Arbitrum, a layer-2 scaling chain, has been integrated into the Web3 infrastructure platform of Circle Internet Financial, as noted in a blog post on September 12.

The blog post stated that the Web3 platform introduces USDC-centric programmable wallets, smart contract infrastructure, and gas-fee abstraction to Arbitrum.

Arbitrum is the highest layer 2 in Ethereum, with a total value locked (TVL) of approximately $2.5 billion, according to DefiLlama.

In a post on the X platform, Nikhil Chandhok, Circle’s chief product officer, stated that the platform helps developers “build frictionless in-app wallets that support USDC for global payments, e-commerce, [and] gaming,” among other use cases.

The blog post also stated that Circle’s Web3 tooling is incorporated with blockchain networks such as Avalanche, Ethereum, Polygon PoS, and Solana.

The integration is Circle’s most recent attempt to expedite the adoption of USDC, which is in competition with Tether’s USDT for market dominance.

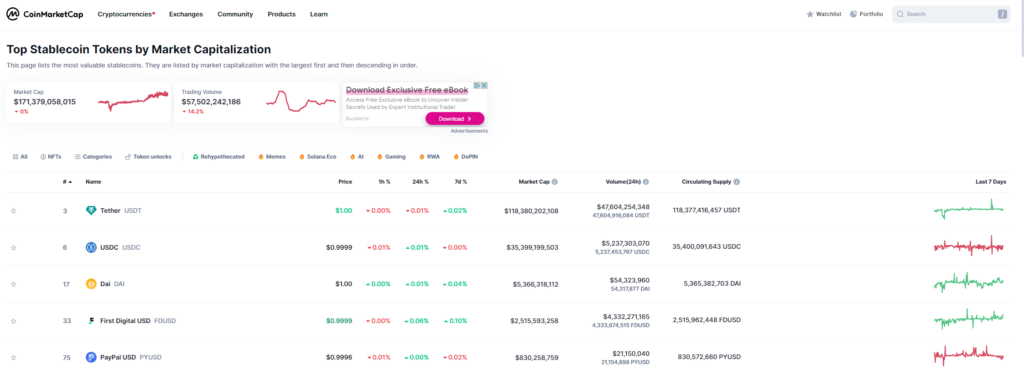

USDC’s total market capitalization, which is approximately $35 billion, is considerably lower than that of its competitor, USDT, which exceeds $118 billion, according to CoinMarketCap.

PayPal’s stablecoin, PayPal US (PYUSD), which was introduced in 2023, is supported by the US dollar and has significantly increased the levels of competition. In August, its total market capitalization exceeded $1 billion.

Circle made USDC natively available on Arbitrum in 2023, enabling applications to mint USDC directly on layer 2 without bridging USDC from other chains.

It also incorporated Arbitrum into its cross-chain transmission protocol, effectively enabling free USDC bridging by managing minting and burning across chains.

Circle’s status as the de facto center for decentralized finance (DeFi) among layer-2s renders Arbitrum an especially critical platform.

Arbitrum is the repository of nearly $4.7 billion in stablecoins employed in various applications, including lending, decentralized exchanges (DEX), and leveraged perpetual trading, as per DefiLlama.

Arbitrum has also been gaining traction in tokenized real-world assets (RWA), which could grow to a multi-trillion-dollar market in the future, according to an executive at Polygon, a rival blockchain network, according to Cointelegraph in August.

On August 27, Ondo Finance, an RWA protocol, announced that it would extend access to the Ondo US Dollar Yield Token (USDY) to Arbitrum. Franklin Templeton, an asset manager, disclosed its intention to broaden FOBXX to the scaling chain on August 8.