On May 29, Ethereum’s Layer-2 network Celo integrated Chainlink’s CCIP Protocol for blockchain Interoperability and real-world price data.

Following the deployment of CCIP on Celo, Eric Nakagawa, the executive director of Celo, released the following statement: “Canonical cross-chain infrastructure can accelerate the adoption and long-term growth of the Celo ecosystem.”

“As the only interoperability solution to achieve level 5 cross-chain security, CCIP is an excellent option for developers, founders, and the broader community to contemplate and embrace,” Nakagawa continued.

Given the impending significant expansion of real-world asset tokenization, cross-chain interoperability remains a fundamental concern within the blockchain industry.

As per the findings of Chainlink, the aggregate valuation of tangible assets in the physical realm amounts to an astounding $874 trillion. Even a negligible amount of that value enters the blockchain.

Regrettably, the dispersion of these assets across multiple platforms, industries, and chains presents challenges for investors and speculators seeking to extract value from conventionally illiquid assets like collectibles and real estate. Specifically, this hampers liquidity and efficiency.

Chainlink’s CCIP

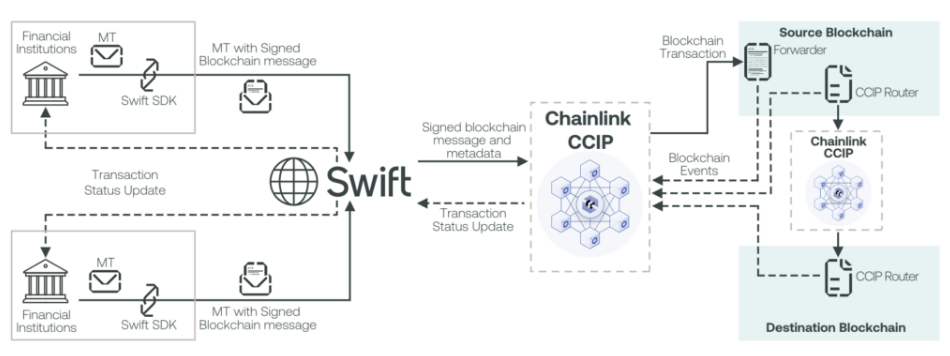

Herein lies the utility of Chainlink’s CCIP protocol. As a “layer 0” protocol, it facilitates cross-chain communication among public blockchains and conventional financial architecture.

Chainlink conducted a pilot test with SWIFT—the international messaging protocol for interbank communication—with success in 2023.

To transfer real-world assets onto the blockchain, the Oracle Network and Interoperability Protocol conducted a comparable experimental test in collaboration with the Depository Trust and Clearing Corporation (DTCC) and several banking partners, including JP Morgan and BNY Mellon.

The experiments that Chainlink conducted involving SWIFT and the DTCC underscore the possible synergies that may arise among blockchain technology, conventional institutions, and the realm of international business.

Challenges of Cross-Border Transactions

At present, cross-border transactions exhibit a degree of sluggishness, high costs, and inefficiency owing to numerous intermediaries intervening in the process.

Payment processors, banks, credit card companies, and information processors participate in the transaction, decelerating the process by charging their fees.

In addition, costly fees and inefficiencies associated with regulatory compliance impede the finality of transactions and prevent more minor actors from conducting business internationally.

Many of the corporate landscape continues using obsolete technology amidst the digital era, resulting in protracted processing times for conventional bank transactions. Simple domestic transactions not involving cross-border communications are also subject to this regulation.