Cardano (ADA) and XRP saw slight institutional inflows after Bitcoin (BTC) and Ethereum (ETH) recorded low prices

Bitcoin, ETH Face Institutional Outflows

Cardano and XRP saw tiny positive inflows in comparison to Bitcoin and Ethereum’s massive outflows.

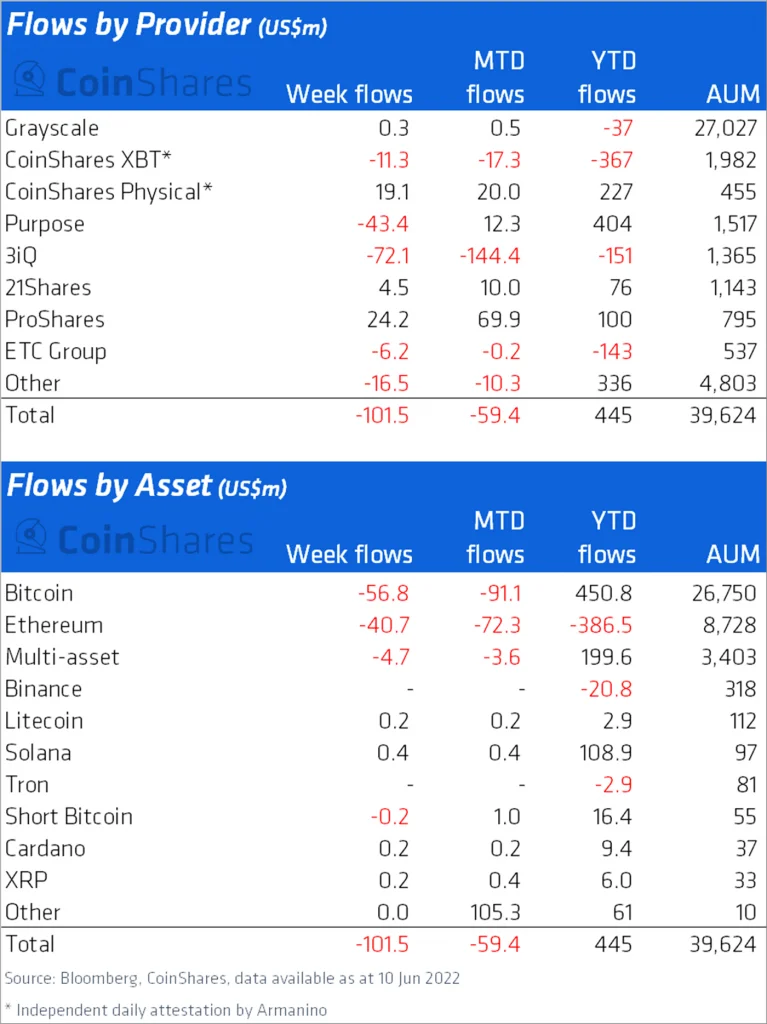

Coinshares reported negative outflows of $102 million in the previous week, indicating that negative sentiment continues to dominate crypto assets.

Bitcoin experienced inflows of US$126 million last week as reported by Coinscreed, increasing the total year-to-date inflows to a little over half a billion dollars, at US$506 million. Just after the “Red Monday” Bitcoin outflows were $57 million increasing the total to $91 million for the month.

Digital asset investment product flows have remained turbulent in anticipation of aggressive monetary policy.

Specifically, Ethereum has seen outflows for 9 weeks in a row, indicating persistently poor investor sentiment.

Ethereum Investment Products Records Outflows for 10 Weeks

Ethereum (ETH) which is the second biggest cryptocurrency is not left out of this recent crypto crash. ETH saw red yesterday and is presently trading at $1,174 as of the time of writing. As a result of this predicament, the crypto coin is having more investors draw funds and invest elsewhere.

As reported by Coinscreed, ETH saw outflows totaling US$32 million which is now the normal trend for ten consecutive weeks. The transfer of funds from the investment products indicates persistently poor investor sentiment.

Ethereum had another $41 million in withdrawals this week, bringing the total year-to-date outflows to $387 million.

The massive outflows of Bitcoin (BTC) and Ethereum (ETH) have made Cardano and XRP see a small margin of inflows.

Cardano, XRP See Positive Institutional Inflows

Cardano and XRP, on the other hand, saw tiny positive inflows in comparison to Bitcoin and Ethereum’s massive outflows.

Inflation figures that were higher than expected are adding to the bearish sentiment on crypto markets, and the US Federal Reserve is expected to boost interest rates this week to rein in rising prices.

General Crypto Market Bleeds

Due to a large sell-off of risk assets, cryptocurrency prices fell to their lowest levels in 2022. In addition, the crypto lending site Celsius froze withdrawals for its customers, prompting fears of a market-wide pandemic.

According to CoinMarketCap data, the cryptocurrency market capitalization went below $1 trillion for the first time since February 2021 on Monday, reaching $958 billion at press time. Cardano dropped as much as 20%, reaching lows of $0.435 before bouncing back quickly.

Cardano was trading at $0.505 at the time of publication, up 15%. XRP also fell to a low of $0.293 before recovering nearly 4% to trade at $0.31 at press time.

When it comes to the market dip, Ripple CEO Brad Garlinghouse promises investors that it will most likely be transitory.