The crackdown on cryptocurrency miners by the Chinese government is not only telling on Bitcoin but also has a role to play in the Ethereum mining hash rate.

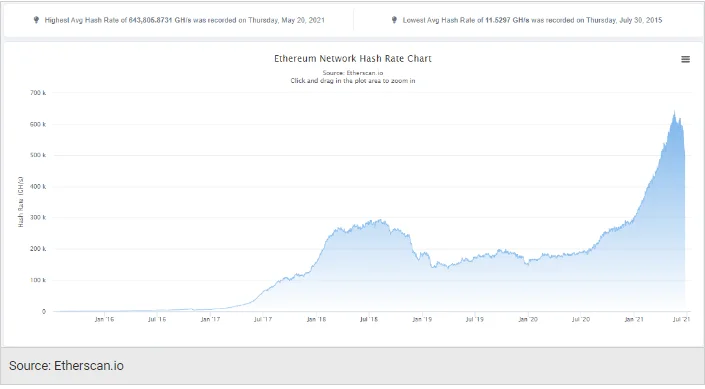

According to data from Etherscan, the Ethereum mining hashrate, which peaked at 643,805.8731 GH/s on May 20, 2021, is rapidly declining.

After decreasing by a staggering 21,397.4621 in two days, the hashrate is now at 493,929.6709 GH/s.

A Proof-of-Work (PoW) consensus mechanism is also used in the current Ethereum blockchain.

Miners in the Ethereum network, like those in the Bitcoin network, must validate transactions by solving a series of computational challenges in order to register transactions within a block.

These operations are carried out via mining devices such as Bitmain’s Antminers, and the migration of miners from China has disturbed the mining ecosystem and hashrate.

The mining hashrate for Ethereum has been continuously increasing since December 2019, as shown in the graph above.

While there were some minor hiccups in the months before, the third quarter of 2020 saw a more significant increase.

The period came to a close at a time when both retail and institutional investors were enthusiastic about the digital currency ecosystem as a whole.

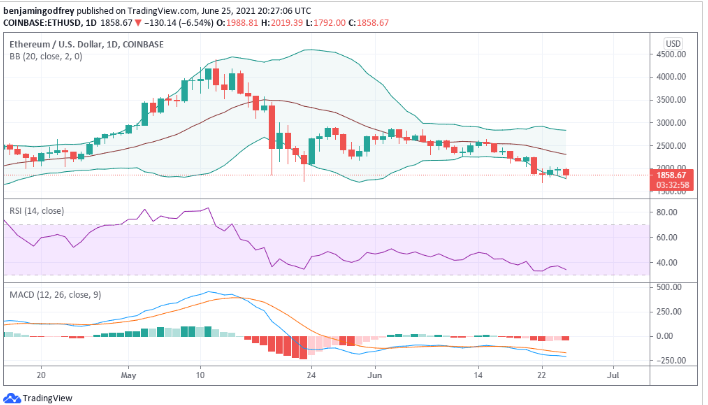

Following the decrease in hashrate on the Ethereum blockchain, there was a corresponding reduction in price.

The world’s second-largest digital currency, according to TradingView’s daily ETH/USD chart, began a widespread downward movement on May 12th.

This reversal in price was preceded by the coin’s All-Time High (ATH) of $4,300, which occurred during the period when the hash rate was at its highest.

With the drop in value, we can observe a positive link between price and Hashrate, and while China has disturbed the mining ecosystem, a return to normalcy as miners look for options abroad might put prices back on a growth path.

The MACD indicator is currently below the signal line, signaling that the decline in the short term is far from over.

A fundamental shift or return of large-scale mining might spark technical indicators to reverse the market run in the medium and long term.