Chainlink and Swift will launch a new blockchain integration, making digital asset settlement easier for financial institutions utilizing existing infrastructure.

Decentralized Oracle provider Chainlink is set to launch a new blockchain payment solution tailored for financial institutions.

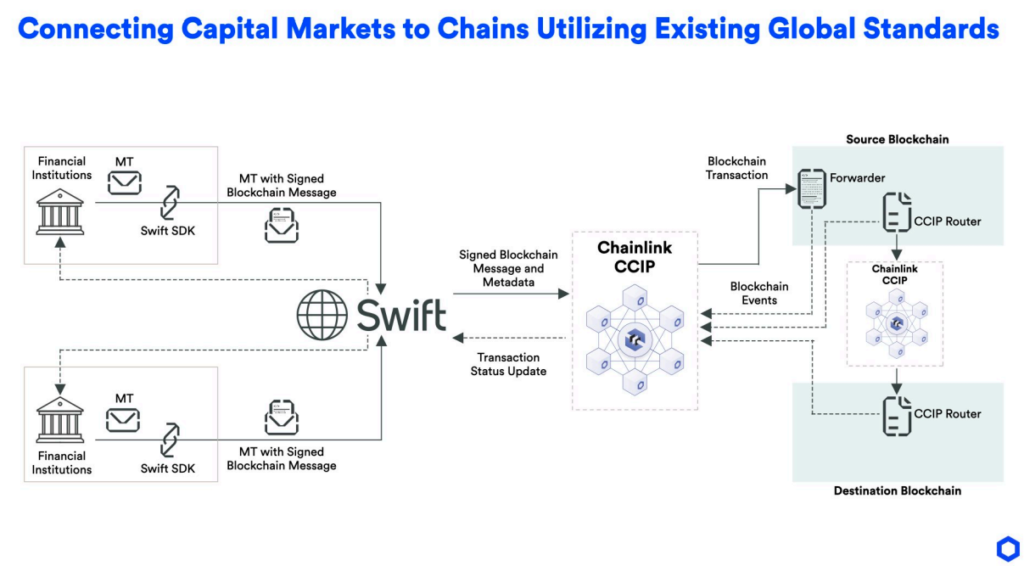

In partnership with Swift, the global messaging network for banks and financial institutions, Chainlink has introduced an integration that allows institutions to utilize Swift messages to connect with blockchain technology.

This integration will enable digital asset settlements with minimal changes to current infrastructure, creating a bridge between decentralized finance (DeFi) and traditional finance (TradFi).

Swift-er Blockchain Payments

Sergey Nazarov, Chainlink’s co-founder, emphasized the practical advantages of the integration during a speech at the Swift-organized Sibos conference in Beijing, China:

“We are in a pre-production stage where we can start offering you something that you can actually start using with your existing institutional systems,” Nazarov stated.

The solution will facilitate pre-settlement and transaction confirmation using Swift’s established messaging protocols, which are already widely adopted in traditional finance.

Once confirmed, Chainlink’s infrastructure will convert these messages into blockchain events, allowing institutions to lock assets and perform on-chain payments.

Institutional Privacy Considerations

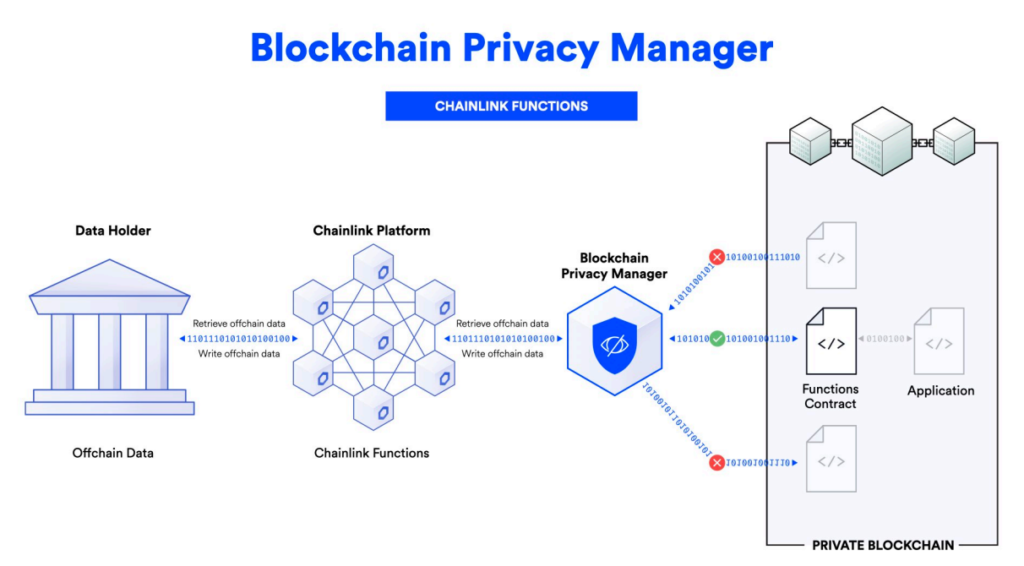

Nazarov also introduced the Blockchain Privacy Manager (BPM), a privacy-focused feature integrating private blockchains with Chainlink’s public platform.

He noted that privacy has been a significant barrier to blockchain adoption in capital markets, stating, “Privacy has been deeply lacking quality in the blockchain industry and has kept the capital markets from adopting digital assets and blockchains.”

“The Blockchain Privacy Manager […] can allow you to manage the privacy assumptions of everything related to your chain,” Nazarov explained, adding that BPM “allows the data from your bank to be selectively placed into certain chains, but not others, and allows you to authoritatively manage what information can and can’t reach chains from your bank.”

BPM targets financial institutions seeking end-to-end privacy for blockchain applications, supported by Chainlink’s Cross-Chain Interoperability Protocol (CCIP) for Private Transactions.

Combined with the new Swift integration, this feature will enable institutions to handle sensitive transactions, including private tokenized asset trading and cross-border payments.

Regulatory and Centralization Concerns

Despite offering institutional-level security, the development raises potential issues related to regulation and centralization.

Regulatory authorities might express concerns about Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance due to the enhanced privacy and possible lack of transparency.

Additionally, the centralization of privacy controls within Chainlink’s ecosystem could contradict the decentralized ethos.

Private transactions might not be subject to public oversight or scrutiny by centralizing control in the hands of institutions.