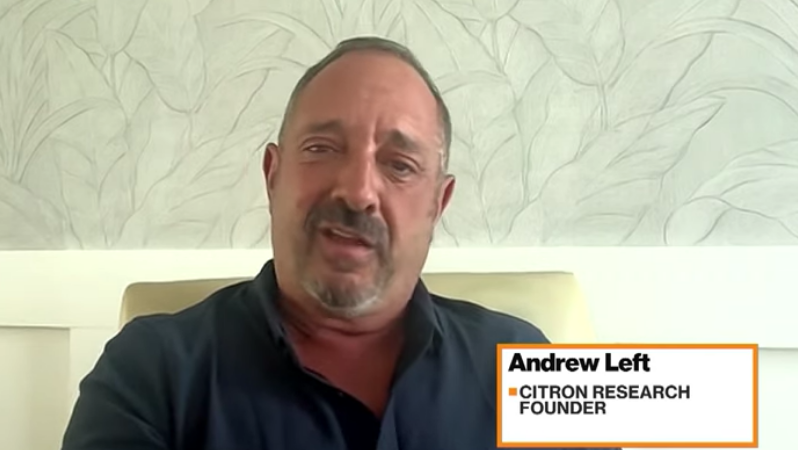

Citron Research founder Andrew Left pleads not guilty to securities fraud charges in Los Angeles court.

Andrew Left, the founder of Citron Research, a financial research firm specializing in short-selling, has pleaded not guilty to several securities fraud allegations brought against him on July 26.

In a 40-minute hearing in a federal court in Los Angeles, Judge Rozella Oliver imposed a $4 million unsecured bond and a $1 million collateralized bond against the founder of Citron. Left was reportedly present.

According to Bloomberg’s July 29 report, Left, who previously declared that the cryptocurrency industry is plagued by “fraud,” must submit the collateralized bond by August 5.

Oliver ordered Left to surrender his passport after United States Assistant Attorney Brett Sagel successfully argued that Left presented a flight risk. Sagel cited over $70 million in assets, including a property abroad.

“He can walk out of this country and live a very luxurious life,” Sagel said.

The short-seller is prohibited from engaging in any financial transactions exceeding $100,000 without obtaining special permission, and his trading activity has been restricted.

The report indicates that Left’s wrists were cuffed during the court proceedings, and he primarily responded to Oliver’s inquiries with one-word responses of “yes” or “no.”

His trial has been scheduled for September 24.

On July 26, the Department of Justice and the Securities and Exchange Commission of the United States each filed allegations against Left.

Both agencies accused left of profiting $16 million by issuing stock recommendations that were intentionally misleading to retail investors, characterized as “bait and switch.”

“Left bought back stock immediately after telling his readers to sell, and he sold stock immediately after telling his readers to buy,” the SEC said.

The SEC and DOJ’s case was reportedly characterized as “defective” by Left’s lawyer, James Spertus, who also maintained that Left was not required to disclose his personal trading intentions.

Spertus reportedly stated that Left would “never” accept a plea bargain from prosecutors, as it would suggest that his actions were unlawful.

The prosecution against Left results from a national initiative to investigate the connections between hedge funds and short-seller research firms.

Citron has previously targeted the crypto industry, advising investors to short Coinbase stock in response to the exchange’s temporary disruption on February 28.

In recent months, other “short seller firms” have targeted crypto firms, and they may be intently monitoring the outcome of Left’s case as well.

On July 11, Culper Research, a fellow short-seller firm, condemned Bitcoin mining firm IREN for its “wildly overvalued” status. The firm was criticized for its “big game” talk regarding its high-performance computing and artificial intelligence plans, which were not substantiated by invested capital.

IREN stated that it expended less than $1 million per megawatt to construct its HPC center. However, experts estimate that constructing a completely operational center would require between $10 million and $20 million. Culper explicated this:

“In an analogy, IREN asserts that it is poised to win the Monaco Grand Prix, but it has only recently arrived at the track in a Toyota Prius.”

According to Google Finance, IREN’s stock has declined by 24.6% since Culper’s short-seller report on the company on July 11.

A short-seller report on Bitcoin miner Riot Platforms was also published by Kerrisdale Capital analysts on June 5. The report asserted that Riot “does a far better job playing energy arbitrage games and issuing stock than generating shareholder value by mining crypto.”