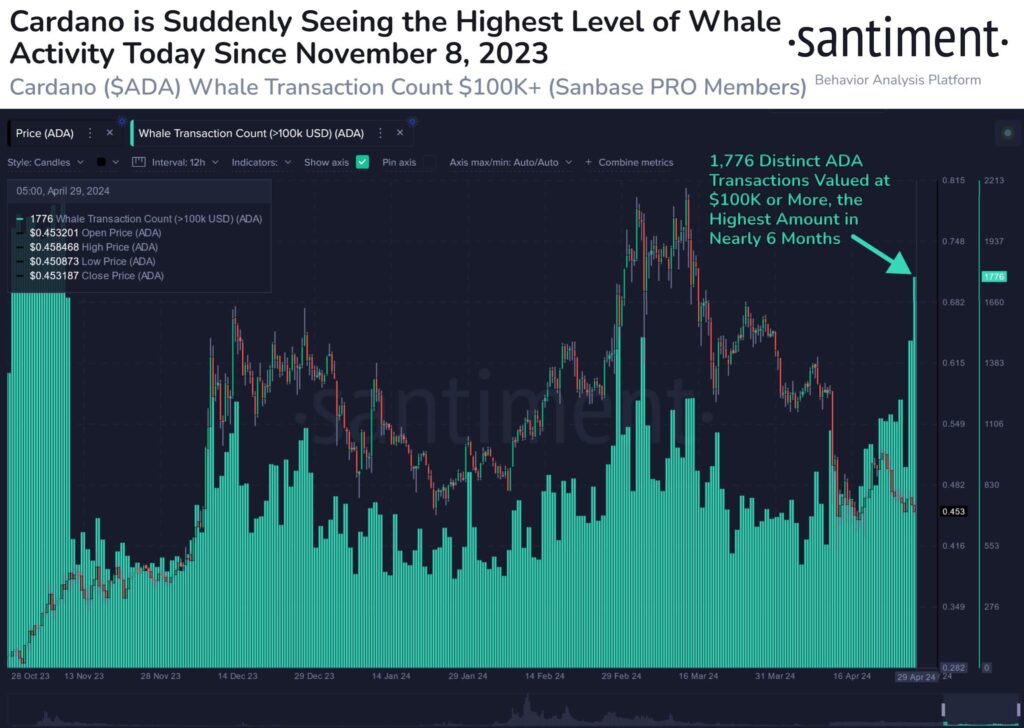

Cardano whale transactions have risen to a six-month high, perhaps serving as a bullish catalyst for the ADA price surge ahead.

Cardano’s native cryptocurrency, ADA, has been subject to intense selling pressure amid the broader market decline, with a weekly chart correction exceeding 11%.

As of press time, Cardano (ADA) is trading at $0.4536, representing a market cap of $16.16 billion, a decrease of 0.36%.

Cardano Whale Transactions Explode

Santiment, an on-chain data provider, has discovered that transactions involving substantial quantities of Cardano (ADA) tokens exceeding $100,000 in value have reached their peak since November 8th.

Historically, this significant increase in Cardano whale activity has corresponded with potential price reversals in the market trajectory of ADA.

Notably, since March 13th, the market capitalization of ADA has declined substantially, falling by 43%.

This decline signifies a phase characterized by considerable volatility and market adaptations for the cryptocurrency.

ADA Price Action Ahead

The $0.50 level was where the Cardano (ADA) price encountered its most significant loss of support last week, falling to $0.45, the altcoin’s critical support zone.

Should the price of ADA undergo a substantial decrease below its present level, it has the potential to incite further adverse momentum, with $0.4280 being the next anticipated significant support.

On the contrary, the psychological threshold of $0.500 is observed to be ADA’s immediate resistance at $0.4920.

A definitive ascendance beyond this threshold could ignite a surge, propelling ADA towards $0.5250 and conceivably even $0.5650 if the current sentiment is favorable.

Following the overall bearish trend of the market, ADA has also encountered a decrease in its global market capitalization, which reflects its subdued Year-to-Date (YTD) performance with a contraction of -23.69%.

Active ADA wallets have decreased marginally over the past three months, according to data from Santiment, which contradicts indications of market recovery.

This anomaly could indicate that ADA is undervalued or that investor and user interest has diminished.

Over the past three months, the total number of active Cardano (ADA) wallets decreased marginally by 0.13%, according to data obtained from Santiment.

ADA is notable for being among the few networks that have observed a decline in wallet activity within this period.