Chainlink on-chain data shows a rise in active addresses from 2,900 on May 18 to 11,300 on May 21. LINK price eyes $22.

In the past 24 hours, Oracle service provider Chainlink has decoupled significantly from the broader market correction, gaining over 6%.

The Chainlink (LINK) price is approaching its critical resistance level of $17.5 as of press time, and its market capitalization has surpassed $10.1 billion.

Additionally, the daily trading volume for LINK has increased by 80%, reaching $858 million.

Chainlink On-Chain Data Indicates a Bullish Signal

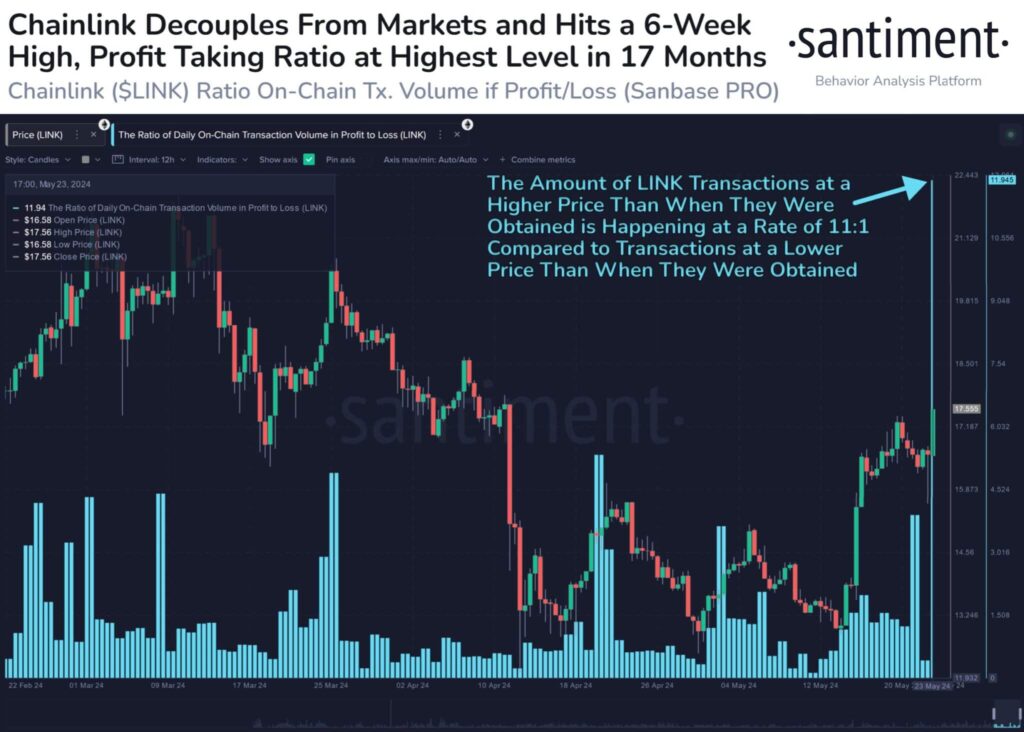

Chainlink (LINK), which has surpassed $17.50 for the first time in the past six weeks, has emerged as a market leader in cryptocurrencies, according to insights provided by on-chain data provider Santiment.

Meanwhile, the present on-chain analysis unveils a noteworthy pattern: eleven transactions generate a profit for each Chainlink transaction that incurs a loss.

The unprecedented ratio has reached its utmost level since December 8, 2022, indicating a robust bullish sentiment regarding the recent price fluctuations of Chainlink.

This Breakout Can Trigger Major Surge for LINK Price

A daily bearish order block, which has historically seen substantial market participants place sell orders at $17.58, is presenting resistance for the current price of Chainlink.

However, at $16.48, this resistance level coincides with the weekly resistance barrier.

A potential consequence of purchasers’ inability to propel the LINK price higher is the occurrence of a retracement.

Analysis of the volume profile indicator suggests that a substantial number of transactions occurred near $14.62, which could serve as a support level for the expected correction.

In addition, this level strongly correlates with the 61.8% Fibonacci retracement level, creating an appealing area for accumulation in anticipation of a possible subsequent bullish leg.

The Ethereum spot ETF approval has recently sparked a surge in bullish sentiment, which has increased optimism.

However, if Chainlink were to locate support at $14.62, it might indicate an 18% ascent to retest the daily order block at $17.58.

Under the condition that Chainlink whale accumulation ceases, a breach of this level of resistance could, in a highly optimistic scenario, propel the Chainlink price to $22, representing a total gain of 50%.

Even with robust technical analysis and on-chain data supporting Chainlink’s potential, a weekly candlestick close below $13.59 would negate the bullish outlook by forming a lower low on a higher timeframe.

A scenario in which LINK’s price falls by 13% could potentially push the stock towards $11.80, a critical support level.

Furthermore, the on-chain data demonstrates that Chainlink has also made progress.

The quantity of operational addresses within the Chainlink network has experienced a substantial upsurge, expanding from 2,900 on May 18 to 11,300 on May 21.

The substantial surge in usage suggests an expanding market need for the Chainlink platform.