The attempt by Ethereum bulls to push the altcoin’s price past resistance at $2,839. Algorand is constructing a bridge to Ethereum, which could increase the amount of Ethereum transactions. If Ethereum price remains above its macro low of $2300, the altcoin may return to the area before reversing its trend.

The bulls are unable to push the price of Ethereum over the barrier level.

The price of Ethereum has not recovered from its dip below the macro bottom of $2,300. The Ethereum network’s transaction fees have continued to fall. Despite lower transaction costs, the Ethereum-killer Cardano’s transaction volume eclipsed that of the second-largest cryptocurrency.

The Ethereum network’s transaction fees are now 80% cheaper than they were on January 10, 2022. Proponents anticipate increased transaction volume and on-chain activity as the cost of transacting on the Ethereum blockchain decreases.

In the case of Ethereum, though, this remains to be seen. The average price per transfer has dropped to $10.26. Transaction fees on Ethereum scaling solutions have dropped dramatically, and the inclusion of the Algorand bridge to the altcoin’s network may increase its utility and demand.

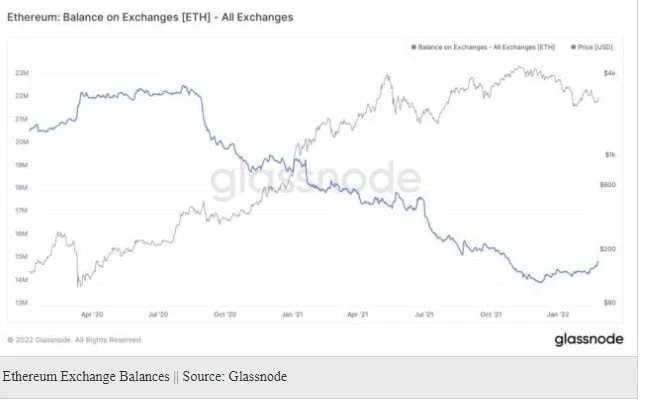

The exchange balance, a major indicator of Ethereum’s price trajectory, has increased dramatically. The current market cycle has seen a sustained gain in exchange balance since Ethereum’s price crossed $4,500.

A bearish trend in the price of Ethereum is compatible with rising exchange balances. As the price of Ethereum continues to fall and exchange reserves rise, there is an obvious lack of demand.

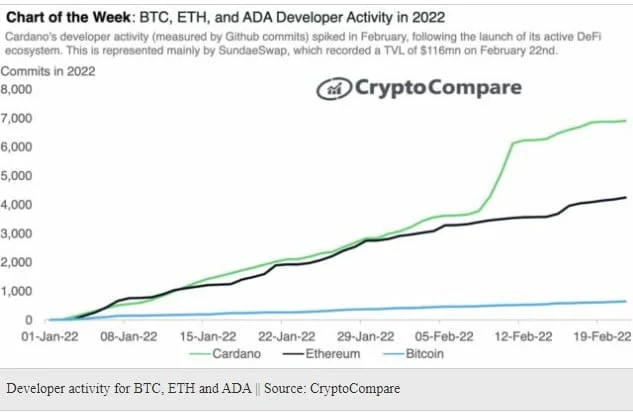

In 2022, Cardano’s developer activity is much higher than Ethereum’s. A higher number of Github commits has historically fueled an optimistic sentiment among users. Cardano, the Ethereum killer, is seeing an increase in commits, indicating a change in demand from the second-largest altcoin to ADA.

In the midst of the Russian-Ukrainian conflict, Ethereum outperformed gold, and the altcoin was added to the list of assets maintained by BNY Mellon, the world’s largest bank. Ethereum’s acceptance by institutional clients may boost the altcoin’s demand.